STOCK CHARTS AND ANALYSIS – BDO

STOCK CHARTS AND ANALYSIS – BDO

In accordance with our Independence Day commitment, following is our Technical Analysis of BDO (BDO UNIBANK, INC.) as of July 20, 2015.

This is the first of our THREE for FREE for this week

TA – The Responsible Trader’s Way – No Hyping, No Bashing Just Plain Cold Facts.

Positive

1. Attempt to recover from Descending Triangle Breakdown. BDO is attempting to recover after breaking down from a Descending Triangle Chart Pattern.

Negative

1. Breakdown after Consolidation. After a trendline break, BDO consolidated in a Descending Triangle Pattern and had a subsequent breakdown. It needs to go back to P105.50 to recover from the breakdown. Otherwise, this might send the stock to its next support at P99.90

2. BDO’s recent price action is below the 15 EMA and 20 SMA showing that it is Bearish on the Short Term.

3. Price action below 50 SMA – Bearish – Medium Term . BDO’s recent price action below the 50 SMA shows that it is Bearish on the Medium Term. Recent price action also below 200 SMA shows that the stock is now in Bear Territory.

As we mentioned in our last post, Responsible trading is evidence-based trading so we will try to present more evidence to validate the negative points.

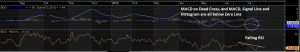

4. MACD on Dead Cross. The MACD is now on a Dead Cross and the MACD, Signal line and histogram are all below zero line showing weakness in trend.

5. Falling RSI. After the trendline break, RSI had been falling further confirming the downtrend.

NOTE: Positive points are things that could work in your favor. Negative points are things that you have to watch out for.

The Chart and Analysis is presented for educational purposes only and should NEVER BE TAKEN as a RECOMMENDATION to BUY, HOLD, or SELL.

Please trade with CAUTION, please trade with CARE. As always, IT’S YOUR TAKE, IT’S YOUR CALL. IT’S YOUR MONEY AFTER ALL.

Good luck on all your trades