Top Ten Smart Money Moves – Feb. 9, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading

Moves, starting January 2015, is the official trading newsletter of The Responsible Trader

newsletter of The Responsible Trader to promote

to promote his advocacy, Responsible Trading

his advocacy, Responsible Trading . This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying

. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded

and Selling, Top Ten in Total Traded Value, including Trading

Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader

Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on Feb. 9, 2016 Data)

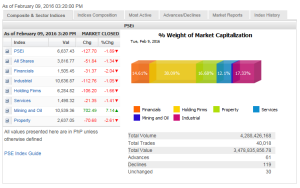

Total Traded Value – PhP 3.479 Billion – Low

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 119 Declines vs. 61 Advances = 1.95:1 Neutral

Total Foreign Buying – PhP 1.568 Billion

Total Foreign Selling – (Php 1.456) Billion

Net Foreign Buying (Selling) – Php 0.112 Billion – 2nd day of Net Foreign Buying after 2 days of Net Foreign Selling

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

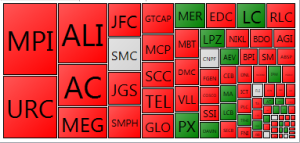

PSE Heat Map

Screenshot courtesy of: PSEGET Software

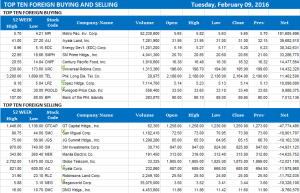

Top Ten Foreign Buying and Selling

and Selling

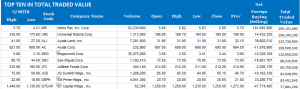

Top Ten in Total Traded Value

Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Posted on February 09, 2016 08:31:00 PM

By Krista A. M. Montealegre, Senior Reporter

PSE index tumbles as global marts slump anew

STOCKS faltered in light trading yesterday, giving in to selling pressure following another rout in markets worldwide on the back of renewed fears on the health of the global economy.

The bellwether Philippine Stock Exchange index (PSEi) tumbled 127.70 points or 1.88% to close at yesterday’s low of 6,637.43, ending a two-session rise.

The all-shares index slipped 51.84 points or 1.34% to settle at 3,816.77.

“We were tracking the US [yesterday]. US was down for two straight days and we came from a holiday so we were just making up for lost time,” Luis A. Limlingan, business development head at Regina Capital Development Corp., said in a telephone interview.

“It’s profit taking due to mixed labor data results from the US last week. Earnings reports have started to trickle in and some investors are still on a holiday break,” Joylin F. Telagen, equity analyst at IB Gimenez Securities, Inc., said in a mobile phone message.

A sell-off in US stocks overnight triggered a wave of selling in Asian markets yesterday.

Wall Street ended deep in the red on Monday night, as investors dumped equities amid concerns on growth against a backdrop of rising interest rates.

“Volume was thin because most of our Asian counterparts are still on holiday so we were really focused on the Western front,” Regina Capital’s Mr. Limlingan said.

Several Asian markets such as Hong Kong, Singapore, South Korea, Malaysia and Vietnam remained shut for the Lunar New Year holiday. Markets in China and Taiwan are closed for the week.

Most of the counters were deep in the red. Mining was the lone sub-index that escaped yesterday’s sell-off, surging 702.49 points or 7.14% to close at 10,539.36.

In contrast, property slid 70.68 points or 2.61% to 2,637.05; financials fell 31.37 points or 2.04% to 1,505.45; holding firms declined 106.20 points or 1.66% to 6,284.82; services went down 21.35 points or 1.40% to 1,498.32; and industrial shed 112.76 points or 1.04% to 10,636.87.

Value turnover was halved to P3.48 billion after 4.29 billion shares changed hands, from P7.39 billion in the prior session.

Losers outnumbered gainers, 119 to 61, while 30 issues were unchanged.

Net foreign buying dropped to P111.47 million from P173.61 million registered on Friday.

The volatility in financial markets worldwide puts the spotlight on Federal Reserve Chairperson Janet Yellen when she gives her semiannual monetary policy report before the US Congress this week.

“Investors want reaffirmation that future rate hikes are tied to the global economy and more clues if there will be more interest rate hikes at their next meeting,” Mr. Limlingan said.

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=pse-index-tumbles-as-global-marts-slump-anew&id=122819

==================================================

Good luck on all your TRADES

luck on all your TRADES today

today .

.

DISCLAIMER There is a very high degree of risk involved in TRADING . Past results

. Past results are not indicative of future returns

are not indicative of future returns . Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION

. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER

or endorsement of any security. In accordance with the Responsible TRADER ’s Creed: I will never tell and you take full

’s Creed: I will never tell and you take full responsibility for all your TRADING

responsibility for all your TRADING results

results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion