Top Ten Smart Money Moves – August 2, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on August 2, 2016 Data)

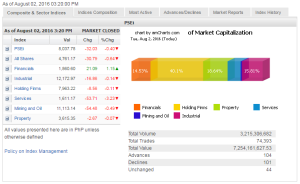

Total Traded Value – PhP 7.254 Billion – Low

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 104 Advances vs. 101 Declines = 1.03:1 Neutral

Total Foreign Buying – PhP 3.405 Billion

Total Foreign Selling – (PhP 3.490) Billion

Net Foreign Buying (Selling) (PhP 0.085) Billion – 1st day of Net Foreign Selling after a day of Net Foreign Buying

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

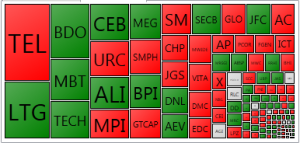

PSE HEAT MAP

Screenshot courtesy of PSEGET

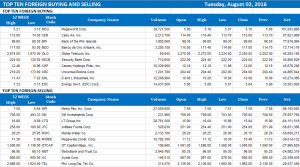

Top Ten Foreign Buying and Selling

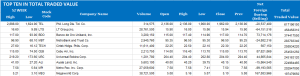

Top Ten in Total Traded Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

PSEi hovers above 8,000 even as PLDT weighs

Posted on August 03, 2016

THE PHILIPPINE Stock Exchange index (PSEi) slipped on Tuesday ahead of the so-called “ghost month” that starts today and stretches for the rest of August when the market traditionally performs dismally.

Yesterday, analysts pointed to Philippine Long Distance Telephone Co. (PLDT) as the weakest link that weighed on the bourse, resulting in the benchmark index losing 32.03 points or 0.40% to close at 8,037.78 and the all-shares index shedding 30.79 points of 0.64% to end 4,761.17.

PSEi still hovered above the 8,000 mark throughout yesterday’s trades.

“It’s mostly PLDT. It’s the heaviest in the index and it’s down by 8% today,” said Joseph Y. Roxas, president of Eagle Equities, Inc., in a telephone interview.

To be exact, shares in PLDT plunged by 8.15% to finish at P1,962 each from P2,136 the other day. The company reported a 6% drop in consolidated core net income to P17.7 billion last semester from P18.928 billion a year ago, while reported net income plummeted by 33% to P12.463 billion from P18.729 billion in the same comparative six months.

Mr. Roxas said the company, which has interest in BusinessWorld through the Philippine Star Group which it controls, was losing its landline business while its data business has yet to take off.

“Weak TEL earnings prompted profit taking,” said Jonathan L. Ravelas, BDO Unibank, Inc. chief market strategist, referring to PLDT’s stock market symbol. “It’s been over a week since the market topped at 8,118.44.”

PLDT also led the retreat of the services index, which gave up 53.71 points or 3.23% to 1,611.17, the trading day’s biggest sectoral loser.

The rest of the losing sectors registered milder declines. Mining and oil was down 54.48 points or 0.49% to finish 11,113.14, industrial slipped by 16.86 points or 0.14% to 12,172.97, holding firms were off by 8.56 points or 0.11% to 7,963.22, while property ceded 2.67 points or 0.07% to end 3,615.35.

Financials were the only bright spot, finishing higher by 21.09 points or 1.15% to 1,860.60.

Without PLDT, local shares would have traded higher, Mr. Roxas said, noting most other companies had reported relatively good results for the first half.

Mr. Roxas also pointed out that the market was coming from new highs hit in July, thus he expects shares to “consolidate a bit.”

Value turnover slipped slightly to P7.254 billion from Monday’s P7.32 billion as 3.215 billion shares changed hands.

Yesterday saw P85.47-million net sales by foreigners from Monday’s P735.11-million net buying.

Overseas, Monday saw the S&P 500 and the Dow ending slightly lower by 0.13% and 0.15%, respectively, as a drop in oil prices dragged down energy stocks, while the Nasdaq Composite added 0.43%.

The MSCI AC Asia-Pacific index gained 0.72% yesterday. Japan’s Nikkei 225 and TOPIX indices ended 1.47% and 1.64% lower, respectively, while the Hang Seng rose 1.09%. — VVS

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=psei-hovers-above-8000-even-as-pldt-weighs&id=131330

==================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion