Top Ten Smart Money Moves – Jan. 29, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading

Moves, starting January 2015, is the official trading newsletter of The Responsible Trader

newsletter of The Responsible Trader to promote

to promote his advocacy, Responsible Trading

his advocacy, Responsible Trading . This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying

. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded

and Selling, Top Ten in Total Traded Value, including Trading

Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader

Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on Jan. 29, 2016 Data)

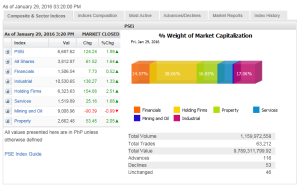

Total Traded Value – PhP 9.789 Billion – Medium

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 116 Advances vs. 53 Declines = 2.19:1 Bullish

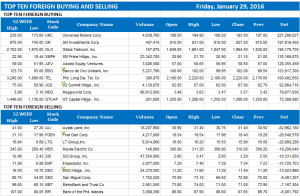

Total Foreign Buying – PhP 5.943 Billion

Total Foreign Selling – (Php 4.455) Billion

Net Foreign Buying (Selling) – Php 1.488 Billion – 5th day of Net Foreign Buying after 5 days of Net Foreign Selling

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

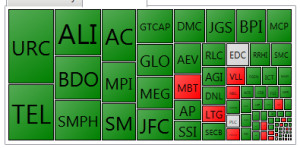

PSE Heat Map

Screenshot courtesy of: PSEGET Software

Top Ten Foreign Buying and Selling

and Selling

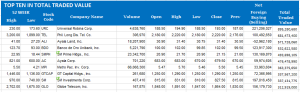

Top Ten in Total Traded Value

Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Posted on January 31, 2016 07:31:00 PM

By Krista A.M. Montealegre, Senior Reporter

US, China reports in focus as market seeks leads

INVESTORS will look to manufacturing data out of China and the employment report in the US to assess the strength of last week’s rally, with stocks primed to test resistance levels in the week ahead.

Local equities are coming off their first weekly gain this year on the back of a rebound in crude oil prices, higher-than-expected Philippine gross domestic product print, and accommodative statements and responses from central banks in the United States and Japan.

The benchmark Philippine Stock Exchange index surged 7.72% to end the week at 6,687.62, trimming the local barometer’s decline to 3.8% for the year.

The monster gains pushed the bellwether index out of “bear” territory after cutting losses to 17.72% from its peak of 8,127.48 in April.

“We see potential rallies to 6,730 (50-day moving average) [this] week but the index is close to overbought conditions so there might be moderate corrections to around 6,450 to 6,400. These moves are crucial because this will dictate the index’s move for February,” Luis A. Limlingan, business development head at Regina Capital Development Corp., said via text.

“Prospects this week will be data-dependent, which could add more gyration on fund flow movement,” online brokerage 2TradeAsia.com. said in a research note.

Once again, the spotlight will be on China with the release of its manufacturing purchasing managers’ index and a private estimate by Caixin — both due today — which could set the tone for the market’s direction this week. To recall, weak manufacturing data from the world’s second largest economy triggered the extreme volatility in Chinese stocks at the start of the year, which spilled over to other markets worldwide.

The US will see significant economic data releases as well, including the crucial nonfarm payrolls report, that can influence the Federal Reserve’s monetary policy at its next meeting.

In December, the Fed increased its benchmark interest rate for the first time in nearly a decade and signaled at further hikes this year. But events and economic reports since then, which the central bank acknowledged at its January meeting, have not been supportive of the envisioned policy tightening.

“Given expectations of continued weakness in China’s manufacturing, we expect cautious trading in global equities with downward bias, but upside surprises for any of these data releases will boost markets moving forward,” BPI Asset Management said in a research note released over the weekend.

“Right now, we are still not too bullish on the market but it is gearing up for a key reversal which I think will happen in March,” Regina Capital’s Mr. Limlingan said.

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=us-china-reports-in-focus-as-market-seeks-leads&id=122347

==================================================

Good luck on all your TRADES

luck on all your TRADES today

today .

.

DISCLAIMER There is a very high degree of risk involved in TRADING . Past results

. Past results are not indicative of future returns

are not indicative of future returns . Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION

. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER

or endorsement of any security. In accordance with the Responsible TRADER ’s Creed: I will never tell and you take full

’s Creed: I will never tell and you take full responsibility for all your TRADING

responsibility for all your TRADING results

results

NOTES:

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion