THE RESPONSIBLE TRADER – TRADING LESSONS – MULTICOLLINEARITY

THE RESPONSIBLE TRADER – TRADING LESSONS – MULTICOLLINEARITY

If you are really serious in bringing your trading to a higher level, one of the concepts you need to know is Multicollinearity. This is where a lot of new traders go wrong. Based on the paradigm two heads are better than one, a new trader also thinks that two or more indicators are better than one. Actually in trading as in life, less is more.

This is what I have written in my first book – The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market.”

Multicollinearity

Ok, I promised not to use “nosebleed” technical terms. So I will try to explain this by using simple terms and a simple example. Multicollinearity simply means using the same information more than once. The additional use does not add any value to the information at all.

For example, if you measure my height in inches using a ruler, it does not add any value if you measure my height in inches for the second time using a tape measure. The result would be the same. In Technical Analysis you have to understand what you are trying to measure so that you can make an appropriate choice among a set of Technical Indicators. I hope that is clear now. Please allow me to quote John Bollinger regarding his opinion on this matter.

“A cardinal rule for the successful use of technical analysis requires avoiding multicollinearity amid indicators. Multicollinearity is simply the multiple counting of the same information. The use of four different indicators all derived from the same series of closing prices to confirm each other is a perfect example.”

Source: Bollinger, John. Using Bollinger Bands. Stocks & Commodities, V.10:2. Pp.47-51.

Bollinger suggests that the best way to quickly determine if an indicator is collinear with another one is to have them laid out in a chart and make sure you have enough data on the chart to get a good indication. According to him, If they basically rise and fall in about the same areas, the odds are that they are collinear and you should just use one of them.

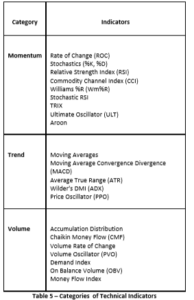

Below is Table 5 showing Categories of Technical Indicators from Stock Charts.com to serve as guide in choosing Technical indicators to avoid Multicollinearity.

Of course the Table is not intended to be a complete list but just to give an idea. COLFinancial has no less than 100 Indicators in its Trading Platform, Tradingview has more or less the same. You just need to be sure what you are trying to measure so you can choose the appropriate indicator and avoid using another one for the same purpose. Another piece of advice, always remember the Responsible Trader’s KISS – Keep it Simple and Sustainable.

Good luck on all your trades.

NOTE: No change in numbering of Figure is made so that those who have my books, “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” and “Swing Trading with TRT – a Definitive Guide for Swing Trading the Philippine Stock Market” can refer to them easily.

=====================================================

In line with our VISION, A RESPONSIBLE TRADER IN EVERY FILIPINOS HOME, we aim to continue promoting financial literacy on the area of stock market trading and investing to our countrymen both here and abroad through the following:

1. We have successfully launched “Swing Trading with TRT – a Definitive Guide for Swing Trading the Philippine Stock Market” last September 2, 2019. This book is the second in our Responsible Trader Education Series.

You can download Chapter 1 and see the Table of Contents here: https://drive.google.com/file/d/1NZEABnQMiQ_zenEMs0lPFWweX4WBxBHg/view?usp=sharing

The first book, “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” provided all the basic knowledge that a trader needs to know in order to trade the Philippine Stock Market effectively and efficiently. The first book is about the basics. This second book is about the specifics.

2. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/. For those interested in the hard copy, please send email to: ninjatrader919@gmail.com Subject: The Responsible Trader – Hard Copy.

As requested by those abroad and those who want the book in digital form, we have produced an eBook version. For those interested please send email to: ninjatrader19@gmail.com Subject: The Responsible Trader – eBook Version.

The book can also be ordered online through our publisher, Central Book Supply. Just go to: http://central.com.ph/bookstoreplus then click Search – The Responsible Trader.

3. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

4. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

5. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES: Please take note of the following changes. Effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than PhP 8 Billion b. Medium – Total Traded Value Php 8 Billion but not more than P15 Billion c. High – Total Traded Value more than Php 15 Billion.

Starting with August 11, 2017 data we are including the Top Ten Gainers and Losers for a more comprehensive coverage of significant stock movements during the day.