Top Ten Smart Money Moves – Jan. 12, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading

Moves, starting January 2015, is the official trading newsletter of The Responsible Trader

newsletter of The Responsible Trader to promote

to promote his advocacy, Responsible Trading

his advocacy, Responsible Trading . This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying

. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded

and Selling, Top Ten in Total Traded Value, including Trading

Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader

Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on Jan. 12, 2016 Data)

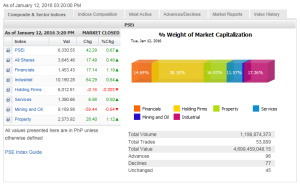

Total Traded Value – PhP 4.699 Billion – Low

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 96 Advances vs. 77 Declines = 1.25:1 Neutral

Total Foreign Buying – PhP 2.342 Billion

Total Foreign Selling – (Php 2.411) Billion

Net Foreign Buying (Selling) – (Php 0.690) Billion – 3rd day of Net Foreign Selling after a day of Net Foreign Buying

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

PSE Heat Map

Screenshot courtesy of: PSEGET Software

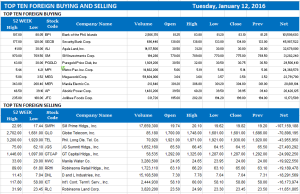

Top Ten Foreign Buying and Selling

and Selling

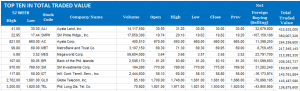

Top Ten in Total Traded Value

Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Posted on January 12, 2016 08:31:00 PM

PHL stocks recover as investors pick up bargains

LOCAL SHARES partially recovered from Monday’s bloodbath yesterday after investors seized buying opportunities on marked-down equities, analysts said.

The bellwether Philippine Stock Exchange index (PSEi) bounced back by 42.29 points or 0.67% to end yesterday’s trading at 6,330.55. It however pared heftier gains logged during the session, which saw the main gauge rise to an intraday high of 6,433.75.

The broader all-shares index also recouped 17.49 points or 0.48% to settle at 3,645.46 at the closing bell.

“It’s just bargain hunting of selected stocks after heavy sell-off yesterday,” Joylin F. Telagen, equity research analyst at IB Gimenez Securities, Inc., said in a mobile phone reply.

At the start of the trading week, the PSEi entered bear market territory after falling to its lowest level in nearly two years, amid a regional sell-off over concerns of a slowdown in China’s economy. The local barometer closed at 6,288.26, shaving 22.63% off its record closing high of 8,127.48 logged on April 10, 2015 to meet the common definition of a bear market: a 20% drop from a previous high.

“For the week, I advise investors to let it stabilize before getting back. On a technical note, let the gap fill in (the gap is between 6,523 to 6,555) before stepping into the volatile market,” Ms. Telagen said.

Lexter L. Azurin, head of research at Unicapital Securities, Inc., echoed this view, saying in a separate text message: “Market bounced [yesterday] as it reached oversold levels. Investors took advantage of beaten-down stocks, while some of the major companies announced buyback programs to support the share prices.

Four out of six domestic subindices ended in the green, with financials leading the rally after gaining 17.14 points or 1.19% to 1,453.43. Property advanced by 28.40 points or 1.11% to 2,573.92; industrials climbed 64.29 points or 0.63% to 10,190.28; and services inched up by 6.98 points or 0.50% to 1,390.66.

On the other hand, holding firms ended flat, losing less than a point, while the mining and oil subindex dropped 59.44 points or 0.64% to 9,189.98.

Value turnover yesterday shrank to P4.70 billion after 1.20 billion shares changed hands, from Monday’s P7.23 billion.

Gainers outnumbered losers, 96 to 77, while 45 issues did not move.

Foreign investors continued to dump local shares, but net outflows were reduced to P69.10 million yesterday from the P1.16 billion logged in the previous session.

“We have heard people call this a bear market after it broke below the 6,500 line. There are warning signs all around… Caution still is the name of our game,” Justino B. Calaycay, Jr., analyst at Philstocks Financial, Inc., said in a market report.

Chart-wise, the PSEi’s immediate resistance lies at 6,600, while support is between 6,300 and 6,200, according to Unicapital’s Mr. Azurin. — Daphne J. Magturo

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=phl-stocks-recover-as-investors-pick-up-bargains&id=121333

==================================================

Good luck on all your TRADES

luck on all your TRADES today

today .

.

DISCLAIMER There is a very high degree of risk involved in TRADING . Past results

. Past results are not indicative of future returns

are not indicative of future returns . Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION

. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER

or endorsement of any security. In accordance with the Responsible TRADER ’s Creed: I will never tell and you take full

’s Creed: I will never tell and you take full responsibility for all your TRADING

responsibility for all your TRADING results.

results.