Top Ten Smart Money Moves – June 3, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading

Moves, starting January 2015, is the official trading newsletter of The Responsible Trader

newsletter of The Responsible Trader to promote

to promote his advocacy, Responsible Trading

his advocacy, Responsible Trading . This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying

. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded

and Selling, Top Ten in Total Traded Value, including Trading

Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader

Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on June 3, 2016 Data)

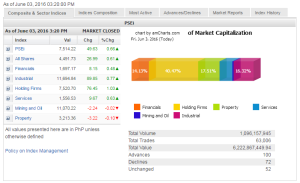

Total Traded Value – PhP 6.223 Billion – Low

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 100 Advances vs. 72 Declines = 1.39:1 Neutral

Total Foreign Buying – PhP 3.593 Billion

Total Foreign Selling – (Php 3.128) Billion

Net Foreign Buying (Selling) Php 0.465 Billion – 8th day of Net Foreign Buying after 3 days of Net Foreign Selling

Data from the Philippine Stock Exchange ‘

‘

Screenshot courtesy of: www.pse.com.ph

PSE Heat Map

Screenshot courtesy of: PSEGET Software

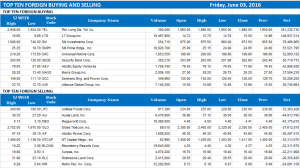

Top Ten Foreign Buying and Selling

and Selling

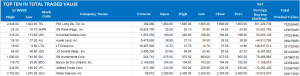

Top Ten in Total Traded Value

Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Posted on June 05, 2016 08:59:00 PM

By Keith Richard D. Mariano

Cautious trading seen as markets await US hike

LOCAL STOCKS may continue to trade around the 7,500 mark this week, as investors await signals for another interest rate hike in the United States, according to analysts.

The benchmark Philippine Stock Exchange index (PSEi) gained 102.54 points or 1.38% throughout last week, rising to 7,514.22 from its 7,411.68 close on May 27. The market saw net foreign buying of P3.95 billion.

“The local equities market continued to rally amid recovering oil prices and further buying on earlier [merger and acquisition] activity,” BPI Asset Management said in a report.

Last week witnessed San Miguel Corp. sell its telecommunication assets, including the coveted 700-megahertz frequency, to Philippine Long Distance Telephone Co. (PLDT) and Globe Telecom, Inc. for $1.5 billion.

Also, Metro Pacific Investments Corp. further expanded its shareholding in Beacon Electric Asset Holdings, Inc., which owns 36% of Manila Electric Co. and 56% of Global Business Power Corp., in a P26.2-billion deal.

Still, local stocks traded within range as investors remained cautious ahead of economic data releases from the US and the Federal Open Market Committee (FOMC) meeting on June 14-15.

“[L]ocal equities and fixed income would once again look abroad for direction, especially as the much-awaited FOMC decision draws closer,” BPI Asset Management said.

Joylin F. Telagen, equity research analyst at IB Gimenez Securities, Inc., said investors will particularly take their cue from the US jobs report and Federal Reserve Chair Janet L. Yellen’s statement on Tuesday.

“I’m expecting a cautious trading within the 7,400 to 7,568 range. That will be driven by US jobs report, and Fed Chair Yellen statement on Tuesday regarding the timing of interest rate hike before they meet on June 14 to 15,” Ms. Telagen noted in a text message.

BPI Asset Management noted that “any indications of a potential Fed rate hike may cause investors on the local bourse to sell off.

The May employment data from the US, however, dimmed prospects for another interest rate hike. The world’s largest economy created the fewest number of jobs since September 2010, according to Reuters.

Online brokerage 2TradeAsia.com noted that “the lack of major corporate news at home this week may convince players to stay on the sidelines.”

“This is likely to result in a timely pause for the market, a much needed breather, in our view. Since [the May 9] presidential election, the PSEi has surged nearly 7% and a respite appears forthcoming,” 2TradeAsia said.

“Certain economic data set for release this week such as US unemployment claims and inflation in China may not be compelling enough for investors to aggressively load on shares at these levels,” it said, pegging immediate support at 7,3007,400 and resistance at 7,550 to 7,600 this week.

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=cautious-trading-seen-as-markets-await-us-hike&id=128537

==================================================

Good luck on all your TRADES

luck on all your TRADES today

today .

.

DISCLAIMER There is a very high degree of risk involved in TRADING . Past results

. Past results are not indicative of future returns

are not indicative of future returns . Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION

. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER

or endorsement of any security. In accordance with the Responsible TRADER ’s Creed: I will never tell and you take full

’s Creed: I will never tell and you take full responsibility for all your TRADING

responsibility for all your TRADING results

results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion