Stock Trading Lessons for Beginners – Module 2 – TRT POV

[adsense]

Stock Trading Lessons for Beginners is part of the Continuous Education element of my advocacy, Responsible Trading. In this connection, I am pleased to share these with you. All these lessons are shared without cost to you. All of these are free.

For your proper guidance, whenever I post the video from Cloud9 Media Limited, the title of my article will end with – Video. Whenever I post my own, my article will end with – TRT-POV.

Ok, let’s go to Module 2.

MODULE 2 – CHARTING BASICS

LEARNING OBJECTIVES:

After viewing this video, you should now know the following:

1. The different types of Charts – line, price bars, and candlestick

2. Why candlestick charting has become the most popular charting method

3. The importance of viewing charts on different time frames

4. What is the difference between arithmetic scale and logarithmic scale

QUICK SUMMARY OF MY TRT-POV

1. A chart is a graphical representation of data. In technical analysis the three types of charts are: line, bar and candlestick.

2. The candlestick chart dates back 200 years ago and it could be traced to Munehisa Honma, a rice trader who used it sucessfully in his family’s business.

3. A westerner by the name of Steve Nison discovered this secret technique called Japanese candlesticks from a fellow Japanese broker. The technique caught Steve Nison like wildfire and today he has earned the moniker “Mr. Candlestick.”

4. Technical analysis can be applied to any time frame of charting. It is always useful to view the monthly and weekly charts in addition to the daily charts to see the trend on different time frames.

5. You can use arithmetic or logarithmic price scales – log is sometimes better on the long term charts.

For a more comprehensive discussion, please click the video below:

JUST A FEW GENTLE REMINDERS

1. These lessons are not intended to be a substitute for the seminars offered by your broker/s but intended to serve as basic foundation to enable you to better appreciate the seminars offered once you have access to them.

2. I will post the videos and outline the Learning Objectives every Saturday. As a value added, I will post my TRT-POV, (The Responsible Trader’s Point of View) every Thursday of the following week, to annotate and explain the trading lessons in a simple and understandable way.

Based on PM’s I received (most of them are in “Taglish” a combination of Tagalog and English, ) In order to enhance better understanding of the topic discussed, I will try to use “Taglish” in my TRT-POV, (The Responsible Trader’s Point of View) whenever I can, to be able to better relate to my readers who are mostly Filipino.

3. After posting this video, , I expect you to view and try to understand the topic discussed and to compare what I am sharing with what you have learned. plus your own personal research. We will repeat the whole process until we finish the whole course.

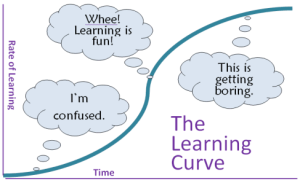

4. Learning is better when done in short durations with breaks in between. The learning curve looks like this.

Learning curve image source: http://easternseastar21.wordpress.com/2013/05/15/exploring-the-learning-curve/

Rate of learning starts slowly then gradually builds up where it becomes fun and enjoyable. After reaching a certain level it decelerates to the point of boredom.

If you divide your study periods into shorter durations with breaks in-bteween, you are going to double the point where learning is fun and enjoyable and you will be able to retain more materials in your brain.

Learning curve image source: http://easternseastar21.wordpress.com/2013/05/15/exploring-the-learning-curve/

5. To make it easy for you to refer to the entire course, I will always include this as your guide and underline the topic that we are discussing.

The Video lessons are taken from Cloud9 Media Limited’s Master’s Certificate in Technical Analysis covering the following:

Module 1 – Technical Analysis and Dow Theory

Module 2 – Charting Basics

Module 3 – Trend Concepts

Module 4 – Reversal and Continuation Patterns

Module 5 – Volume and Open Interest

Module 6 – Moving Averages

Module 7 – Oscillators and Sentiment Indicators

Module 8 – Further Charting

Module 9 – Elliott Waves and Cycles of Time

Module 10 – Cloud Charts – Ichimoku Technique

Module 11 – Money Management and Computers

Module 12 – How to Build a Trading System

I have created The Responsible Trader’s YouTube Channel: https://www.youtube.com/theresponsibletrader

where I will post all my own videos and other videos that will help us in our learning journey. Please visit my Channel and subscribe so you will always be updated every time I upload new materials.

I wish you all the best in your learning journey and good luck on all your trades.