Top Ten Smart Money Moves – December 29, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on December 29, 2016 Data)

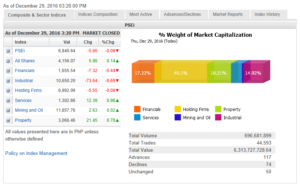

Total Traded Value – PhP 6.314 Billion – Low

Advances Declines Ratio – (Ideal is 2:1) 117 Advances vs. 74 Declines = 1.58:1 Neutral

Total Foreign Buying – PhP 3.877 Billion

Total Foreign Selling – (PhP 3.620 Billion)

Net Foreign Buying (Selling) – PhP 0.257 Billion – 2nd day of Net Foreign Buying after 12 days of Net Foreign Selling

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

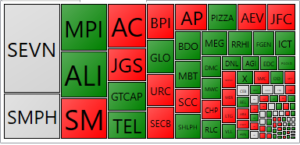

PSE HEAT MAP

Screenshot courtesy of PSEGET

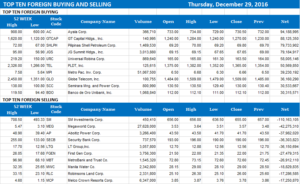

Top Ten Foreign Buying and Selling

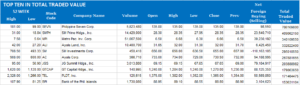

Top Ten in Total Traded Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

PSEi to remain under pressure as trades resume

Posted on January 03, 2017

AFTER closing in the red for the second year in a row, the Philippine Stock Exchange index (PSEi) is expected to struggle to regain its strength in the first few days of 2017, with analysts baring mixed expectations for the market’s performance in the absence of major drivers.

The bellwether PSEi closed 2016 at 6,840.64 last Dec. 29, weaker than its 2015 finish of 6,952.08.

It was the second straight year of losses for the benchmark index after declining by 3.85% in 2015. The PSEi nearly quadrupled in value from 2009 to 2014 — marked by six consecutive years of gains.

Philippine markets will reopen today after a four-day break in lieu of local holidays.

F. Yap Securities, Inc.’s online trading arm, 2TradeAsia.com, said bargain hunting would help sentiment this week “but on frail turnover,” which could push the PSEi higher by 277 points to 6,840 or up 4.2% week on week.

In contrast, April Lynn L. Tan, research head at COL Financial Group, Inc., said in a television interview that she expected a rally as the market had been sold down “quite a bit.”

“Technically speaking, there is a possibility that the market could rally, at least in the short term.”

The new year will start with a number of economic reports, namely manufacturing data from the US and China, the US jobs report and the Philippine inflation print for December.

China’s manufacturing sector expanded for a fifth month in December, but growth slowed a touch more than expected in a sign that government measures to rein in soaring asset prices are starting to have a knock-on effect on the broader economy.

The official Purchasing Managers’ Index stood at 51.4 in December compared with 51.7 in November.

Meanwhile, Philippine inflation likely hit a two-year high in December due to higher oil and utility costs coupled with a weak peso, economists said in a BusinessWorld poll last week. Seven economists tapped late last week pointed to a median inflation of 2.8% last month, which if realized would be the fastest pace in over two years since a 3.7% reading in November 2014.

The Philippine Statistics Authority will release December and full-year 2016 inflation data on Thursday.

2TradeAsia.com expects the release of the Federal Open Market Committee’s December minutes tomorrow to help investors differentiate the Fed’s tone and identify as to whether its plan to raise rates three times this year “is firm enough relative to the earlier issued statement.”

“Nonetheless, focus will likely be on transition of the US administration on Jan. 20, as investors bet on robust fiscal spending to boost the US economy,” 2TradeAsia.com said, adding that all eyes will be on global and local fiscal policies ahead of major spending changes in the world’s largest economy.

The online brokerage pegged the PSEi’s immediate support at 6,800, secondary at 6,750, and resistance at 6,910. — V.V. Saulon

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=psei-to-remain-under-pressure-as-trades-resume&id=138433

==================================================

We aim to continue promoting financial literacy on the area of stock market trading and investing to our countrymen both here and abroad through the following:

1. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/.

As requested by those abroad and those who want the book in digital form, we have produced an eBook version. For those interested please send email to: ninjatrader19@gmail.com Subject: The Responsible Trader – eBook Version.

2. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

3. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

4. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES: Please take note of the following changes effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion