Top Ten Smart Money Moves – Apr. 1, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading

Moves, starting January 2015, is the official trading newsletter of The Responsible Trader

newsletter of The Responsible Trader to promote

to promote his advocacy, Responsible Trading

his advocacy, Responsible Trading . This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying

. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded

and Selling, Top Ten in Total Traded Value, including Trading

Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader

Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on Apr. 1, 2016 Data)

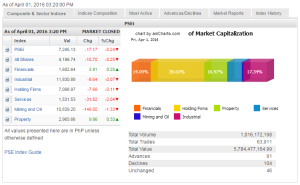

Total Traded Value – PhP 5.784 Billion – Low

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 104 Declines vs. 91 Advances = 1.14:1 Neutral

Total Foreign Buying – PhP 3.337 Billion

Total Foreign Selling – (Php 3.257) Billion

Net Foreign Buying (Selling) – Php 0.080 Billion – 1st day of Net Foreign Buying after 2 days of Net Foreign Selling

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

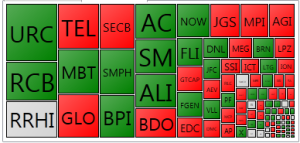

PSE Heat Map

Screenshot courtesy of: PSEGET Software

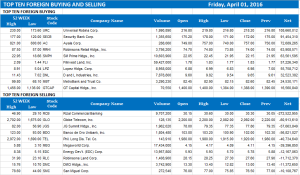

Top Ten Foreign Buying and Selling

and Selling

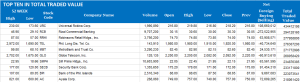

Top Ten in Total Traded Value

Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Posted on April 03, 2016 10:01:00 PM

By Daphne J. Magturo, Reporter

Overseas concerns to cap PHL equities’ advance

DESPITE generally positive sentiment at home, stocks will likely struggle for direction this week on concerns over China’s economy and the oil slump in the Middle East, analysts said over the weekend.

Week on week, the bellwether Philippine Stock Exchange index (PSEi) erased 114.92 points or 1.56% to end at 7,245.13 last Friday from 7,360.05 on March 23.

The broader all-shares index also declined by 23.84 points or 0.57% to settle at 4,196.74 from 4,220.58 in the same comparable period. Foreign investors were net buyers at P322.87 million.

“The local equities market is expected to trade sideways as markets closely monitor movements abroad and as investors watch local data releases next week such as the March inflation,” BPI Asset Management said in its weekly review.

The PSEi will likely hover within the 7,100 to 7,250 range this week, according to listed Bank of the Philippine Islands’ investment arm.

In a separate report, 2TradeAsia.com pointed out the “increased likelihood” of a downgrade in Standard & Poor’s sovereign credit rating for China, “on the heels of the agency’s cutting of its outlook on the country from ‘stable’ to ‘negative’, as fiscal condition and debt metrics may deteriorate.”

The online brokerage said China’s economic situation “severely imposes a cap” on regional optimism over the short and medium-term.

2TradeAsia.com added: “As early as Friday, oil slumped after Saudi Arabia’s deputy crown prince, Mohammed bin Salman, hinted a pre-condition before they cut on output if Iran and other members do the same.”

In February, oil prices received a major boost from an accord among Venezuela, Qatar, Russia and Saudi Arabia, resulting in a temporary cap on production as they convinced other players to cooperate.

“While sentiment may sway with news, meaningful movement in prices should come from either the unwinding of the February deal, or the striking of a more comprehensive accord to cap and eventually cut production,” the online brokerage explained in its report.

The local market’s uptrend remains “intact” even though the PSEi continues to trade lower, according to AB Capital Securities, Inc. It noted that last week’s selling was “necessary” and an “expected healthy pullback” bringing the market to a “more comfortable” level.

“For next week, we are bullish that the index can continue to trade back at the 7,300 area and climb higher to 7,400,” it said.

AB Capital noted that the May elections will be a “strong driver” to push the main index toward 7,700, or to overshoot to 8,000 level.

Meanwhile, Sy-owned BDO Unibank, Inc. said that a break below the 7,200 levels this week “will call for further losses” to the 7,000 mark.

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=overseas-concerns-to-cap-phl-equities-advance&id=125392

==================================================

Good luck on all your TRADES

luck on all your TRADES today

today .

.

DISCLAIMER There is a very high degree of risk involved in TRADING . Past results

. Past results are not indicative of future returns

are not indicative of future returns . Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION

. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER

or endorsement of any security. In accordance with the Responsible TRADER ’s Creed: I will never tell and you take full

’s Creed: I will never tell and you take full responsibility for all your TRADING

responsibility for all your TRADING results

results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion