Top Ten Smart Money Moves – February 20, 2017

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on February 20, 2017 Data)

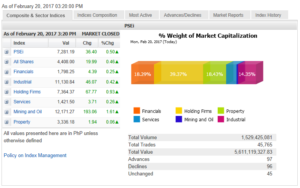

Total Traded Value – PhP 5.611 Billion – Low

Advances Declines Ratio – (Ideal is 2:1) 97 Advances vs. 99 Declines = 1.01:1 Neutral

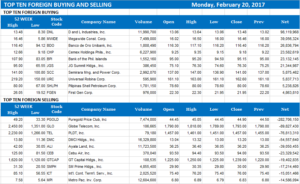

Total Foreign Buying – PhP 2.481 Billion

Total Foreign Selling – (PhP 2.874 Billion)

Net Foreign Buying (Selling) – (PhP 0.393) Billion – 2nd day of Net Foreign Selling after a day of Net Foreign Buying

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

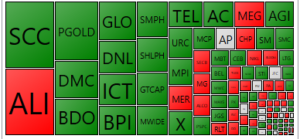

PSE HEAT MAP

Screenshot courtesy of PSEGET

Top Ten Foreign Buying and Selling

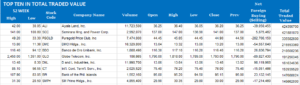

Top Ten in Total Traded Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

PSEi advances as strong data spark Wall St. rally

Posted on February 21, 2017

LOCAL STOCKS recorded some gains on Monday as it tracked the advance of US markets over the weekend due to strong economic data there.

The Philippine Stock Exchange index (PSEi) rose by 0.50% or 36.40 points to close at 7,281.19 on Monday.

Moving in the same direction, the broader all shares index gained 0.46% or 19.99 points to finish the session at 4,408.

Luis A. Limlingan, business development head at Regina Capital Development Corp., said the local bourse aligned with US markets, which he said posted their seventh successive record session, citing a deal in the stables segment that helped offset the weakness in energy.

“Value turnover was lackluster as the US markets are closed today for the Presidents’ Day holiday,” he said, adding that leading US economic indicators advanced in January.

“The Conference Board’s leading economic index climbed 0.6%,” he said, comparing the improvement to market estimates of 0.5% month on month, and December’s 0.5% rise.

“The interest rate spread, building permits, average weekly initial jobless claims and the ISM (Institute for Supply Management) new orders index were among the largest positive contributors. Meanwhile, Treasuries advanced as fresh developments in the French presidential election — two leaders from the political left could join forces, possibly hurting the chances of the centrist candidate Emmanuel Macron and helping Ms. [Marine] Le Pen — drove investors towards safe harbor bonds,” Mr. Limlingan said.

All counters ended in the green. Mining and oil issues climbed by 1.61% or 193.06 points to finish at 12,171.27, making the sector the day’s top performer after it sustained steady battering in the past few days on closure and suspension issues. Holding firms followed with a 0.93% rise or 67.77 points to 7,364.37. Industrials also moved up by 0.42% or 46.07 points to 11,130.84; services rose 0.26% or 3.71 points to 1,421.50; financials added 0.24% or 4.39 points to 1,798.25; and property inched up by 0.06% or 1.94 point to 3,336.18.

With the improvement, advancers narrowly edged out decliners at 97 to 96, while 45 stocks closed unchanged.

However, value turnover decreased to P5.61 billion from Friday’s P6.99 billion, with 1.53 billions shares changing hands.

Foreigners continued to exit the market as they sold P2.87 billion worth of stocks as against buying of P2.48 billion, resulting in a net selling of P393.85 million or more than eight times Friday’s net outflow of P47.37 million.

2TradeAsia.com, the online arm of F. Yap Securities, Inc., said the market might continue with its consolidation phase this week, “with no new catalysts in place yet to trigger a sizeable run-up.”

It expects the PSEi’s immediate support at between 7,150 and 7,200, while resistance at 7,300 to 7,350. It said locals would continue to monitor the release of corporate earnings from large cap companies. — Victor V. Saulon

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=psei-advances-as-strong-data-spark-wall-st.-rally&id=140952

==================================================

We aim to continue promoting financial literacy on the area of stock market trading and investing to our countrymen both here and abroad through the following:

1. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/.

As requested by those abroad and those who want the book in digital form, we have produced an eBook version. For those interested please send email to: ninjatrader19@gmail.com Subject: The Responsible Trader – eBook Version.

2. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

3. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

4. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES: Please take note of the following changes effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than PhP 8 Billion b. Medium – Total Traded Value Php 8 Billion but not more than P15 Billion c. High – Total Traded Value more than Php 15 Billion