Top Ten Smart Money Moves – May 5, 2017

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on May 5, 2017 Data)

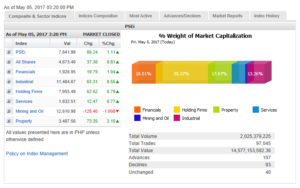

Total Traded Value – PhP 14.577 Billion – Medium

Advances Declines Ratio – (Ideal is 2:1) 107 Advances vs. 93 Declines = 1.15:1 Neutral

Total Foreign Buying – PhP 9.542 Billion

Total Foreign Selling – (PhP 8.076) Billion

Net Foreign Buying (Selling) – PhP 1.466 Billion – 4th day of Net Foreign Buying after a day of Net Foreign Selling

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

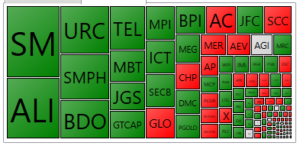

PSE HEAT MAP

Screenshot courtesy of PSEGET

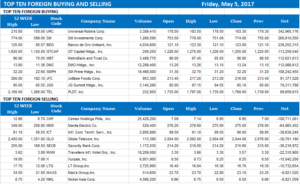

Top Ten Foreign Buying and Selling

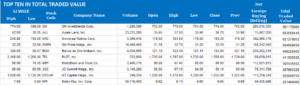

Top Ten in Total Traded Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Local stocks seen to move sideways this week

Posted on May 08, 2017

STOCKS may move sideways this week as investors keep a close eye on the French presidential elections and more first quarter earnings reports from local companies.

The Philippine Stock Exchange index (PSEi) surged 86.24 points or 1.11% to end last week at 7,841.99, its highest finish since settling at 7,845.49 on Aug. 26, 2016, as oil prices plunged and foreign funds returned to the local market.

The PSEi ended last week with a gain of 2.36%. Year-to-date, this pushed the main gauge’s return to 14.64%, while the wider all-shares index climbed 37.30 points or 0.80% to 4,673.40. The bellwether closed the month of April at 7,661.01.

Justino B. Calaycay, Jr., head of marketing and research at A&A Securities, Inc., said markets will focus on the French presidential elections, oil price movements and corporate profit reports this week.

“The French head to the polling booths for the second time to elect either Marine Le Pen or Emmanuel Macron to succeed Francois Hollande as President. Polls point to a Macron victory which presents an EU-friendly France and douses cold water on ‘Frexit,’” Mr. Calaycay said.

The French election on Sunday is being keenly watched as it will determine whether Macron, a pro-European Union centrist, or Le Pen, a far-rightist known for her anti-EU stance, will lead the euro zone’s second largest economy.

“A Macron-finish could help boost sentiment, and further lessen forex volatility, as exit overhangs for the euro block is lifted. Meanwhile, the broad picture rests on fiscal spending drives, specifically on US tax cuts that will support increased consumer and investment spending,” online brokerage 2TradeAsia.com said in a market note.

Also, Mr. Calaycay noted that investors will also watch out for movements in oil prices after crude oil dropped below the $45-a-barrel mark. The West Texas Intermediate oil settled at $46.22 on Friday.

“Inventories are building up as US shale production rejuvenates tempering the impact of OPEC’s (Organization of the Petroleum Exporting Countries) production caps. This puts the spotlight on OPEC when it meets on May 25 of an ‘ordinary’ meeting in Vienna, Austria,” he added.

Luis A. Limlingan, managing director at the Regina Capital Development Corp. said there will also be some speculation ahead of the release of the country’s first quarter gross domestic product data on May 18.

On Friday, net foreign buying accelerated on Friday to P1.47 billion from P21.98 million in the previous session. Value turnover doubled to P14.58 billion, from P7.52 billion on Thursday, after 2.03 billion shares changed hands.

“As the PSEi approaches the crucial 8,000 mark, all eyes are on the continuity of the local bourse’s ascent and macro catalysts that will further propel gauges. It would be timely to consider increasing equities holdings to generate improved real returns. Seize on weakness to position & hold,” the online brokerage 2TradeAsia said.

Analysts placed immediate support for the bellwether PSEi at 7,750, while resistance was pegged at 7,900-7,950 level. — I.C.C. Delavin

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=local-stocks-seen-to-move-sideways-this-week&id=144800

=====================================================

We aim to continue promoting financial literacy on the area of stock market trading and investing to our countrymen both here and abroad through the following:

1. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/.

As requested by those abroad and those who want the book in digital form, we have produced an eBook version. For those interested please send email to: ninjatrader19@gmail.com Subject: The Responsible Trader – eBook Version.

2. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

3. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

4. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES: Please take note of the following changes effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than PhP 8 Billion b. Medium – Total Traded Value Php 8 Billion but not more than P15 Billion c. High – Total Traded Value more than Php 15 Billion