Top Ten Smart Money Moves – Feb. 4, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading

Moves, starting January 2015, is the official trading newsletter of The Responsible Trader

newsletter of The Responsible Trader to promote

to promote his advocacy, Responsible Trading

his advocacy, Responsible Trading . This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying

. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded

and Selling, Top Ten in Total Traded Value, including Trading

Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader

Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on Feb. 4, 2016 Data)

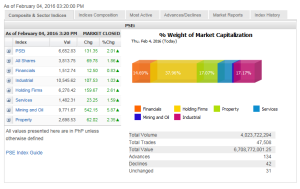

Total Traded Value – PhP 6.707 Billion – Low

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 134 Advances vs. 42 Declines = 3.19:1 Bullish

Total Foreign Buying – PhP 3.386 Billion

Total Foreign Selling – (Php 3.414) Billion

Net Foreign Buying (Selling) – (Php 0.028) Billion – 2nd day of Net Foreign Selling after 7 days of Net Foreign Buying

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

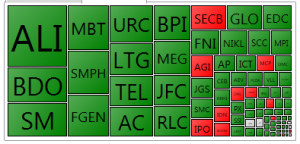

PSE Heat Map

Screenshot courtesy of: PSEGET Software

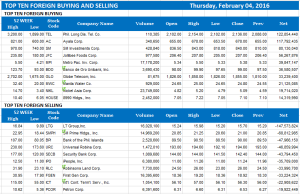

Top Ten Foreign Buying and Selling

and Selling

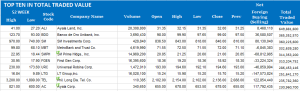

Top Ten in Total Traded Value

Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Posted on February 04, 2016 08:51:00 PM

By Krista A. M. Montealegre, Senior Reporter

Stocks rebound on dovish Fed bets, oil recovery

STOCKS ENDED a two-day slump yesterday, as optimism that the US Federal Reserve would slow the pace of interest rate increases, alongside a rebound in oil prices, boosted the risk appetite of investors.

The benchmark Philippine Stock Exchange index (PSEi) rallied 131.35 points or 2.01% to close at the session’s high of 6,652.83.

The broader all-shares index climbed 69.78 points or 1.86% to finish at 3,813.75.

“We tracked the US market because of the statement of [Federal Reserve Bank of New York President] William Dudley that conditions have become tighter and that might delay further interest rate hikes,” Luis A. Limlingan, business development head at Regina Capital Development Corp., said in a telephone interview.

Mr. Dudley told financial news agency MNI that “tight” financial conditions would be considered when the US central bank meets to review policy anew in March.

Wall Street staged a late turnaround on Wednesday night, buoyed by the rebound in oil prices and as weak economic data boosted bets that the Fed would keep interest rates steady at its next meeting.

Overnight, the Dow Jones industrial average ended up 183.12 points or 1.13% to 16,336.66; the Standard & Poor’s 500 gained 9.5 points or 0.5% to 1,912.53; and the Nasdaq Composite index dropped 12.71 points or 0.28% to 4,504.24.

The International Supply Management’s non-manufacturing index stood at 53.5 in January, lower than the 55.8 in the prior month and the lowest reading since December 2013.

“It’s just bargain hunting of greatly battered stocks. Investors jumped in when the PSEi reached the previous 6,600 resistance level, as they were hoping that might lead to a retest of the 6,700 level,” Joylin F. Telagen, equity research analyst at IB Gimenez Securities, Inc., said in a mobile phone message.

All counters jumped by nearly 1% each yesterday. Mining and oil was the session’s top performer, surging 542.15 points or 5.87% to 9,771.67.

Likewise, holding firms advanced 159.67 points or 2.61% to 6,278.42; property jumped 62.02 points or 2.35% to 2,698.53; services went up 23.25 points or 1.59% to 1,482.31; industrial added 107.53 points or 1.03% to 10,545.62; and financials rose 12.50 points or 0.83% to 1,512.74.

Value turnover improved to P6.71 billion after 4.02 billion shares changed hands, from P5.8 billion on Wednesday.

Three stocks advanced for every issue that declined, while 31 stocks closed flat.

Net foreign selling thinned to P27.89 million from Wednesday’s P93.88 million.

“At the end of the week, investors will watch for US nonfarm payrolls, but they might reposition ahead of the Chinese New Year holiday,” IB Gimenez Securities’ Ms. Telagen said.

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=stocks-rebound-on-dovish-fed-bets-oil-recovery&id=122628

==================================================

Good luck on all your TRADES

luck on all your TRADES today

today .

.

DISCLAIMER There is a very high degree of risk involved in TRADING . Past results

. Past results are not indicative of future returns

are not indicative of future returns . Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION

. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER

or endorsement of any security. In accordance with the Responsible TRADER ’s Creed: I will never tell and you take full

’s Creed: I will never tell and you take full responsibility for all your TRADING

responsibility for all your TRADING results

results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion