Top Ten Smart Money Moves – August 1, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on August 1, 2016 Data)

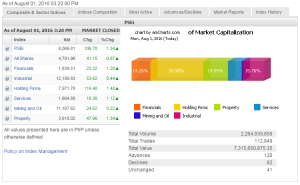

Total Traded Value – PhP 7.316 Billion – Low

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 120 Advances vs. 82 Declines = 1.46:1 Neutral

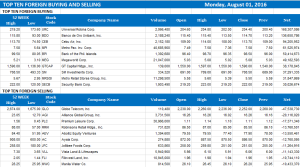

Total Foreign Buying – PhP 4.155 Billion

Total Foreign Selling – (PhP 3.420) Billion

Net Foreign Buying (Selling) PhP 0.735 Billion – 1st day of Net Foreign Buying after a day of Net Foreign Selling

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

PSE HEAT MAP

Screenshot courtesy of PSEGET

Top Ten Foreign Buying and Selling

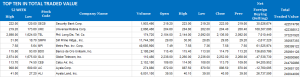

Top Ten in Total Traded Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

PSEi back above 8,000 mark on foreign buying

Posted on August 02, 2016

THE BELLWETHER index on Monday returned above the 8,000 mark and snapped out of its retreat late last week as foreign investors continued buying local shares to push the market higher, traders said.

The Philippine Stock Exchange index (PSEi) finished the session higher by 106.70 points or 1.34% to 8,069.81.

The all-shares index also climbed by 41.15 points or 0.87% to 4,791.96.

Joylin F. Telagen, research head at IB Gimenez Securities, said investors had anticipated the weaker-than-expected US economic growth for the second quarter, which she said had the greater weight on local stocks’ performance yesterday, than expectations that the Federal Reserve could delay an increase in interest rates.

On Friday, the US reported a 1.2% rise in gross domestic product, well below the expected 2% growth. It failed to rebound from an even weaker performance during the first quarter. This came as the US central bank decided to leave rates unchanged and hinted on leaving the option open for an interest rate rise towards yearend.

“Also, investors are positioning to companies ahead of the second-quarter corporate earnings or some are buying stocks that already reported strong earnings,” Ms. Telagen said.

Among the companies that reported first-half results are Manila Electric Co. with P10.4 billion in core net income, down 11% from the level a year ago, largely because of a one-off cost recovery last year and the lower distribution rate so far this year.

Aboitiz Equity Ventures, Inc. posted a 34% jump in consolidated net income in the first half to P10.5 billion after the strong performance of its power business, which accounted for 67% of the semester’s bottom line.

Philex Petroleum Corp. has trimmed its losses in the first half to P21.8 million or more than half of last year’s P48.7-million consolidated net loss attributable to equity holders of the parent company.

Quarterly earnings reports are scheduled for submission on for before Aug. 15.

All sectoral indices closed higher, with holding firms recording the biggest jump at 116.40 points or 1.48% to 7,971.78. Property stocks followed, gaining 47.96 points or 1.34% to 3,618.02. Financials and services both ended the trading day with gains of more than 1%.

Mining and oil stocks remained the weakest mover, up by 24.62 points or 0.22% to 11,167.62. Industrials closed higher by 53.62 points or 0.44% to 12,189.83.

Foreign investors bought more shares than they sold, at a net of around P735.11 million, a reversal of Friday’s net foreign selling worth P40.15 million.

Value turnover declined to P7.32 billion from the P11.93 billion seen the previous session, as 2.26 billion shares changed hands.

“We will likely see new highs in the coming days,” said Miko A. Sayo, trader at Angping & Associates Securities Inc. — Victor V. Saulon

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=psei-back-above-8000-mark-on-foreign-buying&id=131276

==================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion