Top Ten Smart Money Moves – Jan. 5, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading

Moves, starting January 2015, is the official trading newsletter of The Responsible Trader

newsletter of The Responsible Trader to promote

to promote his advocacy, Responsible Trading

his advocacy, Responsible Trading . This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying

. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded

and Selling, Top Ten in Total Traded Value, including Trading

Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader

Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on Jan. 5, 2016 Data)

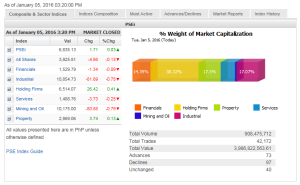

Total Traded Value – PhP 3.987 Billion – Low

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 97 Declines vs. 73 Advances = 1.33:1 Neutral

Total Foreign Buying – PhP 2.144 Billion

Total Foreign Selling – (Php 2.269) Billion

Net Foreign Buying (Selling) – (Php 0.125) Billion – 1st day of Net Foreign Selling after 8 days of Net Foreign Buying

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

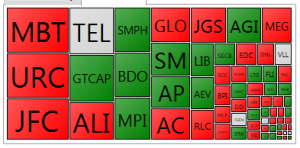

PSE Heat Map

Screenshot courtesy of: PSEGET Software

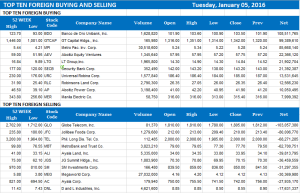

Top Ten Foreign Buying and Selling

and Selling

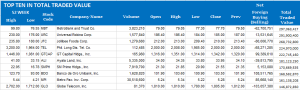

Top Ten in Total Traded Value

Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Posted on January 05, 2016 08:21:00 PM

By Krista A. M. Montealegre, Senior Reporter

Shares eke out small gains after volatile session

LOCAL share prices stabilized yesterday following a rout in Chinese shares that spooked global financial markets on the opening day of trades for the new year.

Coming off its worst start to a new year in 15 years, the benchmark Philippine Stock Exchange index (PSEi) dipped in and out of negative territory throughout yesterday’s session before squeezing out a slim gain of 1.71 points or 0.02% to 6,835.13 at the close of trades.

The broader all-shares slipped 4.98 points or 0.12% to finish at 3,925.81.

“The market was actually volatile, but we closed relatively flat. The story was still yesterday’s sell-off in Chinese equities, which spread to the US stocks,” Lexter L. Azurin, head of research at Unicapital Securities, Inc., said in a text message on Tuesday.

US stocks booked steep losses on Monday night following a global sell-off triggered by a rout in Chinese shares and escalating tensions in the Middle East.

After Chinese stocks dived 7% on Monday, the People’s Bank of China yesterday unexpectedly infused 130 billion yuan into the domestic markets to boost borrowing. The central bank’s move helped prop up Chinese equities on Tuesday, but the gains were short-lived.

“Overselling caused some cherry picking as some stocks were brought up due to low valuations,” Luis A. Limlingan, business development head at Regina Capital Development Corp., said separately in a mobile phone message.

Counters finished mixed. Holding firms climbed 26.42 points or 0.4% to 6,514.07 and property went up by 3.74 points or 0.13% to 2,869.06.

In contrast, mining and oil slumped 80.88 points or 0.78% to 10,175.00; industrial shed 81.89 points or 0.74% to 10,854.73; services gave up 3.73 points or 0.25% to 1,488.76; and financials lost 1.34 points or 0.08% to 1,529.79.

Decliners outnumbered advancers, 97 to 73, while 40 names closed unchanged.

Value turnover improved to P3.99 billion after 908.48 million shares were traded, from P2.99 billion, but was still well below the average daily turnover of P8.96 billion last year.

Foreigners dumped local equities, with net sales of P125.88 million — a reversal of their net purchases of P129.72 million on Monday.

The blue-chip PSEi could test support levels between 6,600 and 6,800 with several economic data from China expected to come out this month that could add to signs of weakness in the world’s second biggest economy, analysts said.

“Sentiment is on the negative side,” Unicapital’s Mr. Azurin said.

“It will be a challenging year not only for the Philippine market but global market as well due to slowdown concerns in China and whether the Federal Reserve did the right move in raising interest rates.”

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=shares-eke-out-small-gains-after-volatile-session&id=120957

==================================================

Good luck on all your TRADES

luck on all your TRADES today

today .

.

DISCLAIMER There is a very high degree of risk involved in TRADING . Past results

. Past results are not indicative of future returns

are not indicative of future returns . Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION

. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER

or endorsement of any security. In accordance with the Responsible TRADER ’s Creed: I will never tell and you take full

’s Creed: I will never tell and you take full responsibility for all your TRADING

responsibility for all your TRADING results.

results.