Top Ten Smart Money Moves – Feb. 18, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading

Moves, starting January 2015, is the official trading newsletter of The Responsible Trader

newsletter of The Responsible Trader to promote

to promote his advocacy, Responsible Trading

his advocacy, Responsible Trading . This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying

. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded

and Selling, Top Ten in Total Traded Value, including Trading

Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader

Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on Feb.18, 2016 Data)

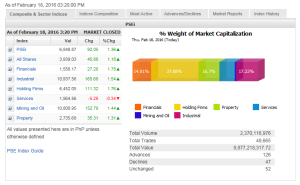

Total Traded Value – PhP 9.877 Billion – Medium

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 126 Advances vs. 47 Declines = 2.68:1 Bullish

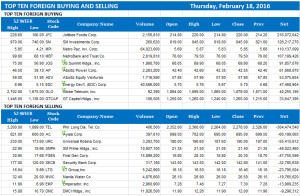

Total Foreign Buying – PhP 4.261 Billion

Total Foreign Selling – (Php 5.061) Billion

Net Foreign Buying (Selling) – (Php 0.800) Billion – 3rd day of Net Foreign Selling after a day of Net Foreign Buying

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

PSE Heat Map

Screenshot courtesy of: PSEGET Software

Top Ten Foreign Buying and Selling

and Selling

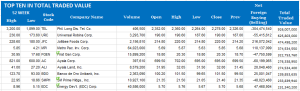

Top Ten in Total Traded Value

Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Posted on February 18, 2016 08:31:00 PM

By Krista A. M. Montealegre, Senior Reporter

Stocks extend rally on revived investor appetite

LOCAL STOCKS extended their winning streak yesterday to a fourth straight session, moving closer to being in positive territory for the year, as investor appetite for risky assets improved on easing concerns overseas.

The benchmark Philippine Stock Exchange index climbed 92.05 points or 1.36% to close at 6,848.87, its highest level since closing at 6,835.13 on Jan. 5. The local barometer is now down by only 1.5% or roughly 103 points from its end-2015 finish after plunging by as much as 12.5%.

The all-shares index added 45.88 points or 1.17% to settle at 3,939.03.

“We were helped by the good performance from Wall Street and the strength of some commodities,” Miko A. Sayo, trader at Angping & Associates Securities, Inc., said in a telephone interview.

“It seems like investor confidence has started to return given that concerns have eased in general and this is one of the reasons equities have been rallying. Global central banks have managed to take measure to address specific concerns,” Lexter L. Azurin, head of research at Unicapital Securities, Inc., said in a separate interview.

Overnight, Wall Street staged its first three-day rally this year, buoyed by the 5.6% gain in US crude, after Iran expressed its support to the decision of Russia and Saudi Arabia to freeze production to address oversupply.

Minutes of last month’s Federal Open Market Committee meeting released on Wednesday showed policy makers were concerned about tighter global financial conditions weighing on the world’s largest economy and were mulling over changes to the pace of interest rate hikes this year.

Services was the lone counter in the red, losing 5.29 points or 0.33% to 1,564.56.

All other sub-indices chalked up gains of at least 1% each. Financials rallied 27.28 points or 1.78% to 1,558.17; holding firms surged 111.32 points or 1.75% to 6,452.05; industrial gained 165.68 points or 1.53% to 10,937.56; mining and oil went up 152.79 points or 1.43% to 10,800.95; and property added 35.31 points or 1.30% to 2,735.68.

Value turnover spiked to P9.88 billion after 2.37 billion shares changed hands, from the P6.91 billion seen in the prior session.

Advancers dominated decliners, 126 to 47, while 52 issues were flat.

Net foreign selling was logged at P800.11 million yesterday, higher than the P628.99 million registered on Wednesday.

Equities have room to trek higher before the trading week ends, possibly testing the major resistance at the 7,000 mark, analysts said.

“We can creep a little bit higher. In the short term, the rally is sustainable, but in the medium- to long term, I’m not sure. It’s the same concerns as before: low growth, currency wars and low commodity prices,” Angping & Associates Securities’ Mr. Sayo said.

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=stocks-extend-rally-on-revived-investor-appetite&id=123301

==================================================

Good luck on all your TRADES

luck on all your TRADES today

today .

.

DISCLAIMER There is a very high degree of risk involved in TRADING . Past results

. Past results are not indicative of future returns

are not indicative of future returns . Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION

. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER

or endorsement of any security. In accordance with the Responsible TRADER ’s Creed: I will never tell and you take full

’s Creed: I will never tell and you take full responsibility for all your TRADING

responsibility for all your TRADING results

results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion