Top Ten Smart Money Moves – August 9, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on August 9, 2016 Data)

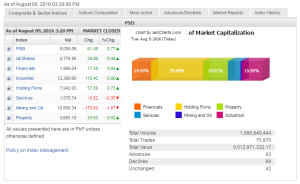

Total Traded Value – PhP 9.513 Billion – Medium

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 99 Declines vs. 93 Advances = 1.06:1 Neutral

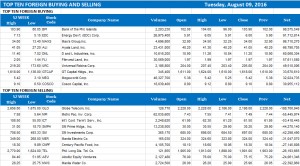

Total Foreign Buying – PhP 4.846 Billion

Total Foreign Selling – (PhP 4.526) Billion

Net Foreign Buying (Selling) PhP 0.320 Billion – 1st day of Net Foreign Buying after 2 days of Net Foreign Selling

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

PSE HEAT MAP

Screenshot courtesy of PSEGET

Top Ten Foreign Buying and Selling

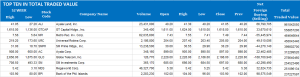

Top Ten in Total Traded Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Main index returns above 8,000 on Q2 earnings

Posted on August 10, 2016

SECOND-QUARTER corporate earnings continued to be the market’s main driver on Tuesday, fuelling the main index’s climb above the 8,000 mark ahead of the financial reporting deadline and the release of quarterly economic growth figures.

“It’s trying to test the record high… I think, so it’s another threshold we’re trying to break. We’re having a hard time trying to break that resistance. So we’re trying to build momentum again,” Luis A. Limlingan, business development head at Regina Capital Development Corp., said in an interview.

The Philippine Stock Exchange index (PSEi) gained 61.48 points or 0.76% to close at 8,055.06. The index has stayed below 8,000 for the past four trading days.

The all-shares index rose by 20.86 points or 0.43% to 4,778.56.

Mr. Limlingan said the earnings of blue chip firms have been “quite good because we’ve seen the effects of election spending come into play.”

“They’ve been rather positive at this point,” he said, citing the earnings report of Ayala Land, Inc. and Jollibee Foods Corp., although he said International Container Terminal Services, Inc. (ICTSI) performance was not as expected.

ICTSI’s net income attributable to equity holders declined by 3% to $45.1 million in the second quarter from $46.4 million a year earlier.

“And of course, we’re getting ready for the second-quarter GDP (gross domestic product), which is out next week. And I think the expectations are also high,” Mr. Limlingan said. He added that the National Economic and Development Authority, which previously said GDP growth could hit 7%, was “fairly accurate” with its predictions.

“So I think everyone is looking at 7% GDP target for the second quarter,” he said.

He noted, however, that growth should be well above 7% for the main index to rise past its record because investors were already discounting the pace that the government’s economic team had predicted.

Joylin F. Telagen, research head at IB Gimenez Securities, said aside from “upbeat” quarterly earnings, other factors from abroad had a play in the market’s showing. She said China’s inflation report, which came as expected, also boosted market demand on Tuesday.

“Overseas in the US, there’s still some positive sentiment from the job data that came out last Friday,” Regina Capital’s Mr. Limlingan said.

Yesterday, four of the six sectoral indices advanced, with financials taking the lead with a 17.38-point or 0.93% rise to 1,869.04. The other gainers for the day were property, industrial and holding firms.

Decliners edged out advancers, 99 to 93, while 42 names ended flat. Foreigners turned net buyers, with their net purchases at P320.38 million from Monday’s net foreign selling of P259.03 million. Value turnover reached P9.51 billion as 1.97 billion shares changed hands, up from the previous session’s P6.98 billion. — VVS

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=main-index-returns-above-8000-on-q2-earnings&id=131660

==================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion