Top Ten Smart Money Moves – May 3, 2018

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on May 3, 2018 Data)

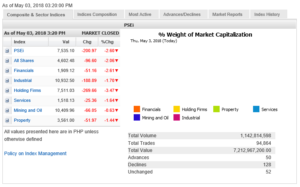

Total Traded Value – PhP 7.213 Billion – Low

Advances Declines – (Ideal is 2:1) 128 Declines vs. 50 Advances = 2.56:1 Bearish

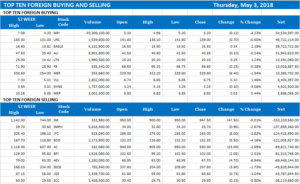

Total Foreign Buying PhP 4.118 Billion

Total Foreign Selling – (PhP 5.081) Billion

Net Foreign Buying (Selling) (PhP 0.963) Billion – 10th day of Net Foreign Selling after a day of Net Foreign Buying

Data from the Philippine Stock Exchange

Screenshot courtesy of PSE.com.ph

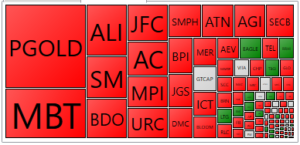

PSE HEAT MAP

Screenshot courtesy of PSEGET

Top Ten Foreign Buying and Selling

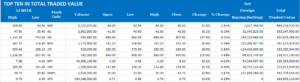

Top Ten in Total Traded Value

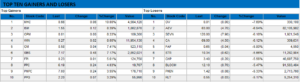

Top Ten Gainers and Losers

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

PHL stocks tumble on BSP interest rate hike bets

May 3, 2018 | 6:18 pm

By Krista A.M. Montealegre, National Correspondent

STOCKS retreated on Thursday to their lowest level in more than a year, dragged lower by mounting fears about higher interest rates.

The bellwether Philippine Stock Exchange index (PSEi) dropped for the second straight session, tumbling 200.97 points or 2.59% to close at 7,535.10, the lowest level since April 19, 2017 when the benchmark index ended at 7,522.98.

The all-shares index fell 96.60 points or 2.05% to 4,602.48.

“The market is still pricing in the effects of a possible rate hike by both the Bangko Sentral ng Pilipinas (BSP) and to a lesser extent the Federal Reserve given the lower probability of a hike based on the current consensus,” PNB Securities President Manuel Antonio G. Lisbona said in a mobile phone message.

“What is weighing on the market is fears of rising rates in the United States so if ever the BSP will start raising rates as well on May 10 that will be a trigger for foreign funds to not sell any further and it will temper the depreciation of the peso,” Miko A. Sayo, trader at AP Securities, said in an interview.

Several economists are anticipating a rate hike when the BSP Monetary Board reviews policy settings next week, noting that such a move will keep borrowing rates competitive at a time of faster inflation.

Headline inflation averaged 3.8% as of end-March, just below the 3.9% expected by the BSP for the full year and close to breaching the 2-4% target band.

In the United States, the Federal Open Market Committee kept interest rates unchanged on Thursday, a move widely expected by investors. Policy makers, however, signaled growing confidence in the outlook for inflation, leaving it on course to jack up borrowing costs next month.

Heavy foreign selling in emerging markets and a number of first-quarter earnings reports that came in below forecast also contributed to the market’s weakness, Miguel A. Agarao, analyst at Wealth Securities, Inc., said in a mobile phone message.

All counters finished in the red, with holding firms sustaining the heaviest losses after plummeting 269.66 points or 3.46% to 7,511.03.

Financials plunged 51.16 points or 2.61% to 1,909.12; industrials slid 188.89 points or 1.69% to 10,932.50; services went down 25.36 points or 1.64% to 1,518.13; property lost 51.97 points or 1.43% to 3,561.00; and mining and oil shed 66.05 points or 0.63% to 10,409.96.

Value turnover accelerated to P7.21 billion as 1.14 billion shares changed hands, from P6.53 billion on Wednesday.

Decliners dominated advancers, 128 to 50, while 52 issues were unchanged.

Foreigners continued to dump local equities, as net sales picked up to P963.29 million from P340.68 million in the prior session.

“While we are very near immediate support, it seems that there is still some bearish pressure on the market and may test the 7,250 level soon,” PNB’s Mr. Lisbona said.

Source: http://bworldonline.com/phl-stocks-tumble-on-bsp-interest-rate-hike-bets/

May 2, 2018 | 5:57 pm

By Krista A.M. Montealegre, National Correspondent

STOCKS broke a three-day winning streak on Wednesday, as investors looked ahead to the conclusion of the United States Federal Reserve’s monetary policy meeting.

Emerging out of the Labor Day holiday, the benchmark Philippine Stock Exchange index (PSEi) shed 83.18 points or 1.06% to end at 7,736.07.

The broader all-shares index slid 24.08 points or 0.51% to close at 4,699.08.

“Investors remained on the sidelines ahead of the monetary policy meeting in the US,” Edgar V. Lay, junior equity analyst at AB Capital Securities, Inc., said in a phone interview, adding that JG Summit Holdings, Inc., Ayala Corp. and PLDT, Inc. accounted for 57 points of the day’s decline.

“While there is only a 34% chance that the Fed will raise rates (this month), there is uncertainty that the central bank may raise interest rates four times this year amid rising inflationary pressure,” Mr. Lay said.

The Federal Open Market Committee is widely expected to keep interest rates steady at the end of the two-day policy meeting. Investors, however, will search for hints on the future pace of monetary tightening against a backdrop of rising inflation and low unemployment.

The Fed hiked its benchmark lending rate three times in 2017.

“The market’s pessimism overcame news of [S&P Global Ratings]’s possible credit upgrade for the country the other day, which could have been reasonably expected given the persistent net foreign selling despite the market’s rally since Thursday,” PNB Securities President Manuel Antonio G. Lisbona said in a mobile phone message.

Leading the market’s weakness was the holding firms sub-index, which fell 127.81 points or 1.61% to 7,780.69.

Services also dropped 15.68 points or 1% to 1,543.49; mining and oil declined 85.55 points or 0.81% to 10,476.01; financials went down 9.35 points or 0.47% to 1,960.28; and property lost 9.20 points or 0.25% to 3,612.97.

Industrials was the lone counter in the green, with a gain of 11.03 points or 0.09% to 11,121.39.

Value turnover improved to P6.53 billion as 1.29 billion shares changed hands, from P6.41 billion on Monday.

Market breadth was positive, as advancers dominated decliners, 117 to 87, while 43 issues were unchanged.

Foreign investors remained in selling territory, with net outflows of P340.68 million, slower than the net sales of P605.44 million in the previous session.

“It isn’t unreasonable to expect that this kind of volatility will persist in the near future given interest rate pressures. Short-term traders are reminded to keep their stops tight while longer-term investors should keep an eye out for compelling value,” PNB’s Mr. Lisbona said.

Source: http://bworldonline.com/shares-snap-climb-ahead-of-fed-policy-statement/

=====================================================

In line with our VISION, A RESPONSIBLE IN EVERY FILIPINOS HOME, we aim to continue promoting financial literacy on the area of stock market trading and investing to our countrymen both here and abroad through the following:

1. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/. For those interested in the hard copy, please send email to: ninjatrader919@gmail.com Subject: The Responsible Trader – Hard Copy.

As requested by those abroad and those who want the book in digital form, we have produced an eBook version. For those interested please send email to: ninjatrader19@gmail.com Subject: The Responsible Trader – eBook Version.

The book can also be ordered online through our publisher, Central Book Supply. Just go to: http://central.com.ph/bookstoreplus then click Search – The Responsible Trader.

2. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

3. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

4. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES: Please take note of the following changes. Effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than PhP 8 Billion b. Medium – Total Traded Value Php 8 Billion but not more than P15 Billion c. High – Total Traded Value more than Php 15 Billion.

Starting with August 11, 2017 data we are including the Top Ten Gainers and Losers for a more comprehensive coverage of significant stock movements during the day.