Top Ten Smart Money Moves – Apr. 11, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading

Moves, starting January 2015, is the official trading newsletter of The Responsible Trader

newsletter of The Responsible Trader to promote

to promote his advocacy, Responsible Trading

his advocacy, Responsible Trading . This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying

. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded

and Selling, Top Ten in Total Traded Value, including Trading

Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader

Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on Apr. 11, 2016 Data)

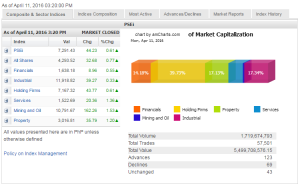

Total Traded Value – PhP 5.500 Billion – Low

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 123 Advances vs 69 Declines = 1.78:1 Neutral

Total Foreign Buying – PhP 3.030 Billion

Total Foreign Selling – (Php 2.741) Billion

Net Foreign Buying (Selling) – Php 0.289 Billion – 1st day of Net Foreign Buying after 4 days of Net Foreign Selling

Data from the Philippine Stock Exchange ‘

‘

Screenshot courtesy of: www.pse.com.ph

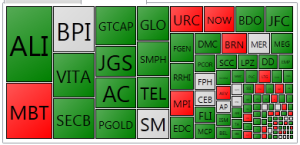

PSE Heat Map

Screenshot courtesy of: PSEGET Software

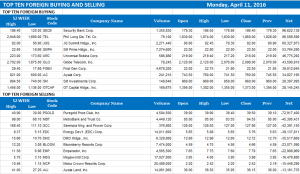

Top Ten Foreign Buying and Selling

and Selling

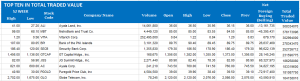

Top Ten in Total Traded Value

Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Posted on April 11, 2016 08:41:00 PM

Foreign inflows after slump boost local equities

LOCAL SHARES opened the week in the green as the influx of foreign investors supported positive sentiment back home, analysts said.

The Philippine Stock Exchange index (PSEi) advanced by 44.23 points or 0.61% to close Monday trading at 7,291.43.

The broader all-shares index also gained 32.68 points or 0.76% to finish at 4,293.52.

“The market has a relatively low volume today. It was driven by foreign inflows on emerging markets,” Miguel A. Agarao, analyst at Wealth Securities, Inc., said in a telephone interview after trading hours on Monday.

Value turnover thinned to P5.5 billion yesterday after 1.72 billion shares changed hands, from the P6.55 billion recorded last Friday.

“[Yesterday] was just a technical rebound because we saw five consecutive days of net foreign selling last week. Retail investors saw this as a level they can enter,” Victor F. Felix, equity analyst at AB Capital Securities, Inc., said separately by phone.

Monday’s net foreign buying amounted to P289.49 million, reversing Friday’s net outflow worth P127.92 million.

All sectors were in positive territory, with mining and oil leading the rally after surging by 162.26 points or 1.52% to 10,791.67.

The services counter jumped by 20.36 points or 1.35% to 1,522.69; property increased by 35.79 points or 1.20% to 3,016.81; holding firms climbed 43.77 points or 0.61% to 7,167.32; financials inched up by 8.96 points or 0.55% to 1,638.18; and industrials added 39.27 points or 0.33% to 11,918.82.

AB Capital’s Mr. Felix noted some bargain hunting in shares of Philippine Long Distance Telephone Co. (PLDT), which jumped by 1.75%.

Aside from PLDT, yesterday’s major index movers were SM Prime Holdings, Inc., Ayala Corp., and JG Summit Holdings, Inc., according to Wealth Securities’ Mr. Agarao.

Gainers overwhelmed decliners, 123-69, while 43 issues did not move.

AB Capital’s Mr. Felix said the PSEi will likely stay “flat” for the rest of the week, with a weekend target set at 7,400.

Mr. Agarao added that the market is expected to “consolidate in a tight range” until elections.“I am looking at 7,000 to 7,400, but some investors are starting to buy at 7,200,” he said.

Stocks rallied in Asia excluding Japan while copper prices advanced as Chinese inflation data pointed to a pick-up in industrial demand in the world’s second largest economy.

The Shanghai Composite Index rebounded from a one-week low as a report showed producer prices increased month on month for the first time since September 2013. Japanese shares retreated as the yen headed for its longest winning streak since 2012.

Hastings Holdings, Inc., a unit of PLDT Beneficial Trust Fund subsidiary MediaQuest Holdings, Inc., has a stake in BusinessWorld through the Philippine Star Group, which it controls. — Daphne J. Magturo with Bloomberg

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=foreign-inflows-after-slump-boost-local-equities&id=125789

==================================================

Good luck on all your TRADES

luck on all your TRADES today

today .

.

DISCLAIMER There is a very high degree of risk involved in TRADING . Past results

. Past results are not indicative of future returns

are not indicative of future returns . Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION

. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER

or endorsement of any security. In accordance with the Responsible TRADER ’s Creed: I will never tell and you take full

’s Creed: I will never tell and you take full responsibility for all your TRADING

responsibility for all your TRADING results

results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion