Top Ten Smart Money Moves – Apr. 15, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading

Moves, starting January 2015, is the official trading newsletter of The Responsible Trader

newsletter of The Responsible Trader to promote

to promote his advocacy, Responsible Trading

his advocacy, Responsible Trading . This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying

. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded

and Selling, Top Ten in Total Traded Value, including Trading

Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader

Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on Apr. 15, 2016 Data)

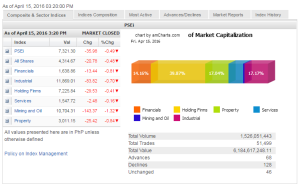

Total Traded Value – PhP 6.185 Billion – Low

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 128 Declines vs.68 Advances = 1.88:1 Neutral

Total Foreign Buying – PhP 3.653 Billion

Total Foreign Selling – (Php 4.031) Billion

Net Foreign Buying (Selling) – (Php 0.378) Billion – 4th day of Net Foreign Selling after a day of Net Foreign Buying

Data from the Philippine Stock Exchange ‘

‘

Screenshot courtesy of: www.pse.com.ph

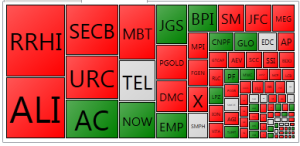

PSE Heat Map

Screenshot courtesy of: PSEGET Software

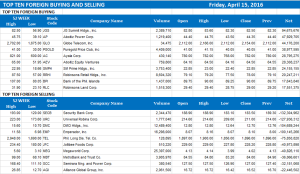

Top Ten Foreign Buying and Selling

and Selling

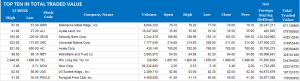

Top Ten in Total Traded Value

Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Posted on April 15, 2016 07:51:00 PM

By Daphne J. Magturo, Reporter

PSEi snaps 6-day winning streak amid profit-taking

LOCAL equities broke their six-day winning streak as investors locked in gains amid lackluster Chinese economic data and ahead of oil producers’ meeting this week, analysts said.

The benchmark Philippine Stock Exchange index (PSEi) lost 35.98 points or 0.49% to end the week at 7,321.30.

The broader all-shares index also slid by 20.78 points or 0.48% to settle at 4,314.67.

Alexander Adrian O. Tiu, senior equity analyst at AB Capital Securities, Inc., said the market’s drop was caused by “profit-taking following six days of consecutive ‘up’ days.”

“Also, Chinese economy continues to slow down as per its latest quarterly GDP (gross domestic product),” he said in a mobile phone reply.

Reuters reported that China’s GDP grew at by an annual 6.7% in the first quarter of 2016, easing slightly from 6.8% in the preceding quarter, and the slowest since 2009.

“We experienced a sell down today because of the weekend meeting of oil producers. That’s basically risk aversion — a cautionary measure because we don’t know what will happen this weekend,” Ralph Christian G. Bodollo, analyst at RCBC Securities, said separately by phone.

“Producers might decide to cut down production, which will boost oil prices and is good for equities. But if they don’t reach an agreement, it may cause further sell down next week,” he explained.

All subindices were in the red, with mining and oil suffering the most after plunging by 143.37 points or 1.32% to 10,704.31. The property sector fell by 25.42 points or 0.84% to 3,011.15; financials declined by 13.44 points or 0.81% to 1,638.86; industrials slipped by 83.82 points or 0.70% to 11,869.01; holding firms shed 29.53 points or 0.41% to 7,225.84; and services dipped by 2.48 points or 0.16% to 1,547.72

Friday’s most active decliners were Robinsons Retail Holdings, Inc., Ayala Land, Inc., Security Banking Corp., Universal Robina Corp., and Metropolitan Bank & Trust Co.

Thursday’s value turnover fell to P6.18 billion with 1.53 billion shares changing hands, from the P8.11 billion seen in the previous session.

Net foreign selling persisted for a fourth straight day but declined to P378.1 million from Thursday’s P490.51 million.

Almost two stocks declined for every one that advanced, while 46 names did not move.

For next week, the market may see more profit-taking, with the PSEi’s resistance still at 7,400, while support is pegged at 7,300, according to AB Capital’s Mr. Tiu.

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=psei-snaps-6-day-winning-streak-amid-profit-taking&id=126056

==================================================

Good luck on all your TRADES

luck on all your TRADES today

today .

.

DISCLAIMER There is a very high degree of risk involved in TRADING . Past results

. Past results are not indicative of future returns

are not indicative of future returns . Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION

. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER

or endorsement of any security. In accordance with the Responsible TRADER ’s Creed: I will never tell and you take full

’s Creed: I will never tell and you take full responsibility for all your TRADING

responsibility for all your TRADING results

results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion