Top Ten Smart Money Moves – Jan. 4, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading

Moves, starting January 2015, is the official trading newsletter of The Responsible Trader

newsletter of The Responsible Trader to promote

to promote his advocacy, Responsible Trading

his advocacy, Responsible Trading . This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying

. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded

and Selling, Top Ten in Total Traded Value, including Trading

Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader

Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on Jan. 4, 2016 Data)

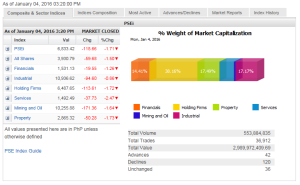

Total Traded Value – PhP 2.990 Billion – Low

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 120 Declines vs. 42 Advances = 2.86:1 Bearish

Total Foreign Buying – PhP 1.593 Billion

Total Foreign Selling – (Php 1.464) Billion

Net Foreign Buying (Selling) – Php 0.129 Billion – 8th day of Net Foreign Buying after 11 days of Net Foreign Selling

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

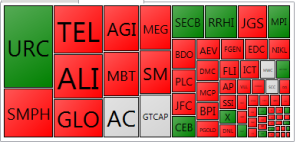

PSE Heat Map

Screenshot courtesy of: PSEGET Software

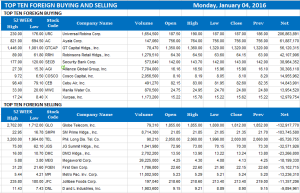

Top Ten Foreign Buying and Selling

and Selling

Top Ten in Total Traded Value

Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Posted on January 04, 2016 08:11:00 PM

PSEi kicks off 2016 in the red on global concerns

LOCAL EQUITIES suffered their first losing start since 2010 on mounting concerns on the Chinese economy and escalating tensions in the Middle East.

The bellwether Philippine Stock Exchange index (PSEi) plunged 118.66 points or 1.7% on the first trading day of 2016 to close at the session’s low of 6,833.42.

This is the local barometer’s first time to close in the red at the year’s start since shedding 1.56% as 2010 began, and is also its second-worst start since falling 3.08% to kick off 2001, Justino B. Calaycay, Jr., analyst at Philstocks Financial, Inc., said in a note.

The wider all-shares index dropped 59.68 points or 1.49% to finish at 3,930.79.

“An early rush of economic data from China and the stirrings of trouble in the Middle East drew mixed reactions, mainly negative for equities and positive for oil and ‘hedging assets,’ keeping stock market investors at bay as 2016 trading went under way,” Mr. Calaycay said.

China’s benchmark CSI 300 sank 7% yesterday after a soft factory survey and a move by its central bank to guide the yuan lower pointed to a struggling world’s second biggest economy, triggering the stock exchange to suspend trade for the first time.

China’s faltering economy had weighed on its export-reliant Asian neighbors and global commodity prices last year.

Rising tensions in the Middle East added to a host of investor worries. Oil prices jumped after Saudi Arabia said over the weekend it is cutting diplomatic ties with Iran after protesters stormed the Saudi Embassy in Tehran and Iran’s top leader blasted the world’s largest oil supplier for executing a prominent Shi’ite cleric.

“It’s the new year but same old concerns remain: the slowdown in the Chinese economy, the changing policy environment triggered by the rising US interest rates and the tensions in the Middle East,” Astro C. del Castillo, managing director at First Grade Finance, Inc., said by phone.

All counters were down by almost 1% each, with services slumping 37.73 points or 2.46% to 1,492.49 to become the biggest drag to the broader market.

Likewise, property shed 50.28 points or 1.72% to 2,865.32; holding firms declined 113.61 points or 1.72% to 6,487.65; mining and oil dropped 171.36 points or 1.64% to 10,255.88; financials tumbled 19.55 points or 1.26% to 1,531.13; and industrial slid 94.60 points or 0.85% to 10,936.62.

Value turnover came under the P3-billion mark, thinning to P2.99 billion after 553.88 million shares changed hands, from P6.46 billion on Dec. 29 — the last trading day of 2015.

Roughly three stocks fell for every issue that advanced, while 36 stocks closed flat.

Foreign net purchases slumped to P129.72 million from P961.56 million in the prior session.

“Dropping to 6,600 is a possibility, but we might see a rebound [today],” Alexander Adrian O. Tiu, senior equity analyst at AB Capital Securities, Inc., said in a phone interview. — Krista Angela M. Montealegre

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=psei-kicks-off-2016-in-the-red-on-global-concerns&id=120877

==================================================

Good luck on all your TRADES

luck on all your TRADES today

today .

.

DISCLAIMER There is a very high degree of risk involved in TRADING . Past results

. Past results are not indicative of future returns

are not indicative of future returns . Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION

. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER

or endorsement of any security. In accordance with the Responsible TRADER ’s Creed: I will never tell and you take full

’s Creed: I will never tell and you take full responsibility for all your TRADING

responsibility for all your TRADING results.

results.