Top Ten Smart Money Moves – December 11, 2017

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on December 11, 2017 Data)

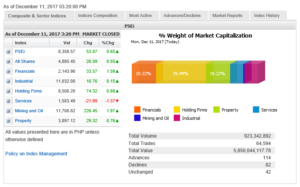

Total Traded Value – PhP 5.850 Billion – Low

Advances Declines – (Ideal is 2:1) 91 Advances vs. 63 Declines = 1.44:1 Neutral

Total Foreign Buying – PhP 2.797 Billion

Total Foreign Selling – (PhP 2.805) Billion

Net Foreign Buying (Selling) – (PhP 0.008) Billion –7th day of Net Foreign Selling after a day of Net Foreign Buying

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

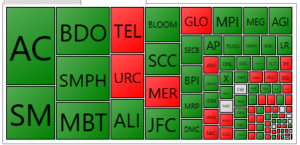

PSE HEAT MAP

Screenshot courtesy of PSEGET

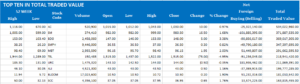

Top Ten Foreign Buying and Selling

Top Ten in Total Traded Value

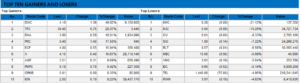

Top Ten Gainers and Losers

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Fitch upgrade cheer provides market lift

December 12, 2017

OPTIMISM over Fitch Ratings’ increase of the Philippines’ investment-grade credit score cured the bourse of initial weakness on Monday.

The Philippine Stock Exchange index (PSEi) climbed by 53.87 points or 0.65% to close 8,358.57 — its best finish in nine trading days — after opening the day 0.10% lower at 8,296.23 and dropping 0.33% to 8,277.26 before closing at its peak for the day. The all-shares index similarly rose 26.59 points or 0.55% to end 4,885.45.

In a reversal of fortunes from earlier in the day that saw most the six sectoral indices losing, five of them ended with gains.

Offshore investors remained predominantly sellers for the seventh straight trading day.

“Locally, the markets cheered as Fitch ratings raised the country’s sovereign rating by one level. This hence provided support to the president’s economic plans, which include a tax reform aimed at strengthening the fiscal outlook,” Regina Capital Development Corp. Managing Director Luis A. Limlingan said in a mobile phone message.

Fitch raised the Philippines’ sovereign rating a notch further into investment grade at BBB with a stable outlook, from its previous BBB- minimum investment score, citing strong investor sentiment unaffected by President Rodrigo R. Duterte’s bloody war on drugs that has otherwise earned international censure.

“Strong and consistent macroeconomic performance has continued, underpinned by sound policies that are supporting high and sustainable growth rates,” Fitch had said.

Five sectoral indices gained: mining and oil by 226.45 points or 1.97% to close 11,708.82; financials by 33.57 points or 1.59% to 2,143.90; holding firms by 74.32 points or 0.88% to 8,500.20; property by 29.32 points or 0.76% to 3,897.12 and industrials by 16.76 points or 0.15% to end 11,032.08.

Only services lost, giving up 21.99 points or 1.37% to 1,583.49.

RCBC Securities, Inc. equity analyst Jeffrey Lucero said in a separate text that losses incurred by PLDT, Inc. and Globe Telecom, Inc. capped general market gains “following news of a possible third telco player in China Telecom (Corporation Ltd.)”

PLDT, Globe, Manila Electric Co. and Universal Robina Corp. were the only losers among Monday’s 20 most actively traded stocks, giving up 4.95% to P1,440, 3.98% to P1,690, 1.55% to P318.40 and by 0.35% to P143.50, respectively.

A total of 923.34 million stocks worth P5.85 billion changed hands, compared to Friday’s 1.02 billion shares worth P6.70 billion.

Stocks that gained continued to outnumber those that lost 91 to 63, while 84 others were unchanged.

Net foreign selling persisted for a seventh straight trading day, but at P7.57 million that was just a fifth of Friday’s P37.284 million and the smallest amount in that period. — Arra B. Francia

Source: bworldonline.com/fitch-upgrade-cheer-provides-market-lift/

=====================================================

In line with our VISION, A RESPONSIBLE IN EVERY FILIPINOS HOME, we aim to continue promoting financial literacy on the area of stock market trading and investing to our countrymen both here and abroad through the following:

1. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/. For those interested in the hard copy, please send email to: ninjatrader919@gmail.com Subject: The Responsible Trader – Hard Copy.

As requested by those abroad and those who want the book in digital form, we have produced an eBook version. For those interested please send email to: ninjatrader19@gmail.com Subject: The Responsible Trader – eBook Version.

The book continues to receive positive response and comments from our readers. To reach a wider audience we have made the book available through selected branches of National Bookstore:

The book can also be ordered online through our publisher, Central Book Supply. Just go to: http://central.com.ph/bookstoreplus then click Search – The Responsible Trader.

2. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

3. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

4. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES: Please take note of the following changes. Effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than PhP 8 Billion b. Medium – Total Traded Value Php 8 Billion but not more than P15 Billion c. High – Total Traded Value more than Php 15 Billion.

Starting with August 11, 2017 data we are including the Top Ten Gainers and Losers for a more comprehensive coverage of significant stock movements during the day.