Top Ten Smart Money Moves – Mar. 8, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading

Moves, starting January 2015, is the official trading newsletter of The Responsible Trader

newsletter of The Responsible Trader to promote

to promote his advocacy, Responsible Trading

his advocacy, Responsible Trading . This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying

. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded

and Selling, Top Ten in Total Traded Value, including Trading

Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader

Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on Mar. 8, 2016 Data)

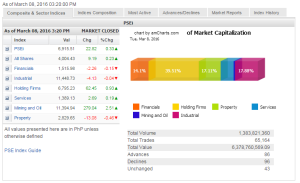

Total Traded Value – PhP6.379 Billion – Low

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 96 Declines vs. 86 Advances = 1.12:1 Neutral

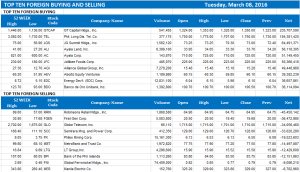

Total Foreign Buying – PhP 3.885 Billion

Total Foreign Selling – (Php 3.132) Billion

Net Foreign Buying (Selling) – Php 0.753 Billion – 2nd day of Net Foreign Buying after a day of Net Foreign Selling

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

PSE Heat Map

Screenshot courtesy of: PSEGET Software

Top Ten Foreign Buying and Selling

and Selling

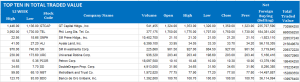

Top Ten in Total Traded Value

Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Posted on March 08, 2016 08:41:00 PM

By Krista A. M. Montealegre, Senior Reporter

Stimulus hopes, select buying lift local equities

STOCKS wobbled yesterday before squeezing out modest gains on optimism of more stimulus from central banks and as investors picked up select blue chips.

The benchmark Philippine Stock Exchange index (PSEi) climbed 22.82 points or 0.33% to close at 6,915.51, also the session’s high. The local barometer was down by as much as 0.76% in early trade.

The all-shares index added 9.19 points or 0.23% to finish at 4,004.43.

“At the close, the market was forced up, as investors were speculating that the European Central Bank will announce more stimulus measures in its meeting this week given that China showed its intention to support the economy,” Jonathan J. Latuja, equity research analyst at Unicapital Securities, Inc., said in a telephone interview.

Last week, the People’s Bank of China cut banks’ reserve requirements by 50 basis points to prop up its slowing economy.

The latest batch economic data from the world’s second-largest economy showed exports fell 25.4% from a year earlier, while imports dropped by an annual 13.8% in February.

“The PSEi was trading around 6,900, but the release of disappointing China trade data pulled the index lower. However, before the close of trading, investors made selective purchases,” Joylin F. Telagen, equity analyst at IB Gimenez Securities, Inc., said in a mobile phone message yesterday.

Lifting the PSEi was index heavyweight Philippine Long Distance Telephone Co., which gained 1.16% to close at P1,750 after being heavily sold off in the previous sessions since reporting disappointing earnings and a gloomy outlook.

Other stocks that boosted the PSEi, according to Unicapital’s Mr. Latuja, were conglomerates SM Investments Corp., which gained 2.83% to P927 apiece; GT Capital Holdings, Inc., up 2.04% to P1,350 apiece; JG Summit Holdings, Inc., 0.83% higher to P73 each; and Ayala Corp., which inched up 0.69% to P725 each.

Mining and oil rallied 279.04 points or 2.51% to 11,394.94; holding firms rose 62.45 points or 0.92% to 6,795.23; and services added 2.69 points or 0.19% to 1,389.13.

In contrast, property shed 13.08 points or 0.46% to 2,829.65; financials slid 2.26 points or 0.14% to 1,515.98; and industrial dipped 4.13 points or 0.03% to 11,448.73.

Value turnover eased to P6.38 billion after 1.38 billion shares changed hands, from Monday’s P7.0 billion.

Decliners edged out advancers, 96 to 86, while 43 issues were unchanged. Net foreign selling surged to P752.96 million from P265.45 million on Monday.

“The market may move sideways as investors are still waiting for more economic signals. Next week, the Federal Reserve will meet again so you can expect investors to be cautious,” Unicapital’s Mr. Latuja said.

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=stimulus-hopes-select-buying-lift-local-equities&id=124219

==================================================

Good luck on all your TRADES

luck on all your TRADES today

today .

.

DISCLAIMER There is a very high degree of risk involved in TRADING . Past results

. Past results are not indicative of future returns

are not indicative of future returns . Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION

. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER

or endorsement of any security. In accordance with the Responsible TRADER ’s Creed: I will never tell and you take full

’s Creed: I will never tell and you take full responsibility for all your TRADING

responsibility for all your TRADING results

results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion