Top Ten Smart Money Moves – April 4, 2017

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Top Ten Smart Money Moves – April 4, 2017

Trading Notes for Today – (Based on April 4, 2017 Data)

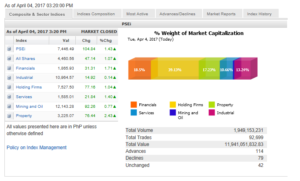

Total Traded Value – PhP 11.9421 Billion – Medium

Advances Declines Ratio – (Ideal is 2:1) 114 Advances vs. 79 Declines = 1.44:1 Neutral

Total Foreign Buying – PhP 7.883 Billion

Total Foreign Selling – (PhP 3.807 Billion)

Net Foreign Buying (Selling) – PhP 4.076 Billion – 3rd day of Net Foreign Buying after 2 days of Net Foreign Selling

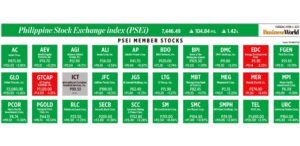

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

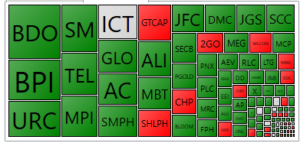

PSE HEAT MAP

Screenshot courtesy of PSEGET

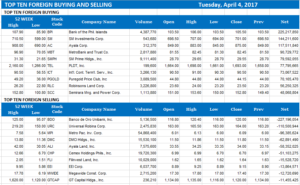

Top Ten Foreign Buying and Selling

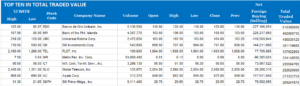

Top Ten in Total Traded Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

PSEi returns to 7,400 for first time in six months

Posted on April 05, 2017

PHILIPPINE SHARES rose for a second day on Tuesday to allow the benchmark index to return to 7,400 level for the first time in almost six months, thanks to foreign buying.

Tuesday’s rally bucked the declines elsewhere in Asia, where stocks took a beating as caution reigned ahead of a potentially tense meeting between US President Donald J. Trump and his Chinese counterpart Xi Jinping later this week.

The Philippine Stock Exchange index (PSEi) rose 1.42% or 104.84 points to close at 7,446.49. That was the PSEi’s best day since Oct. 26 last year when it finished at 7,494.41.

The broader all-shares index was also up by 1.06% or 47.14 points to end the day at 4,460.56.

“There seems to be increased buying pressure from the foreign funds as they were net buyers today. Right now the range bound market has taken an initial bullish stance heading into second quarter of 2017,” Angping and Associates Securities, Inc. equity analyst Frank Gerard J. Barboza said in a text message.

Foreign investors bought more stocks in volumes more than they dumped resulting in a net buying of P4.08 billion in a trading session that saw P11.94 billion shares changing hands.

IB Gimenez analyst Joylin F. Telagen also cited net foreign buying as the reason behind the rally, saying investors “may be repositioning ahead of first quarter results and better economic growth for the quarter.”

That optimism over the economy was supported by latest results of the Nikkei Philippines Manufacturing Purchasing Managers’ Index (PMI) for March which showed solid growth for the local manufacturing sector.

“Locally, Philippine PMI rose marginally to 53.8 in March, which was a slight improvement from the 53.6 recorded in February,” Regina Capital Development Corp. Managing Director Luis A. Limlingan said.

“The latest reading points to further strengthening in the rate of expansion in the country’s manufacturing, as growth is being driven by the domestic demand from. This stems mostly from buoyant consumers and public infrastructure spending,” he added.

Equities in the banking sector were the most active, with BDO Unibank, Inc. and the Bank of Philippine Islands up by 2.74% and 1.93%, respectively. Shares in Universal Robina Corp., SM Investments Corp., and PLDT Inc. also lifted the PSEi.

“The index should stay above 7400 and establish a new support level at that area, otherwise the old trading range will pull the index back to it,” PNB Securities President Manuel Antonio G. Lisbona said in a text message.

All counters were in positive territory with services leading the gains with a 2.42% or 76.44 point-increase to close at 3,225.07.

Advancers outpaced decliners, 114 to 79, while 42 were unchanged.

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=psei-returns-to-7400-for-first-time-in-six-months&id=143267

=====================================================

We aim to continue promoting financial literacy on the area of stock market trading and investing to our countrymen both here and abroad through the following:

1. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/.

As requested by those abroad and those who want the book in digital form, we have produced an eBook version. For those interested please send email to: ninjatrader19@gmail.com Subject: The Responsible Trader – eBook Version.

2. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

3. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

4. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES: Please take note of the following changes effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than PhP 8 Billion b. Medium – Total Traded Value Php 8 Billion but not more than P15 Billion c. High – Total Traded Value more than Php 15 Billion