THE RESPONSIBLE TRADER – TRADING LESSONS – STOCK CLASSIFICATIONS – PART 1

THE RESPONSIBLE TRADER – TRADING LESSONS – STOCK CLASSIFICATIONS – PART 1

In this series of articles, I will be discussing ways that stocks are being classified and at the conclusion of these articles I will share with you my proposal for a new classification as discussed in my second book “Swing Trading with TRT – a Definitive Guide for Swing Trading the Philippine Stock Market” and my reasons for doing so.

PSE CLASSIFICATIONS ACCORDING TO INDUSTRY SECTORS

In the Philippines, stocks have been grouped into several classifications. However, there is only one classification that is officially used by the PSE. PSE has classified stocks according to Industry Sectors as follows

I. FINANCIAL

1. Banks

2. Other Financial Institutions

II. INDUSTRIAL

- Electricity, Energy, Power and Water

- Food, Beverage & Tobacco

- Construction, Infrastructure and Allied Services

- Chemicals

- Electrical, Components and Equipment

- Other Industrials

III. HOLDING

IV. PROPERTY

V. SERVICES

- Media

- Information Technology

- Transportation Services

- Hotel & Leisure

- Education

- Casinos & Gaming

- Retail

- Other Services

IV. MINING AND OIL

- Mining

- Oil

The rest of the classifications currently being used are just based on practice and conventions.

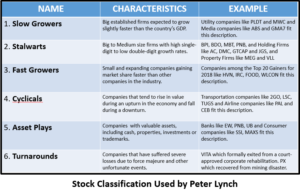

Another popular way of Classification is the Stock Categories used by Peter Lynch in his famous book One Up on Wall Street.

CLASSIFICATIONS USED BY PETER LYNCH

Slow Growers

These are stocks of big, established firms that are generally older and expected to grow slightly faster than the country’s GDP. The payment of cash dividends is the main shareholders’ return on this type of companies. Utility companies like PLDT and MWC and Media companies like ABS and GMA7 fit this description.

Stalwarts

These are stocks of big to medium-sized established firms with high single-digit to low double-digit growth rates. Banks like BPI, BDO, MBT, PNB, and Holding Firms like AC, DMC, GTCAP and JGS, and Property Firms like MEG and VLL fit this description.

Fast Growers

These are stocks of mainly small and expanding companies gaining market share faster than other companies in the industry. Companies among the Top 20 Gainers for 2018 like HVN, IRC, FOOD, WLCON fit this description.

Cyclicals

These are stocks of companies that tend to rise in value during an upturn in the economy and fall during a downturn. They usually include stock in industries that flourish in good times, including airlines and travel and leisure. Such companies have a natural swing in their stock performance. Transportation companies like 2GO, LSC, TUGS and Airline companies like PAL and CEB fit this description.

Asset Plays

These are stock of companies with valuable assets, including cash, properties, investments or trademarks. Their share prices are trading below the value of their assets. These are usually reported by your brokers as undervalued firms. Banks like EW, PNB, UB and Consumer companies like SSI, MAXS fit this description.

Turnarounds

These are stocks of companies that have suffered severe losses due to force majeure and other unfortunate events. They are considered high risk but with high reward. This is one of Warren Buffett’s favorite way of selecting stocks. Such companies can provide great opportunities. Timing is essential in buying these stocks as their operations recover and normalize. A good example is VITA which formally exited from a court-approved corporate rehabilitation. Another good example is PX which was able to recover from the Padcal Mine Disaster, considered to be the biggest mining disaster in the Philippines.

Next on Part 2 – Stock Classifications Based on Market Capitalization

Good luck on all your trades.

=====================================================

In line with our VISION, A RESPONSIBLE TRADER IN EVERY FILIPINOS HOME, we aim to continue promoting financial literacy on the area of stock market trading and investing to our countrymen both here and abroad through the following:

1. We have successfully launched “Swing Trading with TRT – a Definitive Guide for Swing Trading the Philippine Stock Market” last September 2, 2019. This book is the second in our Responsible Trader Education Series.

You can download Chapter 1 and see the Table of Contents here: https://drive.google.com/file/d/1NZEABnQMiQ_zenEMs0lPFWweX4WBxBHg/view?usp=sharing

The first book, “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” provided all the basic knowledge that a trader needs to know in order to trade the Philippine Stock Market effectively and efficiently. The first book is about the basics. This second book is about the specifics.

2. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/. For those interested in the hard copy, please send email to: ninjatrader919@gmail.com Subject: The Responsible Trader – Hard Copy.

As requested by those abroad and those who want the book in digital form, we have produced an eBook version. For those interested please send email to: ninjatrader19@gmail.com Subject: The Responsible Trader – eBook Version.

The book can also be ordered online through our publisher, Central Book Supply. Just go to: http://central.com.ph/bookstoreplus then click Search – The Responsible Trader.

3. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

4. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

5. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results