THE RESPONSIBLE TRADER – TRADING LESSONS – GENERAL APPROACHES FOR CHOOSING STOCKS

THE RESPONSIBLE TRADER – TRADING LESSONS – GENERAL APPROACHES FOR CHOOSING STOCKS

The first step in Swing Trading is choosing the stocks we intend to trade. There are two general approaches for doing this — The Top-Down and the Bottom-up.

Let us discuss both in terms of general applications and then to specific applications to the Philippine stock market.

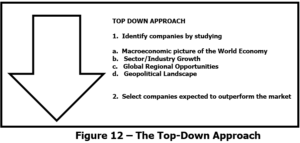

The Top-Down Approach

When trading the international markets, this approach involves looking first at the macro picture of the world economy, and then looking at the smaller factors in finer detail. After looking at the big-picture conditions around the world, we examine the general market conditions followed by particular industrial sectors to select those that are forecast to outperform the market.

From this point, the procedure is similar for both international and local. We analyze the stocks of specific companies using fundamental analysis to select companies that are expected to outperform the market.

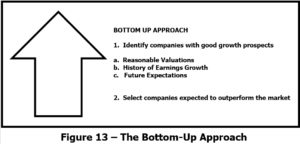

The Bottom-Up Approach

For this approach we look at specific companies and their fundamentals first regardless of market trends. Bottom-up Analysis includes financial ratios, earnings growth, revenue and sales growth, cashflow and management’s leadership and other indicators of performance over time.

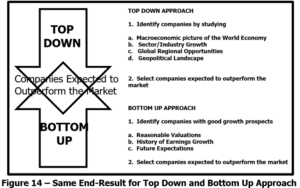

The ultimate goal of both approaches is to select companies expected to outperform the market as indicated in Figure 14.

Whether you are using top-down or bottom-up approach it is very important to be aware about what is happening in the total world scene. Globalization has made the world a one-world economy and financial markets no longer exist and operate on their own.

NOTE: No change in numbering of Figures is made so that those who have my book can easily refer to the topic discussed.

Good luck on all your trades.