Stock Trading Lessons for Beginners – Module 1 – TRT POV

Stock Trading Lessons for Beginners is part of the Continuous Education element of my advocacy, Responsible Trading. In this connection, I am pleased to share these with you. All these lessons are shared without cost to you. All of these are free.

We are presently on the following topic:

MODULE 1 – TECHNICAL ANALYSIS AND THE DOW THEORY

LEARNING OBJECTIVES:

After viewing the video, you should:

1. Become familiar with the Dow Theory

2. Know the Definition of Technical Analysis and its Basis

3. Know The Three Tenets of Technical Analysis

4. Know The Difference between Technical and Fundamental Analysis

My apologies for having this out late today. We made some improvements in our website and I was advised by my Webmaster about the challenges he encountered due to these improvements. This is the reason why I was not able to have this released yesterday, Thursday, as you expected.

I will now share with you my TRT-POV.

TRT-POV (The Responsible Trader’s Point of View) are my notes, my own additional research and studies on the MCTA videos that I posted, and my personal observations and opinions that I am sharing with you to further enhance our knowledge and understanding. Some of these were previously posted on “The Responsible Trader” thread, Stock Market Pilipinas (www.stockmarketpilipinas.com). This is the latest version of previous posts I made. Some of these plus further explanations and discussions will be appearing in my forthcoming book “The Responsible Trader.”

My additional research led me to the Six Tenets of Technical Analysis (not Three as mentioned in the first video) and I learned that this came from the editorial writings of Charles H. Dow, the same person who lent his name to the now famous Dow Jones Industrial Average (DJIA).

Dow&Jones imagesource: http://www.enational.ro/dosarele-enational/dow-jones-cel-mai-important-indice-bursier-65340.html

For your convenience, all of these are now contained in the following video that I prepared for you.

JUST A FEW GENTLE REMINDERS

1. These lessons are not intended to be a substitute for the seminars offered by your broker/s but intended to serve as basic foundation to enable you to better appreciate the seminars offered once you have access to them.

2. I will post the MCTA videos and outline the Learning Objectives every Saturday. As a value added, I will post the TRT-POV every Thursday of the following week, to annotate and explain the trading lessons in a simple and understandable way.

3. We will repeat the whole process until we finish the whole course.

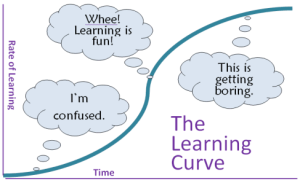

4. Learning is better when done in short durations with breaks in between. The learning curve looks like this.

Learning curve image source: http://easternseastar21.wordpress.com/2013/05/15/exploring-the-learning-curve/

Rate of learning starts slowly then gradually builds up where it becomes fun and enjoyable. After reaching a certain level it decelerates to the point of boredom.

If you divide your study periods into shorter durations with breaks in-bteween, you are going to double the point where learning is fun and enjoyable and you will be able to retain more materials in your brain.

Learning curve image source: http://easternseastar21.wordpress.com/2013/05/15/exploring-the-learning-curve/

5. To make it easy for you to refer to the entire course, I will always include this as your guide and just underline the topic where we are in.

The Video lessons are taken from Cloud9 Media Limited’s Master’s Certificate in Technical Analysis covering the following:

Module 1 – Technical Analysis and Dow Theory

Module 2 – Charting Basics

Module 3 – Trend Concepts

Module 4 – Reversal and Continuation Patterns

Module 5 – Volume and Open Interest

Module 6 – Moving Averages

Module 7 – Oscillators and Sentiment Indicators

Module 8 – Further Charting

Module 9 – Elliott Waves and Cycles of Time

Module 10 – Cloud Charts – Ichimoku Technique

Module 11 – Money Management and Computers

Module 12 – How to Build a Trading System

I wish you all the best in your learning journey and good luck on all your trades.

Thank you for sharing your knowledge on stock market overview. I hope the next module would be easy to understand and interesting. More power to you and God bless.

Hi Alice,

You’re welcome. I am always trying my best to simplify the lessons through my TRT-POV. I will do the same for the succeeding lessons.

thank you! I am also beginning to compile my personal journey in this uncanny yet wonderful world of trading. Thank you for sharing your expertise to us “mga kamote”

Bro Jimbo,

You are welcome and please do not call yourself “kamote.”

The result of your trades do not determine the kind of person that you are. I often see posts “Kamote ako”. Whatever the result of your trades, if you are a good person you remain a good person who made a “kamote” trade. It is your decision making that is at fault, it is what you have to correct. No matter how many “kamote” trades you make, you remain a good person.

Please remember, “As a man thinketh, so he becomes.” Thoughts are things. Positive thoughts translate into positive results. Same is true with negative thoughts

As I breakdown your points of view I feel that you hit the nail on the spot by saying that a lot of budding traders favors technical analysis better than fundamental analysis. (Needless to point out the over hyping of basura stocks this week which in fact is playing decoy that conceals significant uptrend reversals of value stocks… sigurado ako maraming naipit.) In my old fashioned opinion, technical analysis appeals because it delivers a quick and easy visual of profit. The fundamental driver of the trend however is taken for granted.

Moreover, I also think that a lot of budding speculators, including me, does not fully understand the meaning of speculation. Thus I ponder:

The process of speculation is not an intelligent game of guessing; on the contrary it is a CRITICAL MANNER of OBSERVING market movement and the circumstances surrounding it. In so doing, the speculator is able to act, react and foreact with respect to what the market beacons. Further, the speculator is equipped with various types of spectacles (Fundamentals & Technicals) enabling him and her to clearly see and understand such various movements. A timely trading decision and a successful investment endeavor is only a result of a critical and diligent speculation.

Bro Jimbo,

Very good observations. You really have to use whatever works best for you. The most important thing is you take full responsibility for whatever results from the system that you used and the decision that you’ve made.