Top Ten Smart Money Moves – August 3, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on August 3, 2016 Data)

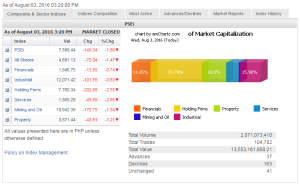

Total Traded Value – PhP 13.553 Billion – Medium

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 163 Declines vs. 37 Advances = 4.41:1 Bearish

Total Foreign Buying – PhP 6.730 Billion

Total Foreign Selling – (PhP 4.199) Billion

Net Foreign Buying (Selling) PhP 2.531 Billion – 1st day of Net Foreign Buying after a day of Net Foreign Selling

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

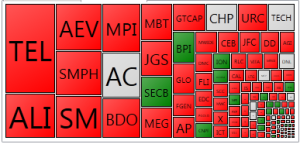

PSE HEAT MAP

Screenshot courtesy of PSEGET

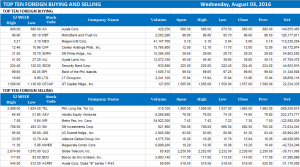

Top Ten Foreign Buying and Selling

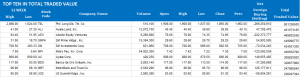

Top Ten in Total Traded Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Local stocks tumble as firms’ results disappoint

Posted on August 04, 2016

LOCAL SHARES continued their trek downwards, with the Philippine Stock Exchange index (PSEi) falling below the 8,000 mark at the start of the ghost month.

The bellwether PSEi finished lower by 149.34 points or 1.85% to 7,888.44 on Wednesday, climbing to as high as 8,027.27 and hitting a low of 7,848.73.

The all-shares index likewise declined by 70.04 points or 1.47% to 4,691.13.

All sectoral indices finished lower, including financials, the other day’s only gainer.

Services posted the biggest drop at 45.89 points or 2.85% to 1,565.28, with market heavyweight Philippine Long Distance Telephone Co. (PLDT) further losing 4.94% or P97 to close at P1,865 per share.

“It’s still the news of PLDT’s disappointing income,” Harry G. Liu, president of Summit Securities, Inc., said in a phone interview when asked about what influenced the market’s retreat on Wednesday.

On Tuesday, PLDT reported a 6% drop in consolidated core net income to P17.7 billion, while reported net income plummeted by 33% to P12.5 billion. Its stock price plunged by 8.15% that day.

Joylin F. Telagen, research head at IB Gimenez Securities, shared the same view, saying that second-quarter corporate earnings had disappointed investors and “continue to affect market sentiment.”

“At the same time it’s the start of the psychological ‘ghost month,’ which is reason for market correction,” Summit’s Mr. Liu said, adding that the last few days had seen shares performing on a “positive tone.”

The “ghost month” is a period in the Lunar calendar when some Asian investors refrain from doing big investments or decisions that coincides with the vacation of fund managers in the West, thereby resulting in lower trading volumes.

As for the other subindices, holding firms gave up 202.88 points or 2.54% to close at 7,760.34. The mining sector eased by 170.75 points or 1.53% to 10,942.39. Property dropped 43.91 points or 1.21% to 3,571.44. Industrials and financials also fell, although at a milder 0.83% to 12,071.42 and 0.74% to 1,846.75, respectively.

Losers outnumbered gainers at 163 against 37, while 41 shares finished the session unchanged.

Foreign investors bought more shares than they sold, netting P2.53 billion. Trading value rose to P13.55 billion as 2.07 billion shares changed hands, from Tuesday’s P7.25 billion worth.

IB Gimenez’s Ms. Telagen said the PSEi was moving towards the 7,800 support level, while Summit’s Mr. Liu said the market should be moving “sideways” for a while and within a 300- to 400-point window. He projected the resistance level between 8,000 and 8,100, with a support between 7,700 and 7,800.

He expects the market to snap out its consolidation mode towards the tail end of August or possibly earlier. He added that upcoming first-half corporate earnings data could still provide a boost to local shares. — V.V. Saulon

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=local-stocks-tumble-as-firms&8217-results-disappoint&id=131393

==================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion