Top Ten Smart Money Moves – August 24, 2018

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on August 24, 2018 Data)

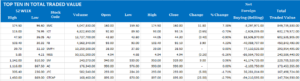

Total Traded Value – PhP 7.218 Billion – Low

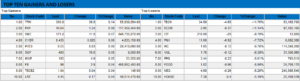

Advances Declines – (Ideal is 2:1) 122 Declines vs.76 Advances = 1.61:1 Neutral

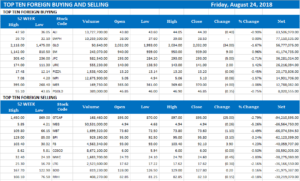

Total Foreign Buying PhP 3.080 Billion

Total Foreign Selling – (PhP 3.479) Billion

Net Foreign Buying (Selling) – (PhP 0.399) Billion – First day of Net Foreign Selling

After 2 days of Net Foreign Buying

Data from the Philippine Stock Exchange

Screenshot courtesy of PSE.com.ph

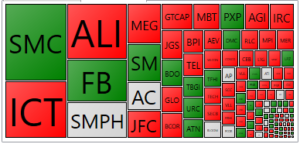

PSE HEAT MAP

Screenshot courtesy of PSEGET

Top Ten Foreign Buying and Selling

Top Ten in Total Traded Value

Top Ten Gainers and Losers

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Shares to move sideways on likely thin volume

August 28, 2018 | 12:01 am

By Arra B. Francia, Reporter

LOCAL EQUITIES may trade sideways in the week ahead as volumes are seen to thin due to the shorter trading period alongside expectations for the US Federal Reserve to maintain rates.

The benchmark Philippine Stock Exchange index (PSEi) jumped 2.41% to 7,766.47 on Friday, buoyed by the gains of listed food and beverage firm San Miguel Food and Beverage, Inc. The company recently announced its plan to raise up to P142 billion through a follow-on offering by yearend, which sent its stock skyrocketing by 18.7% week on week.

Analysts are looking at whether the main index can break through a resistance of 7,800 to determine its movement in the following days. Eagle Equities, Inc. Research Head Christopher John Mangun said should the PSEi breach this level, it could easily climb back to the 8,000 mark.

“However, there are only four trading days [this] week and we may see lower volumes. If this happens, then we may see it trade sideways or come back down to support at 7,600,” Mr. Mangun said in a weekly market report.

Local financial markets were closed yesterday in commemoration of National Heroes’ Day.

Leads for the week include the statements made by Fed Chairman Jerome H. Powell during the Jackson Hole symposium over the weekend, which serves as an annual retreat for bankers focusing on global economic issues.

“There is no indication that the US Federal Reserve will be raising interest rates at the annual Jackson Hole symposium. Nevertheless, the Fed’s hawkish stance may continue to strengthen the dollar and we may see foreign funds continue to flow out which will continue to hurt emerging markets,” Mr. Mangun explained.

Meanwhile, online brokerage firm 2TadeAsia.com is keeping its eyes on the tariff row between the US and China.

“The trade round discussion may unsettle some, but there are those who embrace the challenges it brings. Differing expectations on the outcome of talks definitely spell volatility for equities, and any trading range would still be worth looking into,” 2TradeAsia.com said in a weekly market note.

Both the US and China just slapped tariffs on $16 billion worth of traded goods on each other last week, amid ongoing talks between two of the world’s largest economies.

Negotiations last week failed to make any major progress on the trade spat, with China saying that it will “resolutely respond to the unreasonable measures” taken by the US. The two sides, however, were reported to have “exchanged views on how to achieve fairness, balance, and reciprocity in the economic relationship.”

2TradeAsia.com placed the PSEi’s immediate support at 7,700, while resistance is pegged from 7,850 to 7,950.

=====================================================

In line with our VISION, A RESPONSIBLE IN EVERY FILIPINOS HOME, we aim to continue promoting financial literacy on the area of stock market trading and investing to our countrymen both here and abroad through the following:

1. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/. For those interested in the hard copy, please send email to: ninjatrader919@gmail.com Subject: The Responsible Trader – Hard Copy.

As requested by those abroad and those who want the book in digital form, we have produced an eBook version. For those interested please send email to: ninjatrader19@gmail.com Subject: The Responsible Trader – eBook Version.

The book can also be ordered online through our publisher, Central Book Supply. Just go to: http://central.com.ph/bookstoreplus then click Search – The Responsible Trader.

2. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

3. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

4. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES: Please take note of the following changes. Effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than PhP 8 Billion b. Medium – Total Traded Value Php 8 Billion but not more than P15 Billion c. High – Total Traded Value more than Php 15 Billion.

Starting with August 11, 2017 data we are including the Top Ten Gainers and Losers for a more comprehensive coverage of significant stock movements during the day.