TRT Ichi Moku Analytical Framework – Reading Ichi Moku Charts like A-B-C – Part 2

TRT Ichi Moku Analytical Framework – Reading Ichi Moku Charts like A-B-C – Part 2

My Simple Gift to the Trading World

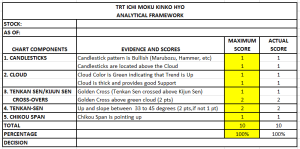

The Responsible Trader’s Ichi Moku Analytical Framework or TRT Ichi Moku Analytical Framework for short, is the worksheet I developed to make reading Ichi Moku Charts as easy as A-B-C. It is still in its infancy but I already included it in my book so as to have it covered by Copyright and form part of my intellectual property. Nothing like it yet in the internet. It is my gift to the trading world to contribute to the knowledge about Ichi Moku Charts. It is my attempt to make trading knowledge available to everyone and the worksheet is given free to those who bought and will buy my book.

Reading Ichi-Moku Charts as easy as A-B-C

Responsible Trading is Evidence-based trading and I have converted the different components of the Ichi Moku Chart as evidence. Through trial and error, I have assigned corresponding points for conditions that support the existence of a low-risk, high-probability trade.

Let us take a close look at the Worksheet and examine the different components and corresponding scores one-by-one.

1. Candlesticks. If the last candlestick is Bullish (Marubozu, Hammer, etc.) or the last Candlestick Pattern is Bullish (two or more candlestick patterns) we give a score of 1.

If the last candlestick or the last candlestick pattern is above the Cloud we give another score of 1

2. Cloud. If the color of the Cloud is Green indicating that the trend is up we give a score of 1. If the cloud is thick and provides good support we give another score of 1.

3. Tenken Sen/Kijun Sen Crossovers. In case of a Golden Cross (Tenkan Sen crossed above Kijun Sen) we give a score of 1. I f the Golden Cross occurred above the Cloud we give another score of 2. If the Golden Cross occurred below the Cloud but was maintained after the breakout from the Cloud we still give a score of 2.

4. Tenkan Sen Slope. Although I stated Kijun Sen in my book, I still prefer to look at the Slope of the Tenkan Sen. If the slope of the Tenkan Sen is between 33 to 45 degrees the uptrend is sustainable so we give a score of 2. More than 45 degrees might suggest a strong trend but is not sustainable so we give a score of 1. Less than 33 degrees means a weak trend so we give a score of 1 instead of 2.

5. Chikou Span. There are a lot of opinions about the Chikou Span. If the Chikou span is above the price action, then this is a bullish signal. If it is found below the price action, then the sentiment in the market is bearish. If the Chikou is found where the candlesticks are, then this is a signal for a market in consolidation.

In the TRT Ichi Moku Analytical Framework we tried to simplify this by just considering direction where it is pointing. If it is pointing up, we give a score of 1.

Of course in all components, we give either the corresponding score or zero if the conditions for the evidence are not met.

Adding all the Scores together gives a maximum of 10 or 100%. Stocks with scores between 100% to 80% are considered low-risk, high probability trades. Stocks with scores below 80% could still be considered as low-risk, high-probability trades as long as components 1, 2, and 3 are present.

In Responsible Trading We Practice Critical Thinking, Never Blind Following

Just a word of caution, even if a stock gets a score of 100% if you see candlesticks expressing Irrational Exuberance (Please see The Responsible Trader’s Clock of Emotions and Price Action in my Book), Bearish Shooting Stars, Bearish Evening Stars, Abandoned Baby Doji, etc. it is better to wait for a pullback before entering the trade to avoid buying at the highs.

Initial Reactions from TRT Premium Subscribers

My TRT Premium Subscribers had an advanced preview of my book even before it was released to the general public. TRT Premium has a three-pronged objective:

1. Teach the Subscriber how to trade not what to trade.

2. Through the TRT Screeners provide choices of stocks that are considered low-risk, high-probability trades.

3. Through Stock Charts and Analysis of actual stocks traded in the market, provide examples on how to apply the lessons learned.

When I first introduced the TRT Ichi Moku Analytical Framework to my TRT Premium Subscribers, they were more than delighted when they learned that reading Ichi-Moku Charts is really not that formidable at all. These are some comments received:

Based on my backtests and actual trades, the TRT Ichi Moku Analytical Framework has already produced good results. As I stated, the TRT Ichi Moku Analytical Framework is still in its infancy and I am presently working on some tweaks to further improve the efficiency of the system. Buyers of the book will be given updates on the framework as I make more progress from time to time.

There you have it! You’ve seen it first in my book and the Responsible Trader.com. Start applying the TRT Ichi Moku Analytical Framework and start reading Ichi-Moku Charts like A-B-C. I would appreciate your feedback about your results.

I wish you the best in your learning journey and good luck on all your trades.

Have a blessed weekend everyone!