Top Ten Smart Money Moves Apr. 13, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading

Moves, starting January 2015, is the official trading newsletter of The Responsible Trader

newsletter of The Responsible Trader to promote

to promote his advocacy, Responsible Trading

his advocacy, Responsible Trading . This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying

. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded

and Selling, Top Ten in Total Traded Value, including Trading

Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader

Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on Apr. 13, 2016 Data)

Total Traded Value – PhP 7.704 Billion – Low

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 95 Declines vs.94 Advances = 1.01:1 Neutral

Total Foreign Buying – PhP 3.801 Billion

Total Foreign Selling – (Php 4.462) Billion

Net Foreign Buying (Selling) – (Php 0.661 Billion) – 1st day of Net Foreign Selling after a day of Net Foreign Buying

Data from the Philippine Stock Exchange ‘

‘

(Sorry, PSE Website Down as of time of Posting)

Screenshot courtesy of: www.pse.com.ph

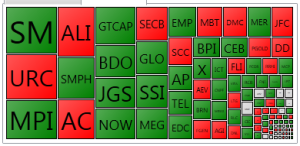

PSE Heat Map

Screenshot courtesy of: PSEGET Software

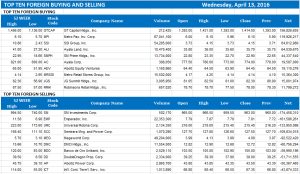

Top Ten Foreign Buying and Selling

and Selling

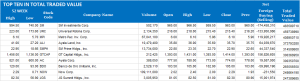

Top Ten in Total Traded Value

Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Posted on April 13, 2016 07:51:00 PM

By Daphne J. Magturo, Reporter

China trade data, rise in oil prices boost equities

LOCAL SHARES tracked global markets to stay above the 7,300 mark on Wednesday, supported by China’s positive exports data and the oil’s rally, analysts said.

The bellwether Philippine Stock Exchange index (PSEi) advanced by 34.44 points or 0.47% to end Wednesday trading at 7,341.

The broader all-shares index also edged up by 15.45 points or 0.35% to settle at 4,318.26.

“Oil continued to rally and reached a 2016 high after Saudi Arabia and Russia agreed to freeze output ahead of the Doha meeting on Sunday,” Luis A. Limlingan, business development head at Regina Capital Development Corp., said by phone.

“US equities also rose, and European equities were rather choppy but ended in the green.”

On Wall Street, the Dow Jones industrial average index soared by 164.84 points or 0.94% to close at 17,721.25, the Standard & Poor’s 500 index climbed 19.73 points or 0.97% to 2,061.72, and the tech-heavy Nasdaq index stayed flat at 4,872.09.

Major European indices were also in the green as of this writing.

“The market managed to close higher due to China exports for the month of March, which was better than expected,” Joylin F. Telagen, equity analyst at IB Gimenez Securities, Inc., said in a mobile phone reply.

Reuters reported that China’s March exports went up by 11.5% year on year, the first increase since June and the largest percentage improvement since February 2015.

“Investor sentiment received a boost as the second biggest economy is becoming stable,” Ms. Telagen said.

She noted that full-year corporate earnings, which are due by Friday, are so far “better than 2014.”

“For PSEi, core earnings grew by 7% (except Alliance Global Group, Inc. and Bloomberry Resorts Corp., not yet reported) better than 5% growth in 2014,” Ms. Telagen said.

All domestic subindices rallied, with services leading the charge, jumping by 10.57 points or 0.69% to 1,541.12.

Holding firms increased by 37.07 points or 0.51% to 7,231.09; property went up by 10.77 points or 0.35% to 3,022.71; financials put on 2.47 points or 0.14% to 1,658.56; industrials added 11.02 points or 0.09% to 11,915.05; and mining and oil inched up by 4.32 points or 0.04% to 10,818.64.

Wednesday’s value turnover increased to P7.7 billion after 1.57 billion shares changed hands, from the P6.84 billion recorded in the previous session.

Net foreign selling continued for a second straight session and ballooned to P660.86 million from the P25.52 million seen on Tuesday.

Losers narrowly beat gainers, 95 to 94, while 52 issues did not move.

“We will still have trouble meeting the 7,400 resistance, but I won’t be surprised if selling pressure starts the closer we get there,” Mr. Limlingan said, pegging the PSEi’s support at 7,170.

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=china-trade-data-rise-in-oil-prices-boost-equities&id=125931

==================================================

Good luck on all your TRADES

luck on all your TRADES today

today .

.

DISCLAIMER There is a very high degree of risk involved in TRADING . Past results

. Past results are not indicative of future returns

are not indicative of future returns . Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION

. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER

or endorsement of any security. In accordance with the Responsible TRADER ’s Creed: I will never tell and you take full

’s Creed: I will never tell and you take full responsibility for all your TRADING

responsibility for all your TRADING results

results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion