Top Ten Smart Money Moves – Jan. 18, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading

Moves, starting January 2015, is the official trading newsletter of The Responsible Trader

newsletter of The Responsible Trader to promote

to promote his advocacy, Responsible Trading

his advocacy, Responsible Trading . This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying

. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded

and Selling, Top Ten in Total Traded Value, including Trading

Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader

Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on Jan. 18, 2016 Data)

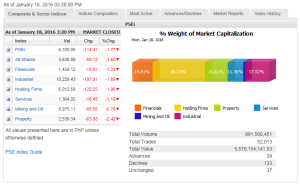

Total Traded Value – PhP 5.579 Billion – Low

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 133 Declines vs. 39 Advances = 3.41:1 Bearish

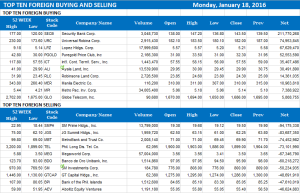

Total Foreign Buying – PhP 2.679 Billion

Total Foreign Selling – (Php 3.150) Billion

Net Foreign Buying (Selling) – (Php 0.471) Billion – 1st day of Net Foreign Selling after a day of Net Foreign Buying

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

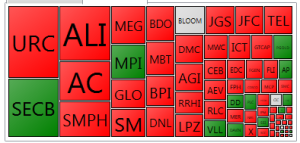

PSE Heat Map

Screenshot courtesy of: PSEGET Software

Top Ten Foreign Buying and Selling

and Selling

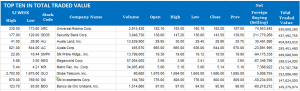

Top Ten in Total Traded Value

Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Posted on January 18, 2016 09:31:00 PM

By Krista A.M. Montealegre, Senior Reporter

Shares tank close to 2-year low after Wall St. skid

STOCKS TOUCHED a near two-year low yesterday before trimming losses to stay above a crucial support level, as investors adopted a risk-on stance ahead of the release of China’s economic growth data.

The benchmark Philippine Stock Exchange index gave up 114.41 points or 1.77% to close at 6,335.09. The local barometer lost as much as 173.39 points or 2.69% intraday to 6,276.10, its lowest level since Feb. 26, 2014, before clawing its way back above 6,300-support level.

The broader all-shares index dropped 59.12 points or 1.59% to end at 3,638.88.

“Markets fell anew following the drop on Wall Street and Asian stocks,” BDO Unibank, Inc. Chief Market Strategist Jonathan L. Ravelas said in a mobile phone message.

Lexter L. Azurin, head of research at Unicapital Securities, Inc., said in a phone interview: “We followed US markets lower after the Dow went down by 300 points.”

“The concern right now is on China and the data that will be released tomorrow [today] can validate concerns that its economy is indeed slowing down,” he added.

Markets in Asia closed mostly lower yesterday following the sell-off on Wall Street on Friday on the back of plunging oil prices, volatility in Chinese stocks, and disappointing US economic data.

The S&P closed at its lowest since late August while the Nasdaq Composite ended at its lowest since October 2014.

Focus will be on China today with the world’s second-largest economy set to release its fourth-quarter gross domestic product data. Chinese Premier Li Keqiang said its economy grew nearly 7% last year.

All counters finished in negative territory.

Property was the biggest drag to the stock market, tumbling 63.08 points or 2.42% to 2,539.34.

Likewise, holding firms plunged 120.25 points or 1.96% to 6,012.58; industrial slid 197.31 points or 1.89% to 10,229.43; financials shed 19.61 points or 1.32% to 1,459.12; services went down by 16.45 points or 1.19% to 1,364.92; and mining and oil slumped 68.56 points or 0.75% to 8,975.11.

Value turnover slipped to P5.58 billion after 991.56 million shares changed hands, from Friday’s P5.62 billion.

Decliners dominated advancers, 133 to 39, while 37 issues closed flat.

Foreign investors were on the sell side yesterday, with net sales of P470.55 million — a reversal of the net purchases of P230.96 million on Friday.

“The market’s movement will really depend on the data that will come out of China. It’s pretty crucial to determine the direction of the market,” Unicapital’s Mr. Azurin said.

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=shares-tank-close-to-2-year-low-after-wall-st.-skid&id=121651

==================================================

Good luck on all your TRADES

luck on all your TRADES today

today .

.

DISCLAIMER There is a very high degree of risk involved in TRADING . Past results

. Past results are not indicative of future returns

are not indicative of future returns . Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION

. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER

or endorsement of any security. In accordance with the Responsible TRADER ’s Creed: I will never tell and you take full

’s Creed: I will never tell and you take full responsibility for all your TRADING

responsibility for all your TRADING results.

results.