Top Ten Smart Money Moves – Apr. 8, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading

Moves, starting January 2015, is the official trading newsletter of The Responsible Trader

newsletter of The Responsible Trader to promote

to promote his advocacy, Responsible Trading

his advocacy, Responsible Trading . This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying

. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded

and Selling, Top Ten in Total Traded Value, including Trading

Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader

Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on Apr. 8, 2016 Data)

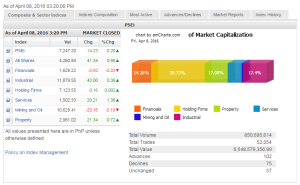

Total Traded Value – PhP 6.549 Billion – Low

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 102 Advances vs 75 Declines = 1.36:1 Neutral

Total Foreign Buying – PhP 3.790 Billion

Total Foreign Selling – (Php 3.918) Billion

Net Foreign Buying (Selling) – (Php 0.128 Billion) – 4th day of Net Foreign Selling after a day of Net Foreign Buying

Data from the Philippine Stock Exchange ‘

‘

Screenshot courtesy of: www.pse.com.ph

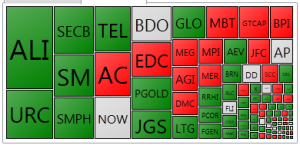

PSE Heat Map

Screenshot courtesy of: PSEGET Software

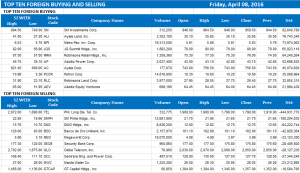

Top Ten Foreign Buying and Selling

and Selling

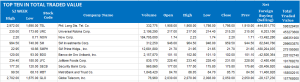

Top Ten in Total Traded Value

Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Posted on April 10, 2016 07:31:00 PM

Weakness to persist ahead of key reports, OPEC

LOCAL STOCKS will likely trade within a range this week as investors bank on major developments abroad and ahead of the release of data on overseas Filipino workers (OFW) remittances, analysts said over the weekend.

Week on week, the benchmark Philippine Stock Exchange index (PSEi) barely budged, adding only 2.07 points or 0.03% to close at 7,247.20 from 7,245.13 on April 1.

In the same comparable period, the broader all-shares index gained 64.10 points or 1.5% to settle at 4,260.84 from 4,196.74.

“We expect the local equities to continue taking cue from the international markets and significant domestic data releases,” BPI Asset Management said in its weekly review.

“For [this] week, we see the PSEi to trade between 7,170 to 7,300, with main catalyst being the OFW remittances data for the month of February. This would confirm if the effects of weak global demand to the overseas workers would really be material,” it added. The Bangko Sentral ng Pilipinas is scheduled to release the latest remittances data on Friday.

Market players will also monitor US inflation data set for release this Thursday, according to 2TradeAsia.com.

“Granted that a rate hike won’t occur at this month’s meeting, the figure would still inform investors whether the working hypothesis of two increases toward the latter part of the year still holds,” the online brokerage explained in an e-mail.

“Five consecutive days of net foreign selling dragged our index, exacerbated further with the steady dip of oil from the $41/barrel highs seen two weeks ago, having reached as low as $35/barrel last Tuesday/Wednesday,” AB Capital Securities said in its weekly outlook.

Investors are keeping an eye on the April 17 meeting of the Organization of the Petroleum Exporting Countries (OPEC) in Qatar “which may spell an agreement between members to curb or freeze oil production,” it said.

Russia, Saudi Arabia, Venezuela and Qatar agreed in February to freeze production at January levels, but said at the time the deal was contingent on other producers joining in.

AB Capital added that foreign investors are becoming “more risk averse” due to the looming elections, amid uncertainty on whether the next president would be investor-friendly and if it can continue the policies of the Aquino administration.

“That said, our domestic economic condition remains stable as seen by the relatively strong corporate earnings results season, as well as with other key indicators… remaining relatively intact,” AB Capital said, adding that election spending will boost this year’s gross domestic product.

Chart-wise, the PSEi’s Friday close confirms a “near-term top” at 7,412, according to BDO Unibank, Inc., as it warned of further weakness towards the 7,000 levels in the near-term.

“Expect the market to range between the 7,150-7,350 levels in the week ahead,” it added. — Daphne J. Magturo with Reuters.

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=weakness-to-persist-ahead-of-key-reports-opec&id=125725

==================================================

Good luck on all your TRADES

luck on all your TRADES today

today .

.

DISCLAIMER There is a very high degree of risk involved in TRADING . Past results

. Past results are not indicative of future returns

are not indicative of future returns . Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION

. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER

or endorsement of any security. In accordance with the Responsible TRADER ’s Creed: I will never tell and you take full

’s Creed: I will never tell and you take full responsibility for all your TRADING

responsibility for all your TRADING results

results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion