Top Ten Smart Money Moves – Apr. 7, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading

Moves, starting January 2015, is the official trading newsletter of The Responsible Trader

newsletter of The Responsible Trader to promote

to promote his advocacy, Responsible Trading

his advocacy, Responsible Trading . This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying

. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded

and Selling, Top Ten in Total Traded Value, including Trading

Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader

Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on Apr. 7, 2016 Data)

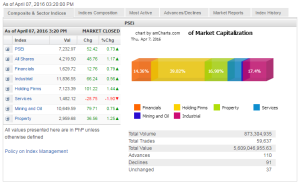

Total Traded Value – PhP 5.609 Billion – Low

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 110 Advances vs 91 Declines = 1.21:1 Neutral

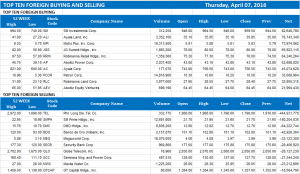

Total Foreign Buying – PhP 2.601 Billion

Total Foreign Selling – (Php 2.999) Billion

Net Foreign Buying (Selling) – (Php 0.398 Billion) – 3rd day of Net Foreign Selling after a day of Net Foreign Buying

Data from the Philippine Stock Exchange ‘

‘

Screenshot courtesy of: www.pse.com.ph

PSE Heat Map

Screenshot courtesy of: PSEGET Software

Top Ten Foreign Buying and Selling

and Selling

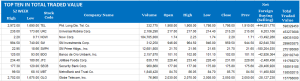

Top Ten in Total Traded Value

Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Posted on April 07, 2016 09:41:00 PM

By Daphne J. Magturo, Reporter

Stocks rebound as Fed minutes signal hike delay

LOCAL SHARES bounced back yesterday after the minutes of the US Federal Reserve’s March meeting affirmed that it will likely not hike interest rates within the first half of the year, analysts said.

The Philippine Stock Exchange index (PSEi) recovered 52.42 points or 0.73% to end Thursday trading at 7,232.97.

The broader all-shares index also recouped 48.76 points or 1.16% to settle at 4,219.50.

Luis A. Limlingan, business development head at Regina Capital Development Corp., said investors examined the minutes of the Fed’s meeting for clues on the timing of its planned interest rate increases.

“It reaffirmed the statement that they won’t be raising rates anytime soon,” he said in a telephone interview after trading hours.

Joylin F. Telagen, equity research analyst at IB Gimenez Securities, Inc., also pointed out that interest rate hikes will be “gradual due to global economic risks and inflation still below their 2% target.”

The Fed appears unlikely to raise interest rates before June amid widespread concern at the US central bank over its limited ability to counter the blow of a global economic slowdown, minutes from the Fed’s March 15-16 policy meeting suggested.

The minutes released on Wednesday showed policy makers debated whether they might hike rates in April but “a number” of them argued headwinds to growth would probably persist, with many arguing they should be cautious about raising rates.

“[This] is actually good for emerging markets like the Philippines. Overseas investors will stay in the medium term,” Ms. Telagen said in a mobile phone message, adding that “we are actually expecting Fed movement in the second half of the year.”

Five out of six domestic subindices returned to positive territory, with holding firms surging by 101.22 points or 1.44% to 7,123.39. The property sector jumped by 36.56 points or 1.25% to 2,959.68; financials advanced 12.76 points or 0.78% to 1,629.72; mining and oil gained 79.71 points or 0.75% to 10,649.59; and industrials inched up by 66.24 points or 0.56% to 11,836.55.

Only the services counter remained in the red after losing 28.75 points or 1.90% to 1,482.12, weighed down by index heavyweight Philippine Long Distance Telephone Co., which fell by 5.86%.

Value turnover slightly improved to P5.61 billion after 873.3 million shares changed hands, from the P5.13 billion seen in the previous session.

Gainers overpowered losers, 110 to 91, while 37 issues ended unchanged.

Net foreign selling persisted but declined to P397.39 million from the P561.72 million seen on Wednesday.

On a technical note, Regina Capital’s Mr. Limlingan said the PSEi’s 7,400-resistance level is “still hard to hit.” Support lies at 7,170, which is the 260-day moving average.

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=stocks-rebound-as-fed-minutes-signal-hike-delay&id=125651

==================================================

Good luck on all your TRADES

luck on all your TRADES today

today .

.

DISCLAIMER There is a very high degree of risk involved in TRADING . Past results

. Past results are not indicative of future returns

are not indicative of future returns . Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION

. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER

or endorsement of any security. In accordance with the Responsible TRADER ’s Creed: I will never tell and you take full

’s Creed: I will never tell and you take full responsibility for all your TRADING

responsibility for all your TRADING results

results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion