Top Ten Smart Money Moves – Jan. 8, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading

Moves, starting January 2015, is the official trading newsletter of The Responsible Trader

newsletter of The Responsible Trader to promote

to promote his advocacy, Responsible Trading

his advocacy, Responsible Trading . This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying

. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded

and Selling, Top Ten in Total Traded Value, including Trading

Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader

Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on Jan. 8, 2016 Data)

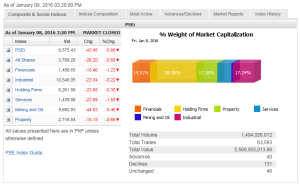

Total Traded Value – PhP 5.570 Billion – Low

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 131 Declines vs. 46 Advances = 2.85:1 Bearish

Total Foreign Buying – PhP 2.192 Billion

Total Foreign Selling – (Php 3.198) Billion

Net Foreign Buying (Selling) – (Php 1.006) Billion – 1st day of Net Foreign Selling after a day of Net Foreign Buying

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

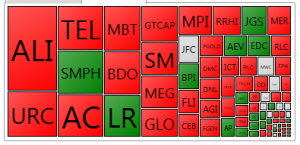

PSE Heat Map

Screenshot courtesy of: PSEGET Software

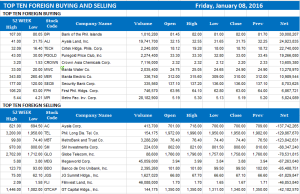

Top Ten Foreign Buying and Selling

and Selling

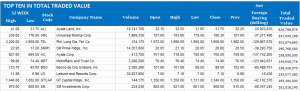

Top Ten in Total Traded Value

Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Posted on January 10, 2016 07:31:00 PM

By Krista A. M. Montealegre, Senior Reporter

Main index seen inching closer to bear territory

AFTER opening the new year with a bloodbath, the Philippine stock market is at risk of entering bear territory, analysts said, with the benchmark index poised to sustain more losses in the week ahead.

The benchmark Philippine Stock Exchange index (PSEi) broke major support levels after plunging by 5.42% in the first week of 2016 to close at 6,575.43 — 19% off its record high of 8,127.48 seen on April 10, 2015 — over renewed concerns of a deep slowdown in China following weaker-than-expected manufacturing data.

At its current level, the PSEi is just 1% away from reaching bear territory. A drop of at least 20% from a previous high is the common definition of a bear market.

“Hopefully, we are nearing the bottom, but I still can’t see the light at the end of the tunnel. The uncertainties remain and there are still a lot of red flags,” Astro C. del Castillo, managing director at First Grade Finance, Inc., said in a telephone interview.

After breaching the major support level of 6,600, the PSEi is expected to drop to as low as 6,300 this week — a level that could trigger a possible rebound since prices are projected to form their channel support there, Luis A. Limlingan, business development head at Regina Capital Development Corp., said via text.

“However, this only strengthens the case of a medium- to long-term downtrend as successive lower highs and lows are being formed,” Mr. Limlingan said.

The main index, however, could prevent this bearish scenario should prices recover above the 6,600-6,700 levels and hold above it, he added.

“With local gauges at the critical juncture at 6,500, we expect participants to have their fingers on the trigger, ready to seize opportunities to score bargains,” online brokerage 2TradeAsia.com said in a report.

“Although local political elections will be in order this May, trading windows are available and the macro events are what would separate the ‘men versus the boys’,” 2TradeAsia added.

With the sell-off creating a lot of bargains in the market, hopes of a rebound this week are dimming following a weak lead from Wall Street.

On Friday, the blue-chip Dow Jones industrial average sank down 167.65 points or 1.02% to 16,346.45, marking its worst weekly start since 2011.

The nonfarm payrolls report in December released last Friday showed the US economy added 292,000 jobs, topping estimates and bolstering expectations that the turmoil in China would not be enough to keep the Federal Reserve from further raising interest rates.

“I think the Fed may consider what’s happening to China so I assume a higher possibility that they will watch the economy’s recovery and the health of the global economy,” Joylin F. Telagen, equity research analyst at IB Gimenez Securities, Inc., said in a mobile phone message.

==================================================

Good luck on all your TRADES

luck on all your TRADES today

today .

.

DISCLAIMER There is a very high degree of risk involved in TRADING . Past results

. Past results are not indicative of future returns

are not indicative of future returns . Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION

. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER

or endorsement of any security. In accordance with the Responsible TRADER ’s Creed: I will never tell and you take full

’s Creed: I will never tell and you take full responsibility for all your TRADING

responsibility for all your TRADING results.

results.