Top Ten Smart Money Moves – Feb. 2, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading

Moves, starting January 2015, is the official trading newsletter of The Responsible Trader

newsletter of The Responsible Trader to promote

to promote his advocacy, Responsible Trading

his advocacy, Responsible Trading . This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying

. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded

and Selling, Top Ten in Total Traded Value, including Trading

Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader

Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on Feb. 2, 2016 Data)

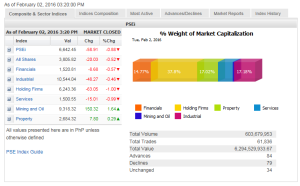

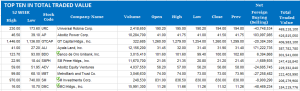

Total Traded Value – PhP 6.294 Billion – Low

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 84 Advances vs. 79 Declines = 1.06:1 Neutral

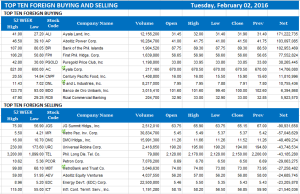

Total Foreign Buying – PhP 3.555 Billion

Total Foreign Selling – (Php 3.480) Billion

Net Foreign Buying (Selling) – Php 0.075 Billion – 7th day of Net Foreign Buying after 5 days of Net Foreign Selling

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

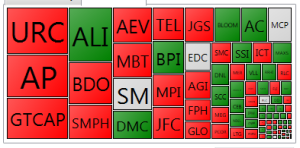

PSE Heat Map

Screenshot courtesy of: PSEGET Software

Top Ten Foreign Buying and Selling

and Selling

Top Ten in Total Traded Value

Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Posted on February 02, 2016 08:01:00 PM

By Krista A. M. Montealegre, Senior Reporter

Profit taking, oil price slump weigh on equities

STOCKS snapped a four-day winning run yesterday, following regional markets lower as the slump in oil prices prompted investors to lock in gains, with the benchmark index hovering at resistance levels.

The Philippine Stock Exchange index (PSEi) gave up 58.91 points or 0.87% to close at 6,642.45, near the session’s high.

The broader all-shares index dropped 20.03 points or 0.52% to finish at 3,805.82.

“It’s mainly profit taking since our market has already rallied close to 11% from the recent low. It’s profit taking and investors are still waiting for earnings results of domestic companies, which have started to trickle in,” Lexter L. Azurin, head of research at Unicapital Securities, Inc., said in a telephone interview.

The benchmark PSEi’s losses reached a high of 12.48%, succumbing to a global market rout amid worries over deteriorating growth in China, plunging oil prices and higher interest rates in the United States. Year to date, the local barometer is only down by 4.45%.

“Today’s action seems to be in line with a technical bounce with key resistance seen between 6,500 and 6,600 level. The market seems to be having problems sustaining gains above 6,700,” BDO Unibank, Inc. Chief Market Strategist Jonathan L. Ravelas said in a mobile phone message on Tuesday.

Local stocks moved with their Asian counterparts after oil prices resumed their decline following the release of downbeat manufacturing data in China. Crude tumbled after China’s official purchasing managers’ index registered a sixth straight month of contraction, raising concerns about the global economy’s health.

“Oil is starting to become a concern already. Oil companies in the Middle East where there is a huge population of working overseas Filipinos may take a hit,” Unicapital’s Mr. Azurin said.

Locally, the mining and oil counter was the day’s best performer, rallying 150.32 points or 1.64% to 9,318.32. Likewise, property added 7.80 points or 0.29% to 2,684.32.

In contrast, holding firms plunged 63.05 points or 1% to 6,243.36; services lost 15.01 points or 0.99% to 1,500.55; financials tumbled 8.68 points or 0.56% to 1,520.81; and industrial fell 48.27 points or 0.45% to 10,544.04.

Value turnover slumped to P6.29 billion after 603.68 million shares changed hands, from Monday’s P8.56 billion. Still, advancers beat decliners, 84 to 79, while 34 issues remained unchanged yesterday.

Foreign investors continued to pick up local equities, but net purchases thinned to P74.67 million from P396.92 million in the prior session.

“I think the volatility is expected to continue in the next few days. The market will be dictated by the upcoming earnings results. Of course, you still have external concerns,” Unicapital’s Mr. Azurin said.

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=profit-taking-oil-price-slump-weigh-on-equities&id=122469

==================================================

Good luck on all your TRADES

luck on all your TRADES today

today .

.

DISCLAIMER There is a very high degree of risk involved in TRADING . Past results

. Past results are not indicative of future returns

are not indicative of future returns . Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION

. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER

or endorsement of any security. In accordance with the Responsible TRADER ’s Creed: I will never tell and you take full

’s Creed: I will never tell and you take full responsibility for all your TRADING

responsibility for all your TRADING results

results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion