THE RESPONSIBLE TRADER – TRADING LESSONS – DIVERGENCE

THE RESPONSIBLE TRADER – TRADING LESSONS – DIVERGENCE

In very simple terms, Divergence means movement in opposite direction. For example Price Moving up and the Indicator moving down and vice-versa.

For the purpose of analyzing Divergences, all Reaction Highs are classified as Highs and all Reaction Lows are classified as Lows whether the stock is in an Uptrend or a Downtrend.

There are two types of Divergence. Regular and Hidden . Under both are Bullish and Bearish types.

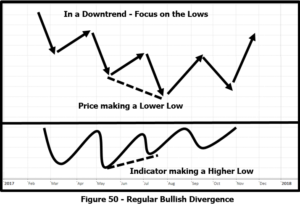

Regular Bullish Divergence

A Regular Bullish Divergence usually occurs at the end of a Downtrend and is used as a possible sign of a trend reversal.

Our focus in spotting a Regular Bullish Divergence is on the Lows on both the Price Chart and the Indicator.

A Regular Bullish Divergence is characterized by price making a Lower Low but the indicator is making a Higher Low .

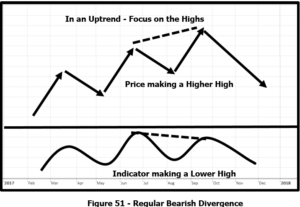

Regular Bearish Divergence

A Regular Bearish Divergence usually occurs at the end of an Uptrend and is used as a possible sign for a trend reversal.

Our focus in spotting a Regular Bearish Divergence is on the Highs on both the Price Chart and the Indicator.

A Regular Bearish Divergence is characterized by price making a Higher High but the indicator is making a Lower High.

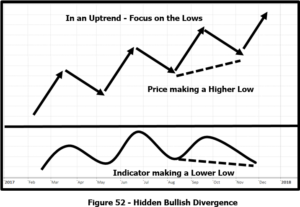

Hidden Bullish Divergence

A Hidden Bullish Divergence can occur at any part of an Uptrend and is used as a possible sign of a trend continuation.

Our focus in spotting a Hidden Bullish Divergence is on the Lows on both the Price Chart and the Indicator.

A Hidden Bullish Divergence is characterized by price making a Higher Low but the indicator is making a Lower Low .

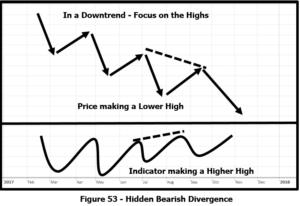

Hidden Bearish Divergence

A Hidden Bearish Divergence can occur at any part of a Downtrend and is used as a possible sign of a trend continuation.

Our focus in spotting a Hidden Bearish Divergence is on the Highs on both the Price Chart and the Indicator.

A Hidden Bullish Divergence characterized by price making a Lower High but the indicator is making a Higher High .

TH0R – My Memory Aid in Remembering Divergence

A lot of traders are sometimes confused where to focus on when trying to spot Divergences.

A simple way of spotting Regular Divergence is to focus on the reactions that are on opposite side of the Trendline. For an Uptrend, since we are connecting the Reactions Lows when drawing the Uptrendline, focus on the Reaction Highs on both the price chart and the indicator. For a Downtrend, since we are connecting the Reaction Highs when drawing the DownTrendline, focus on the Reaction Lows of both the price chart and the indicator. If they are moving in the opposite direction then there is a Divergence.

Again a simple way of spotting Hidden Divergence is to focus on the reactions that are on the same side of the Trendline. For an Uptrend, since we are connecting the Reactions Lows when drawing the Uptrendline, focus on the Reaction Lows on both the price chart and the indicator. For a Downtrend, since we are connecting the Reaction Highs when drawing the Downtrendline, focus on the Reaction Highs on both the price chart and the indicator. If they are moving in the opposite direction then there is a Divergence.

If you still cannot remember Divergence based on what I have stated you can use my memory aid: THOR– Trendline for Hidden and Opposite for Regular and you will never fail to remember Divergence again.

Well-respected technical analysts, such as Alexander Elder and John Murphy, have said that Divergences are the strongest signals for trend reversals and continuation in technical analysis.

It is well worth our time then to include spotting of Divergences in our trading arsenal and consider them when preparing our Trading Plans.

Good luck on all your trades.

NOTE: No change in numbering of Figure is made so that those who have my second book, “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market”, can refer to them easily.