Top Ten Smart Money Moves – April 10, 2018

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on April 10, 2018 Data)

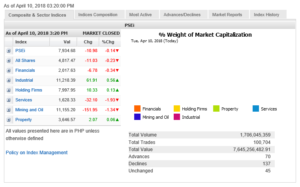

Total Traded Value – PhP 7.645 Billion – Low

Advances Declines – (Ideal is 2:1) 137 Declines vs. 70 Advances = 1.96:1 Neutral

Total Foreign Buying PhP 4.298 Billion

Total Foreign Selling – (PhP 4.764) Billion

Net Foreign Buying (Selling) (PhP 0.466) Billion – 3rd day of Net Foreign Selling after a day of Net Foreign Buying

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

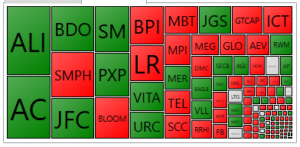

PSE HEAT MAP

Screenshot courtesy of PSEGET

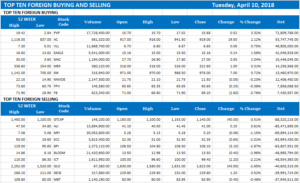

Top Ten Foreign Buying and Selling

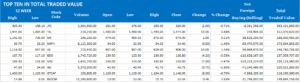

Top Ten in Total Traded Value

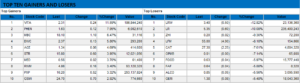

Top Ten Gainers and Losers

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

PSEi falls even as rest of Asia cheers Xi’s assurance

April 10, 2018 | 6:16 pm

THE Philippine Stock Exchange on Tuesday ignored optimism across much of Asia in the face of China President Xi Jinping’s promise to open his country’s economy further, dropping further below the 8,000 mark for the second straight trading day as investors in local equities apparently nitpicked on negative developments in the economy.

The Philippine Stock Exchange index (PSEi) retreated for the second straight trading day by 10.98 points or 0.13% to close at 7,934.68 — there was no trading on Monday which was a public holiday — while the all-shares index dropped 11.03 points or 0.22% to end 4,817.47.

While noting that “some fund managers were not participating, as evidenced by the thinly traded volume” in the wake of “an extended break,” Luis A. Limlingan — Regina Capital Development Corp. managing director — noted via text that the Congressional Policy and Budget Research Department — the think tank of the House of Representatives — now expects the fiscal deficit to breach an official cap of 3% of gross domestic product, possibly hitting 4% and beyond from this year onward due to watered-down tax reform provisions. PSEi had returned below the 8,000 line last Friday after the government reported a 4.3% inflation rate for March that was the fastest in at least five years and pierced a 2-4% full-year target range for 2018.

Mr. Xi’s remarks at the Boao Forum for Asia on Tuesday — in which he vowed to cut import tariffs on products like cars — helped defuse escalating US-China trade tensions, in turn, helping fuel a rally for most of Asia. Japan’s Nikkei 225 and TOPIX index, Hong Kong’s Hang Seng Index, South Korea’s KOSPI Index, the Shanghai Composite Index, the Jakarta Composite Index and the MSCI AC Asia Pacific gained 0.54%, 0.35%, 1.65%, 0.27%, 1.67%, 1.26% and 0.69%, respectively.

At home, the six sectoral indices were equally divided between winners and losers, with sectors that gained consisting of industrials which added 61.91 points or 0.55% to finish 11,218.39; holding firms that increased by 10.33 points or 0.12% to 7,997.95; and property which edged up by 2.07 points or 0.05% to end 3,646.57.

Sectors that lost consisted of services that gave up 32.1 points or 1.93% to finish 1,628.33; mining and oil which dropped 151.95 points or 1.34% to 11,155.2; and financials which retreated by 6.78 points or 0.33% to close 2,017.63.

Tuesday’s list of 20 most active stocks was equally divided between those that gained and those that lost. Ayala Corp. gained 2.12% to P938.50 apiece and Jollibee Foods Corp. added 2.16% to P284 each, while Bloomberry Resorts Corp. gave up 2.96% to P13.10 apiece and Leisure & Resorts World Corp. erased 10.08% to P5.35 each.

Trading volume thinned to 1.70 billion shares worth P7.65 billion changing hands from Friday’s 2.37 billion worth P7.58 billion. Foreigners stayed largely bearish for a third straight trading day, though net selling slipped by 3.51% to P465.76 million from Friday’s P482.69 million. — with interview by J. C. Lim

Source: bworldonline.com/psei-falls-even-as-rest-of-asia-cheers-xis-assurance/

=====================================================

In line with our VISION, A RESPONSIBLE IN EVERY FILIPINOS HOME, we aim to continue promoting financial literacy on the area of stock market trading and investing to our countrymen both here and abroad through the following:

1. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/. For those interested in the hard copy, please send email to: ninjatrader919@gmail.com Subject: The Responsible Trader – Hard Copy.

As requested by those abroad and those who want the book in digital form, we have produced an eBook version. For those interested please send email to: ninjatrader19@gmail.com Subject: The Responsible Trader – eBook Version.

The book can also be ordered online through our publisher, Central Book Supply. Just go to: http://central.com.ph/bookstoreplus then click Search – The Responsible Trader.

2. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

3. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

4. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES: Please take note of the following changes. Effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than PhP 8 Billion b. Medium – Total Traded Value Php 8 Billion but not more than P15 Billion c. High – Total Traded Value more than Php 15 Billion.

Starting with August 11, 2017 data we are including the Top Ten Gainers and Losers for a more comprehensive coverage of significant stock movements during the day.