Top Ten Smart Money Moves – Jan. 15, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading

Moves, starting January 2015, is the official trading newsletter of The Responsible Trader

newsletter of The Responsible Trader to promote

to promote his advocacy, Responsible Trading

his advocacy, Responsible Trading . This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying

. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded

and Selling, Top Ten in Total Traded Value, including Trading

Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader

Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on Jan. 15, 2016 Data)

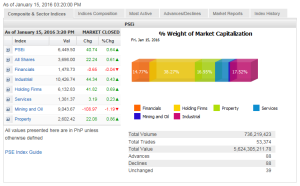

Total Traded Value – PhP 5.624 Billion – Low

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 88 Advances vs. 88 Declines = 1.0:1 Perfectly Neutral

Total Foreign Buying – PhP 3.615 Billion

Total Foreign Selling – (Php 3.384) Billion

Net Foreign Buying (Selling) – Php 0.231 Billion – 1st day of Net Foreign Buying after a day of Net Foreign Selling

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

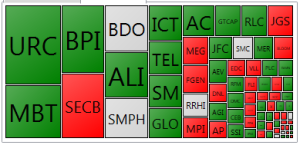

PSE Heat Map

Screenshot courtesy of: PSEGET Software

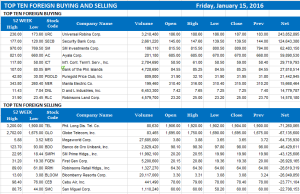

Top Ten Foreign Buying and Selling

and Selling

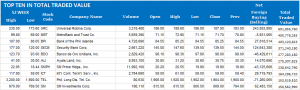

Top Ten in Total Traded Value

Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Posted on January 15, 2016 07:01:00 PM

By Krista Angela M. Montealegre, Senior Reporter

Bargain-hunting lifts PHL stocks

STOCKS carved out gains on Friday, as the overnight rally in Wall Street prompted investors to pick up bargains following the rout in global markets.

The 30-company Philippine Stock Exchange index (PSEi) rose 40.74 points or 0.64% to close at 6,449.50.

The all-shares index went up by 22.24 points or 0.61% to end at 3,698.00.

“The market was up today because oil went back up and this signaled a rebound or a strengthening of the oil price environment. While most Asian markets were down, we were quite resilient,” Victor F. Felix, equity analyst at AB Capital Securities, Inc., said in a phone interview.

“Some investors took advantage of the stocks that were beaten down in the past few days. It is mainly bargain-hunting because we haven’t traded this low for quite a while,” Lexter L. Azurin, head of research at Unicapital Securities, Inc., said in a separate interview.

Wall Street provided some relief for local stocks, which closed out the first two weeks of the year down 7.23% from its closing level of 6,952.08 in 2015.

The local barometer has fallen 20.65% from its peak of 8,127.48 in April 10, 2015 to meet the common definition of a bear market.

The Dow Jones Industrial Average on Thursday scored its biggest one-day gain of the year, climbing 227.64 points or 1.4% to 16,379.05. The S&P 500 rose 31.56 points or 1.7% to 1921.84, while the Nasdaq Composite surged 88.94 points or 2% to 4,615.00.

Asian markets deepened their losses after Chinese data on new yuan loans and money supply growth missed expectations. Worries that a weakening yuan could trigger a competitive currency devaluation across the region have sent global shares prices on a tailspin this month.

Local counters were mixed. Mining and oil tumbled 108.97 points or 1.19% to 9,043.67 and financials slid 0.04% to 1,478.73.

In contrast, property added 22.08 points or 0.86% to 2,602.42; holding firms advanced 41.82 points or 0.69% to 6,132.83; industrial jumped 44.34 points or 0.43% to 10,426.74; and services gained 3.19 points or 0.23% to 1,381.37.

Value turnover picked up to P5.62 billion after 736.22 million shares changed hands, from Thursday’s P5.26 billion.

Advancers and decliners were at 88, while 39 issues were unchanged.

Net foreign purchases stood at P230.96 million — a reversal of the net foreign selling of P489.47 million in the previous session.

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=bargain-hunting-lifts-phl-stocks&id=121557

==================================================

Good luck on all your TRADES

luck on all your TRADES today

today .

.

DISCLAIMER There is a very high degree of risk involved in TRADING . Past results

. Past results are not indicative of future returns

are not indicative of future returns . Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION

. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER

or endorsement of any security. In accordance with the Responsible TRADER ’s Creed: I will never tell and you take full

’s Creed: I will never tell and you take full responsibility for all your TRADING

responsibility for all your TRADING results.

results.