Top Ten Smart Money Moves – August 4, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on August 4, 2016 Data)

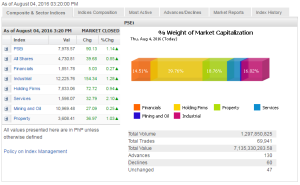

Total Traded Value – PhP 7.135 Billion – Low

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 130 Advances vs. 60 Declines = 2.17:1 Bullish

Total Foreign Buying – PhP 3.561 Billion

Total Foreign Selling – (PhP 3.492) Billion

Net Foreign Buying (Selling) PhP 0.069 Billion – 2nd day of Net Foreign Buying after a day of Net Foreign Selling

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

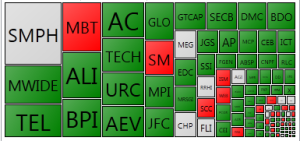

PSE HEAT MAP

Screenshot courtesy of PSEGET

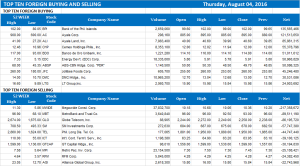

Top Ten Foreign Buying and Selling

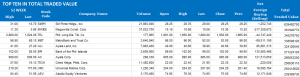

Top Ten in Total Traded Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

PSE index rebounds as sentiment turns positive

Posted on August 05, 2016

THE PHILIPPINE Stock Exchange index (PSEi) on Thursday reversed direction and regained some of the lost ground in the past two days as market heavyweight Philippine Long Distance Telephone Co. (PLDT) finished strong.

Miko A. Sayo, a trader at Angping & Associates Securities Inc., said the market was “rallying from oversold condition” as PLDT recouped its losses.

Shares in the telecommunications company gained 4.56% to end at P1,950 from P1,865 the other day. This pulled up the PSEi, which finished higher by 90.13 points or 1.14% to 7,978.57. The all-shares index also inched up by 39.68 points or 0.85% to close at 4,730.81.

All sectoral indices performed positively, led by services’ 32.79-point advance or 2.09% to 1,598.07. Industrials rose by 154.34 points or 1.27% to 12,225.76. Property stocks moved up by 36.97 points or 1.03% to 3,608.41.

Holding firms also rose by 72.72 points or 0.93% to 7,833.06; financials went up by 5.03 points or 0.27% to 1,851.78; and mining and oil gained 27.09 points or 0.24% to 10,969.48.

Trading volume thinned to around 1.3 billion shares on Thursday, down by around 37% from the previous day’s 2.07 billion shares, with the value down 47% to P7.14 billion from P13.55 billion previously.

Foreign trades hit P7.06 billion, with overseas investors buying more stocks than they sold, resulting in a net foreign buying of P69.56 million. This was down from Wednesday’s net purchases of P2.53 billion.

Gainers outnumbered losers, 130 to 60, while 47 stocks closed unchanged.

SM Prime Holdings, Inc., Aboitiz Equity Ventures, Inc. and Megawide Construction Corp. were the three most traded stocks yesterday. PLDT and Metropolitan Bank & Trust Co. rounded out the top five.

SM Prime reported a 12% rise in first-half core net income to P12.6 billion as consolidated revenues increased by 9% to P39.2 billion.

“SM Prime’s integrated development program in the Philippines that is geared more towards provincial expansion sustained its financial performance in the first half of the year,” SM Prime President Hans T. Sy said in a disclosure to the stock exchange on Tuesday.

“SM Prime is well-positioned for higher growth given that the Philippines’ economic upturn is starting to spread in the provinces.”

Other Southeast Asian stocks also rose on Thursday, with energy shares leading gains in five of the six markets, as global crude prices continued their uptrend and investors counted on the Bank of England to cut interest rates to a record low.

“Global central banks are trying to address the possible impact of global economic slowdown following the ‘Brexit’ vote. We’re going to see a shift of funds from developed economies back to emerging markets,” said Lexter Azurin, an analyst with Unicapital Securities. — VVS with Reuters

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=pse-index-rebounds-as-sentiment-turns-positive&id=131470

==================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion