Top Ten Smart Money Moves – April 15, 2020

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

================================

As promised in my last post, Back from the Hack, we are resuming all our activities both in our website and Facebook starting August 1, 2019.

This section of our website has been running for the past five years. Perhaps you are asking, why Top Ten Smart Money Moves? This is what I have written in my new book: “Swing Trading with TRT – A Definitive Guide for Swing Trading the Philippine Stock Market.”

“SMART MONEY

The PSE achieved a milestone by the end of the year 2018 when they reported that the number of stock market accounts broke past the one million mark as a result of the substantial increase in online accounts.

Retail investors owned most of the stock market accounts, representing 97.5% of the total accounts while the remaining 2.5% is held by the institutional investors also considered as smart money.

While we, the retail traders, are big in number, we are small in terms of influence in the stock market because more than 50% of the Total Traded Value Daily is accounted for the institutional investors whose transactions are focused mostly on a handful of their selected stocks.

In our Website, we have a regular feature “Top Ten Smart Money Moves” where we monitor the Top Ten stocks being bought and sold by the smart money.

========================================================

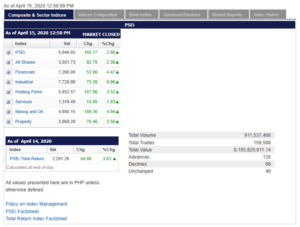

Trading Notes for Today – (Based on April 15, 2020 Data)

Total Traded Value – PhP 9.104 Billion – Medium

Advances Declines – (Ideal is 2:1) 135 Advances vs. 66 Declines = 2.05:1 Bullish

Total Foreign Buying PhP 4.022 Billion

Total Foreign Selling – (PhP 5.390) Billion

Data from the Philippine Stock Exchange

Screenshot courtesy of PSE.com.ph

PSE HEAT MAP

Screenshot courtesy of PSEGET

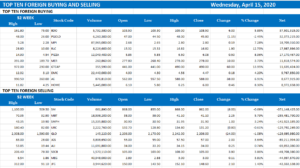

Top Ten Foreign Buying and Selling

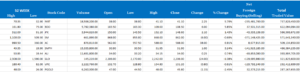

Top Ten in Total Traded Value

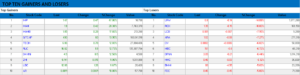

Top Ten Gainers and Losers

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

PHL stocks climb as investors pick up bargains

April 15, 2020 | 9:00 pm

By Denise A. Valdez, Reporter

LOCAL SHARES sustained their climb on Wednesday as bargain hunters continued fanning the market’s rise.

The benchmark Philippine Stock Exchange index (PSEi) rose 165.17 points or 2.85% to close at 5,946.05 yesterday, as the broader all shares index added 82.78 points or 2.38% to 3,551.73.

“Further bargain hunting lifted the local bourse, taking cues from the US indices performance overnight,” Philstocks Financial, Inc. Research Associate Claire T. Alviar said in a text message yesterday.

US markets closed in green territory on Tuesday with the Dow Jones Industrial Average, S&P 500 and Nasdaq Composite indices gaining 2.39%, 3.06% and 3.95%, respectively.

“The continued rally was on the back of optimism brought by the fiscal stimulus package of the Philippine government to fight the current pandemic,” Ms. Alviar added.

The government continued announcing fiscal measures to address the economic impact of the coronavirus disease 2019 (COVID-19) pandemic, as President Rodrigo R. Duterte approved on Monday night a P51-billion allocation for wage subsidy to 3.4 million Filipinos working in small businesses.

“Local shares continued to jump, resuming the market’s sharp rebound from last month’s lows, as investors grew more optimistic about the COVID-19 outbreak,” Regina Capital Development Corp. Head of Sales Luis A. Limlingan said in a mobile message.

The Coronavirus Resource Center of Johns Hopkins University showed a declining trend in new COVID-19 cases starting April 11. Daily cases have been dropping from over 79,800 on Apr. 11, over 75,200 on Apr. 12, over 70,3000 on April 13, to over 58,800 on Apr. 14. As of yesterday afternoon, total COVID-19 cases in the world stood at 1.98 million, with deaths reaching more than 126,700.

Sectoral indices at the local bourse all closed with gains on Wednesday. Financials rose 53.96 points or 4.47% to 1,260.00; mining and oil increased 189.36 points or 4.06% to 4,850.15; holding firms added 187.98 points or 3.31% to 5,852.57; property picked up 76.46 points or 2.55% to 3,069.28; services gained 13.45 points or 1.03% to 1,319.49; and industrials improved 73.39 points or 0.95% to 7,728.99.

Value turnover jumped to P9.1 billion from Tuesday’s P7.38 billion. Some 911.54 million issues switched hands yesterday.

Advancers outnumbered decliners, 135 against 66, while 40 names ended unchanged.

Money continued exiting the market, with net foreign selling growing to P1.37 billion from P1.29 billion seen on Tuesday.

“(Yesterday’s) strong value flows, once sustained, could bring the market back to the 6,000 level,” Ms. Alviar said. “6,000 mark remained to be a resistance, particularly that foreigners are still sellers despite the rally, and as COVID-19 cases are mounting in the country. Sell-on-rally would be the strategy for now in the short-run.”

Source: https://www.bworldonline.com/phl-stocks-climb-as-investors-pick-up-bargains/

=====================================================

In line with our VISION, A RESPONSIBLE TRADER IN EVERY FILIPINOS HOME, we aim to continue promoting financial literacy on the area of stock market trading and investing to our countrymen both here and abroad through the following:

1. We have successfully launched “Swing Trading with TRT – a Definitive Guide for Swing Trading the Philippine Stock Market” last September 2, 2019. This book is the second in our Responsible Trader Education Series.

You can download Chapter 1 and see the Table of Contents here: https://drive.google.com/file/d/1NZEABnQMiQ_zenEMs0lPFWweX4WBxBHg/view?usp=sharing

The first book, “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” provided all the basic knowledge that a trader needs to know in order to trade the Philippine Stock Market effectively and efficiently. The first book is about the basics. This second book is about the specifics.

2. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/. For those interested in the hard copy, please send email to: ninjatrader919@gmail.com Subject: The Responsible Trader – Hard Copy.

As requested by those abroad and those who want the book in digital form, we have produced an eBook version. For those interested please send email to: ninjatrader19@gmail.com Subject: The Responsible Trader – eBook Version.

The book can also be ordered online through our publisher, Central Book Supply. Just go to: http://central.com.ph/bookstoreplus then click Search – The Responsible Trader.

3. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

4. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

5. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES: Please take note of the following changes. Effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than PhP 8 Billion b. Medium – Total Traded Value Php 8 Billion but not more than P15 Billion c. High – Total Traded Value more than Php 15 Billion.

Starting with August 11, 2017 data we are including the Top Ten Gainers and Losers for a more comprehensive coverage of significant stock movements during the day.