Top Ten Smart Money Moves – Dec. 29, 2015

Top Ten Smart Money Moves, starting January 2015, is the official trading

Moves, starting January 2015, is the official trading newsletter of The Responsible Trader

newsletter of The Responsible Trader to promote

to promote his advocacy, Responsible Trading

his advocacy, Responsible Trading . This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying

. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded

and Selling, Top Ten in Total Traded Value, including Trading

Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader

Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Happy New Year to everyone! The long holidays was a very good opportunity for us to spend quality time with our loved ones. We are glad to be back in circulation again.

Trading Notes for Today – (Based on Dec. 29, 2015 Data)

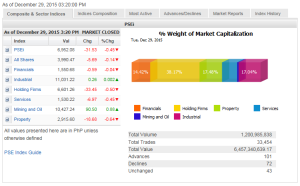

Total Traded Value – PhP 6.457 Billion – Low

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 101 Advances vs 72 Declines = 1.40:1 Neutral

Total Foreign Buying – PhP 2.534 Billion

Total Foreign Selling – (Php 1.571) Billion

Net Foreign Buying (Selling) – Php 0.963 Billion – 7th day of Net Foreign Buying after 11 days of Net Foreign Selling

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

PSE Heat Map (No Heat Map. Same explanation as the day before)

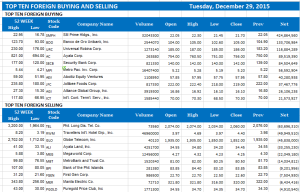

Top Ten Foreign Buying and Selling

and Selling

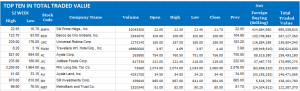

Top Ten in Total Traded Value

Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Posted on December 29, 2015 08:09:00 PM

By Krista Angela M. Montealegre, Senior Reporter

Stocks slump as global oil price weakness persists

STOCKS ended the final trading session of the year on a sour note, sending the blue-chip Philippine Stock Exchange index (PSEi) to its first annual loss in seven years, as lingering concerns overseas pushed investors to lock in gains ahead of the long weekend.

The benchmark PSEi on Tuesday gave up 31.53 points or 0.45% to settle at 6,952.08 at the close of trading in 2015. The local barometer lost 3.85% for the year, ending a six-year bull run.

The wider all-shares index slid 5.69 points or 0.14% to finish at 3,990.47.

“It was a quiet trading day, as most investors stayed on the sidelines due to the shortened trading week. There was not much positive news that can boost the confidence of investors,” Lexter L. Azurin, head of research at Unicapital Securities, Inc., said in a phone interview.

“We didn’t see a Santa Claus rally when a lot of people were expecting the index to end above 7,000. The pressure came from the worsening oil price environment and Chinese economic slowdown,” Victor F. Felix, equity analyst at AB Capital Securities, Inc., said in a separate interview.

US stocks tallied modest losses overnight on the resumption of trades after the Christmas break, as oil prices declined on the back of weak industrial data in China and Japan.

Local counters finished mixed. Property shed 18.68 points or 0.63% to 2,915.60; holding firms dropped 33.45 points or 0.50% to 6,601.26; services fell 6.97 points or 0.45% to 1,530.22; and financials dipped by 0.59 point or 0.03% to 1,550.68.

In contrast, mining and oil went up 90.50 points or 0.87% to 10,427.24 and industrial added a quarter of a point to 11,031.22.

Value turnover more than doubled to P6.46 billion after 1.2 billion shares changed hands, from P3.08 billion on Monday.

Market breadth was positive, as gainers dominated losers, 101 to 72, while 43 issues were unchanged.

Net foreign buying ballooned to P961.56 million from P43.62 million the previous session.

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=stocks-slump-as-global-oil-price-weakness-persists&id=120767

==================================================

Good luck on all your TRADES

luck on all your TRADES today

today .

.

DISCLAIMER There is a very high degree of risk involved in TRADING . Past results

. Past results are not indicative of future returns

are not indicative of future returns . Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION

. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER

or endorsement of any security. In accordance with the Responsible TRADER ’s Creed: I will never tell and you take full

’s Creed: I will never tell and you take full responsibility for all your TRADING

responsibility for all your TRADING results.

results.