THE RESPONSIBLE TRADER – TRADING LESSONS – BLENDING CANDLESTICKS – PART 2

THE RESPONSIBLE TRADER – TRADING LESSONS – BLENDING CANDLESTICKS – PART 2

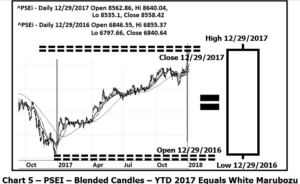

Actually this is the same procedure when candles for a certain trading period like weekly, monthly, yearly etc. are blended. Let us apply this to the the PSE for the Year-to-date 2017 as indicated in Chart 5.

For year-to-date 2017 we start with the Open of 6846.55 as of December 29, 2016 and the Close of 8558.42 as of December 29, 2017. For the Low we use 6797.66 and High of 8640.04 since these are the highest and lowest for the trading period.

Since the Close of the trading period is higher than the Open we have a white candlestick. The candlestick has very little Upper and Lower Wicks. The result is a Bullish Marubozu which characterizes the Bullish sentiment for the Year 2017.

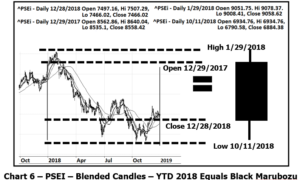

Let us now look at the Year 2018 using the same Procedure as indicated in Chart 6.

This time we start with the Open of 8562.86 as of December 29, 2017 and the Close of 7466.02 as of December 28, 2018. For the Low we use the 6790.58 registered last October 11, 2018 and the High of 9078.37 registered last January 29, 2018 since these are the highest and lowest for the trading period.

The Close of the trading period is lower than the Open giving us a Black candlestick with Upper and Lower Wicks.

The result is a Black candlestick which is still considered a Marubozu since the real body is bigger than the wicks which characterizes the Bearish sentiment for the Year 2018.

Good luck on all your trades.

NOTE: No change in numbering of Figure is made so that those who have my book, “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market”, can refer to them easily.

=====================================================

In line with our VISION, A RESPONSIBLE TRADER IN EVERY FILIPINOS HOME, we aim to continue promoting financial literacy on the area of stock market trading and investing to our countrymen both here and abroad through the following:

1. We have successfully launched “Swing Trading with TRT – a Definitive Guide for Swing Trading the Philippine Stock Market” last September 2, 2019. This book is the second in our Responsible Trader Education Series.

You can download Chapter 1 and see the Table of Contents here: https://drive.google.com/file/d/1NZEABnQMiQ_zenEMs0lPFWweX4WBxBHg/view?usp=sharing

The first book, “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” provided all the basic knowledge that a trader needs to know in order to trade the Philippine Stock Market effectively and efficiently. The first book is about the basics. This second book is about the specifics.

2. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/. For those interested in the hard copy, please send email to: ninjatrader919@gmail.com Subject: The Responsible Trader – Hard Copy.

As requested by those abroad and those who want the book in digital form, we have produced an eBook version. For those interested please send email to: ninjatrader19@gmail.com Subject: The Responsible Trader – eBook Version.

The book can also be ordered online through our publisher, Central Book Supply. Just go to: http://central.com.ph/bookstoreplus then click Search – The Responsible Trader.

3. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

4. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

5. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES: Please take note of the following changes. Effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than PhP 8 Billion b. Medium – Total Traded Value Php 8 Billion but not more than P15 Billion c. High – Total Traded Value more than Php 15 Billion.

Starting with August 11, 2017 data we are including the Top Ten Gainers and Losers for a more comprehensive coverage of significant stock movements during the day.