Top Ten Smart Money Moves – Apr. 6, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading

Moves, starting January 2015, is the official trading newsletter of The Responsible Trader

newsletter of The Responsible Trader to promote

to promote his advocacy, Responsible Trading

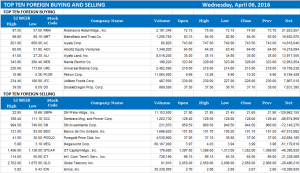

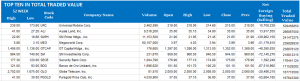

his advocacy, Responsible Trading . This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying

. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded

and Selling, Top Ten in Total Traded Value, including Trading

Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader

Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on Apr. 6, 2016 Data)

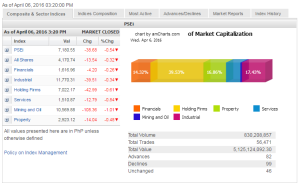

Total Traded Value – PhP 5.125 Billion – Low

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 99 Declines vs. 82 Advances = 1.21:1 Neutral

Total Foreign Buying – PhP 2.385 Billion

Total Foreign Selling – (Php 2.946) Billion

Net Foreign Buying (Selling) – (Php 0.561 Billion) – 2nd day of Net Foreign Selling after a day of Net Foreign Buying

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

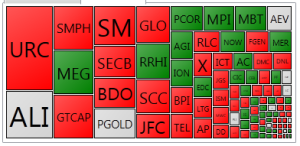

PSE Heat Map

Screenshot courtesy of: PSEGET Software

Top Ten Foreign Buying and Selling

and Selling

Top Ten in Total Traded Value

Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Posted on April 06, 2016 08:11:00 PM

PSEi drops as IMF warns on weak global growth

LOCAL EQUITIES continued to decline yesterday after the International Monetary Fund (IMF) signaled concerns on the global economy’s health amid cautious sentiment ahead of the release of the minutes of the Federal Reserve’s latest meeting, analysts said.

The Philippine Stock Exchange index (PSEi) lost 38.68 points or 0.53% to end yesterday’s trading at 7,180.55.

The broader all-shares index also slipped by 13.54 points or 0.32% to finish at 4,170.74.

“Local equities retreated with pessimism spilling over from Wall Street (Dow Jones Industrial Average -133, Nasdaq Composite -47 points) after IMF chief [Christine] Lagarde cited concerns over the global economy’s growth, which she deemed ‘too slow’ and ‘too fragile,” 2TradeAsia.com said in a market report yesterday.

“Cautious sentiment also took hold ahead of the release of FOMC’s (Federal Open Market Committee) minutes…”

Lexter L. Azurin, head of research at Unicapital Securities, Inc., cited the same reason and added: “The market was down 38 points… on limited volume.”

Value turnover shrank to P5.13 billion after 830.21 million shares changed hands, from the P5.78 billion seen the day before.

“Investors stayed on the sidelines, tracking regional markets on concerns of economic slowdown globally following comments from the IMF,” Mr. Azurin said in a telephone interview after trading hours.

The global economy’s already modest prospects will decline further unless authorities take stronger action to boost growth, Ms. Lagarde, the IMF’s managing director, warned on Tuesday, saying the Fund would cut its headline forecasts next week.

Regional markets were mixed yesterday. Japan’s Nikkei 225 index declined by 17.46 points or 0.11% to 15,715.36; Hong Kong’s Hang Seng index inched up by 29.67 points or 0.15% to 20,206.67; and the Shanghai Composite Index slipped by 2.34 points or 0.08% to close the session at 3,050.72.

All domestic subindices ended in the red, with mining and oil plunging by 108.36 points or 1.01% to 10,569.88. The services sector dropped 12.79 points or 0.83% to 1,510.87; holding firms fell by 42.99 points or 0.60% to 7,022.17; property slid by 14.04 points or 0.47% to 2,923.12; industrials shed 39.51 points or 0.33% to 11,770.31; and financials dipped by 4.20 points or 0.25% to end at 1,616.96.

Yesterday’s major losers were SM Investments Corp., Universal Robina Corp., and Bank of the Philippine Islands, Unicapital Securities’ Mr. Azurin said.

“Those three stocks accounted for 24 points of the market’s drop,” he said.

Foreign investors continued to exit the market, with net foreign selling increasing to P561.72 million from Wednesday’s P406.68 million. Losers beat gainers, 99 to 82, while 46 issues did not move.

For the rest of the week, the PSEi is poised to test support levels at 7,000, said Mr. Azurin. — Daphne J. Magturo with Reuters

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=psei-drops-as-imf-warns-on-weak-global-growth&id=125566

==================================================

Good luck on all your TRADES

luck on all your TRADES today

today .

.

DISCLAIMER There is a very high degree of risk involved in TRADING . Past results

. Past results are not indicative of future returns

are not indicative of future returns . Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION

. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER

or endorsement of any security. In accordance with the Responsible TRADER ’s Creed: I will never tell and you take full

’s Creed: I will never tell and you take full responsibility for all your TRADING

responsibility for all your TRADING results

results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion