Top Ten Smart Money Moves – Feb. 5, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading

Moves, starting January 2015, is the official trading newsletter of The Responsible Trader

newsletter of The Responsible Trader to promote

to promote his advocacy, Responsible Trading

his advocacy, Responsible Trading . This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying

. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded

and Selling, Top Ten in Total Traded Value, including Trading

Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader

Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on Feb. 5, 2016 Data)

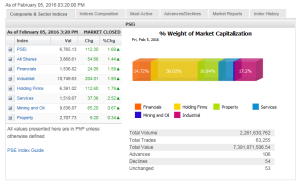

Total Traded Value – PhP 7.392 Billion – Low

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 106 Advances vs. 54 Declines = 1.96:1 Neutral

Total Foreign Buying – PhP 3.847 Billion

Total Foreign Selling – (Php 3.674) Billion

Net Foreign Buying (Selling) – Php 0.173 Billion – 1st day of Net Foreign Buying after 2 days of Net Foreign Selling

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

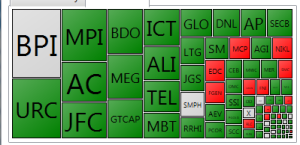

PSE Heat Map

Screenshot courtesy of: PSEGET Software

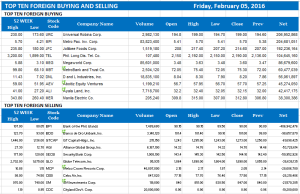

Top Ten Foreign Buying and Selling

and Selling

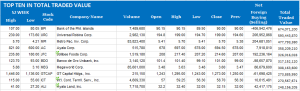

Top Ten in Total Traded Value

Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Posted on February 08, 2016 07:31:00 PM

By Krista A. M. Montealegre, Senior Reporter

Profit taking to cap gains as uncertainty lingers

LOCAL STOCKS may be vulnerable to profit taking after chalking up two straight weeks of gains, as investors turn to Wall Street and domestic earnings reports for direction with Chinese markets closed for a week-long holiday.

The US non-farm payrolls report will set the tone for trades when the local market reopens today, analysts said. Philippine financial markets were closed yesterday because of the Lunar New Year holiday.

The US created 151,000 jobs last month, falling short of expectations for a rise of 190,000. However, there were some hints of strength in the labor market after wages rose and unemployment fell to 4.9%, the lowest since February 2008.

The mixed economic data dragged US stocks on Friday and Asian markets yesterday as investors continue to struggle with growth concerns and its impact on future rate hikes by the Federal Reserve. Still, Asian shares pared early losses on Monday as a weaker yen helped Japan’s Nikkei snap a four-day losing streak, but trade was thin with many regional markets also closed for the Lunar New Year holiday.

“The Fed’s tightening cycle and its impact on China and oil could cap aggressive rallies, particularly for sectors sensitive to interest rate changes and fluctuation in commodity prices,” online brokerage 2TradeAsia.com said in a report.

Local equities have started to recover from a rocky start to the year, posting gains for two weeks in a row as a recent slew of soft economic data bolstered expectations of easy monetary policy across central banks worldwide. The benchmark Philippine Stock Exchange index surged 1.16% to end at 6,765.13 last week after climbing 7.72% in the prior week.

Wild price swings may still be seen in the week ahead especially given the uncertainty of central bank actions globally, BPI Asset Management said in a market report.

“What’s important is there is assurance from the Federal Reserve that whatever happens, it is ready to support the economy. We’ve seen in the previous statements of the Fed that future rate hikes will be data-dependent,” Lexter L. Azurin, head of research at Unicapital Securities, Inc., said in a telephone interview.

On the domestic front, the earnings season shifts into higher gear with several companies led by Ayala-owned firms Globe Telecom, Inc. and Integrated Micro-Electronics, Inc. scheduled to come out with their financial performance.

“The news for the week will be earnings-related. It will depend on the results of local companies. Based on technicals, it seems we are reaching resistance levels. There’s a possibility we may see some profit taking,” Mr. Azurin said.

Immediate resistance is at the 6,800 to 6900 range with support plotted at the 6,650 mark, 2TradeAsia.com said.

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=profit-taking-to-cap-gains-as-uncertainty-lingers&id=122753

==================================================

Good luck on all your TRADES

luck on all your TRADES today

today .

.

DISCLAIMER There is a very high degree of risk involved in TRADING . Past results

. Past results are not indicative of future returns

are not indicative of future returns . Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION

. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER

or endorsement of any security. In accordance with the Responsible TRADER ’s Creed: I will never tell and you take full

’s Creed: I will never tell and you take full responsibility for all your TRADING

responsibility for all your TRADING results

results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion