Top Ten Smart Money Moves – Jan. 27, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading

Moves, starting January 2015, is the official trading newsletter of The Responsible Trader

newsletter of The Responsible Trader to promote

to promote his advocacy, Responsible Trading

his advocacy, Responsible Trading . This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying

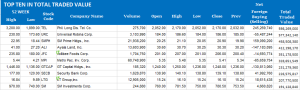

. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded

and Selling, Top Ten in Total Traded Value, including Trading

Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader

Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on Jan. 27, 2016 Data)

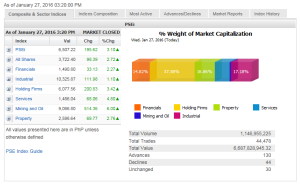

Total Traded Value – PhP 6.888 Billion – Low

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 130 Advances vs. 44 Declines = 2.95:1 Bullish

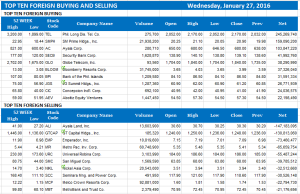

Total Foreign Buying – PhP 3.027 Billion

Total Foreign Selling – (Php 2.914) Billion

Net Foreign Buying (Selling) – Php 0.113 Billion – 3rd day of Net Foreign Buying after 5 days of Net Foreign Selling

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

PSE Heat Map

Screenshot courtesy of: PSEGET Software

Top Ten Foreign Buying and Selling

and Selling

Top Ten in Total Traded Value

Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Posted on January 27, 2016 07:41:00 PM

By Krista A. M. Montealegre, Senior Reporter

Bullish bets on PHL GDP, Fed move boost stocks

STOCKS staged a strong rebound yesterday, sending the benchmark index past the 6,500 mark, fueled by optimism on the country’s economic growth performance and hopes that the US Federal Reserve will keep interest rates unchanged.

The benchmark Philippine Stock Exchange index surged 195.62 points or 3.09% to close at 6,507,22, The broader all-shares index climbed 98.39 points or 2.71% to finish at 3,722.40.

“[Yesterday’s] action seems to be in line with a technical bounce with key resistance seen between 6,500 to 6,600 levels. The market seems to be upbeat on the gross domestic product (GDP) numbers, which is to be released [today],” BDO Unibank, Inc. Chief Market Strategist Jonathan L. Ravelas said in a mobile phone message.

The Philippine Statistics Authority yesterday upwardly revised the country’s third-quarter economic growth print to 6.1% from the 6% announced in November last year.

Philippine GDP likely grew by 6.05% in the fourth quarter and 5.725% for the full year — well below the 7%-8% official target — according to a BusinessWorld poll of 16 economists conducted last week.

“Increased possibility that the Federal Reserve will consider China’s economy and low oil prices in holding off an interest rate hike” boosted share prices, Joylin F. Telagen, equity research analyst at IB Gimenez Securities, Inc., said in a separate message.

The US central bank concludes a two-day policy meeting today, with monetary officials expected to keep interest rates steady amid the turbulence in global financial markets.

Luis A. Limlingan, business development head at Regina Capital Development Corp., said Wall Street’s surge on Tuesday night set the tone for the recovery in local share prices. The three major US averages shot up by more than 1% each, buoyed by a bounce in oil prices on optimism that producers would tackle issues on oversupply.

All counters saw sharp gains yesterday. Mining and oil was the session’s top performer, rising 514.36 points or 6% to 9,086.80.

Likewise, services advanced 68.06 points or 4.8% to 1,486.04; holding firms went up 200.83 points or 3.41% to 6,077.56; property added 69.77 points or 2.75% to 2,598.64; financials jumped 33.13 points or 2.27% to 1,490.80; and industrial rose 111.98 points or 1.09% to 10,325.87.

Value turnover improved to P6.69 billion after 1.15 billion shares changed hands, from Tuesday’s P5.84 billion.

Gainers dominated losers, 130 to 44, while 30 issues were unchanged.

Net foreign buying thinned to P113.37 million from P201.92 million in the previous session.

“We expect a dovish Fed comment followed by a healthy dose of quantitative easing Japan-style to pump more liquidity into the market,” Regina Capital’s Mr. Limlingan said.

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=bullish-bets-on-phl-gdp-fed-move-boost-stocks&id=122176

==================================================

Good luck on all your TRADES

luck on all your TRADES today

today .

.

DISCLAIMER There is a very high degree of risk involved in TRADING . Past results

. Past results are not indicative of future returns

are not indicative of future returns . Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION

. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER

or endorsement of any security. In accordance with the Responsible TRADER ’s Creed: I will never tell and you take full

’s Creed: I will never tell and you take full responsibility for all your TRADING

responsibility for all your TRADING results

results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion