Top Ten Smart Money Moves – April 27, 2017

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on April 27, 2017 Data)

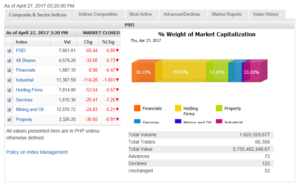

Total Traded Value – PhP 5.755 Billion – Low

Advances Declines Ratio – (Ideal is 2:1) 122 Declines vs. 72 Advances = 1.69:1 Neutral

Total Foreign Buying – PhP 2.585 Billion

Total Foreign Selling – (PhP 2.731) Billion

Net Foreign Buying (Selling) – (PhP 0.146) Billion – first day of Net Foreign Selling after 3 days of Net Foreign Buying

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

PSE HEAT MAP

Screenshot courtesy of PSEGET

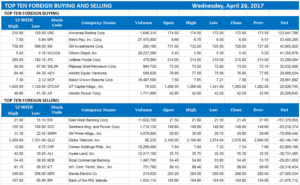

Top Ten Foreign Buying and Selling

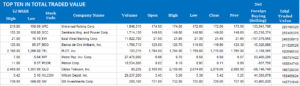

Top Ten in Total Traded Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Stocks to get boost from bullish bets on PHL data

Posted on May 02, 2017

THE MARKET may return to the 7,700 level to start the month amid investors’ bullish bets on local economic data.

The bellwether Philippine Stock Exchange index (PSEi) closed April at 7,661.01 after ending above the 7,700 line twice last week amid easing tensions from the initial results of the French presidential election.

For this week, analysts are looking at local leads to lift the market anew.

“The PSEi will try to retest previous year-to-date highs by reattempting to break through the 7,700 level. First quarter earnings will continue to trickle in while key data such as inflation and GDP (gross domestic product) will drive investors to take positions,” Regina Capital Development Corp. Managing Director Luis A. Limlingan said.

The Philippine Statistics Authority will releasing April inflation data on Friday. A BusinessWorld poll of 13 economists late last week yielded a median 3.5% inflation forecast for the month, which if realized will pick up from a 3.4% rate logged in March and would soar from a 1.1% reading from a year ago.

The estimate also falls close to the midpoint of the 3-3.8% forecast range given by Bangko Sentral ng Pilipinas Governor Amando M. Tetangco, Jr. last week, and logs closer to the high end of the government’s 2-4% target band.

Meanwhile, official first quarter GDP data is set for release on May 18. Mr. Limlingan said “there will be some speculation” on the country’s economic growth report as early as this week, which may boost sentiment.

The market will also look to the US Federal Open Market Committee’s May 2-3 policy meeting, where Fed Chair Janet L. Yellen is expected to drop hints about the US central bank’s future interest rate hikes.

Investors may also be taking positions based on the second round of the French presidential elections is set on May 7, analysts said.

A failure to sustain the rally will bring the main index back to the 7,500 to 7,600 level, Mr. Limlingan noted.

Asian stocks shook off a sluggish start and edged up on Monday, with Japan outperforming on upbeat earnings, while the dollar regained traction as the US government looked likely to avoid a shutdown.

MSCI’s broadest index of Asia-Pacific shares outside Japan added 0.1%. Japan’s Nikkei 225 climbed 0.4%, with high-tech blue chips gaining on strong earnings.

Asian shares initially took their cue from Wall Street, which dipped on Friday after data showed the US economy grew at its weakest pace in three years in the first quarter.

The mood brightened slightly, however, on news that US congressional negotiators hammered out a bipartisan agreement on a spending package to keep the federal government funded through Sept. 30, thus averting a government shutdown. Overall reaction was still limited as many markets in Asia and Europe were closed for Labor Day. — ABF with Reuters

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=stocks-to-get-boost-from-bullish-bets-on-phl-data&id=144528

=====================================================

We aim to continue promoting financial literacy on the area of stock market trading and investing to our countrymen both here and abroad through the following:

1. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/.

As requested by those abroad and those who want the book in digital form, we have produced an eBook version. For those interested please send email to: ninjatrader19@gmail.com Subject: The Responsible Trader – eBook Version.

2. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

3. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

4. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES: Please take note of the following changes effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than PhP 8 Billion b. Medium – Total Traded Value Php 8 Billion but not more than P15 Billion c. High – Total Traded Value more than Php 15 Billion