Top Ten Smart Money Moves – December 16, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on December 16, 2016 Data)

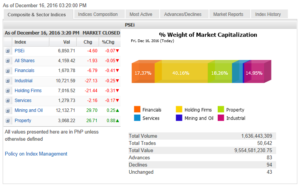

Total Traded Value – PhP 9.554 Billion – Medium

Advances Declines Ratio – (Ideal is 2:1) 94 Declines vs. 83 Advances = 1.13:1 Neutral

Total Foreign Buying – PhP 6.514 Billion

Total Foreign Selling – (PhP 7.452 Billion)

Net Foreign Buying (Selling) – (PhP 0.938) Billion – 6th day of Net Foreign Selling after 2 days of Net Foreign Buying

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

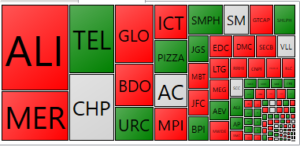

PSE HEAT MAP

Screenshot courtesy of PSEGET

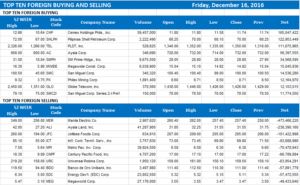

Top Ten Foreign Buying and Selling

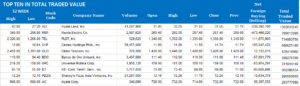

Top Ten in Total Traded Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Investors eye ‘Santa Claus’ rally as year closes

Posted on December 19, 2016

LOCAL INVESTORS are pinning their hopes on a “Santa Claus” rally as the year comes to a close amid an absence of potential catalysts to drive equities after the US Federal Reserve’s decision to raise rates last week.

Last week, the bellwether Philippine Stock Exchange index ended last week with a decline of 192 points or 2.73% from Dec. 9, closing at 6,850.71 on Friday.

A major factor for last week’s loss was the Fed’s preliminary indications of three more rate increases next year, which could attract funds flow in favor of dollar-based assets.

Meanwhile, the debut of Shakey’s Pizza Asia Ventures, Inc., which marked only the fourth initial public offering in the local market this year, was received warmly, as it closed the week at P12.24, almost 9% higher from its listing price, albeit not enough to lift the main index.

For this week, analysts are expecting subdued market movements as the Christmas holidays approach, with trade participation expected to be moderate.

“[This] week for the local market, not much action. The Fed meeting was the major economic cap for the year. Until the end of the year, we can’t expect much catalysts for our markets,” Victor F. Felix, equity analyst at AB Capital Securities, Inc. said by phone over the weekend.

Among the drivers this week, Mr. Felix said, will be the Bank of Japan’s policy meeting and the preliminary fourth quarter gross domestic product result of the US.

“Going into the final two trading weeks for the year, only the hopes of Santa’s visit is left for investors to cling to,” read A&A Securities, Inc.’s outlook for the week.

The report noted that from 2006 to 2015, the final two trading weeks of the year have given positive returns nine times except for 2008, or when a global recession took place.

This historical movement of the local stocks moving toward yearend “provides us with a glimmer of hope,” A&A Securities added.

Meanwhile, following the Fed’s 25-basis-point rate hike, which markets have been discounting for the past few weeks, and the US central bank’s hawkish tone on more interest rate hikes next year, eyes are now set on local monetary authorities’ response, specifically on the direction it will take for 2017.

“Before 2016 comes to a close, a decision from the local Monetary Board to maintain benchmark rates might create added pressure for the Philippine peso,” online brokerage 2TradeAsia.com said in its outlook. The Bangko Sentral ng Pilipinas’ Monetary Board will meet to review policy settings on Thursday.

Still, regardless of tightening moves at home, market sentiment will mostly be banking on prospects for growth next year, the brokerage said.

“There are 1Q17 (first quarter 2017) gifts market players could still hope for, specifically the prospects for reduced income taxes and continued thrust to support infra-related spending,” it added.

Immediate support for the index this week is seen at around 6,800,and resistance at 6,900, the brokerage said. — Janina C. Lim

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=investors-eye-&145santa-claus&8217-rally-as-year-closes&id=137914

==================================================

We aim to continue promoting financial literacy on the area of stock market trading and investing to our countrymen both here and abroad through the following:

1. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/

2. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

3. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

4. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES: Please take note of the following changes effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion