Top Ten Smart Money Moves – Jan. 6, 2016

Top Ten Smart Money Moves, starting January 2015, is the official trading

Moves, starting January 2015, is the official trading newsletter of The Responsible Trader

newsletter of The Responsible Trader to promote

to promote his advocacy, Responsible Trading

his advocacy, Responsible Trading . This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying

. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded

and Selling, Top Ten in Total Traded Value, including Trading

Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader

Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on Jan. 6, 2016 Data)

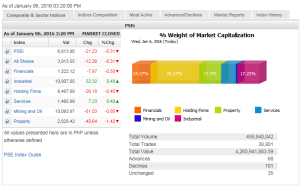

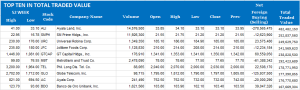

Total Traded Value – PhP 4.261 Billion – Low

Market Breadth and Sentiment indicated by Advances Declines Ratio – (Ideal is 2:1 to be considered Bullish or Bearish) 101 Declines vs. 68 Advances = 1.49:1 Neutral

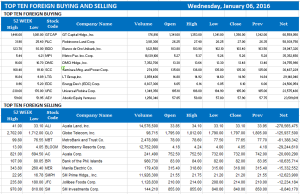

Total Foreign Buying – PhP 2.648 Billion

Total Foreign Selling – (Php 2.798) Billion

Net Foreign Buying (Selling) – (Php 0.150) Billion – 2nd day of Net Foreign Selling after 8 days of Net Foreign Buying

Please take note of the following changes effective August 6, 2015:

1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation.

2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish.

3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than P8 Billion b. Medium – Total Traded Value P8 Billion but not more than P15 Billion c. High – Total Traded Value more than P15 Billion

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

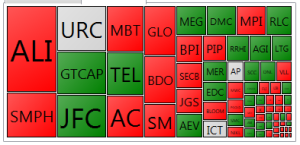

PSE Heat Map

Screenshot courtesy of: PSEGET Software

Top Ten Foreign Buying and Selling

and Selling

Top Ten in Total Traded Value

Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Posted on January 06, 2016 08:41:00 PM

By Krista A. M. Montealegre, Senior Reporter

Stocks decline anew on China, geopolitical risks

STOCKS resumed their downtrend yesterday as investors remained wary over lingering concerns in China and rising geopolitical risks following the supposed nuclear test of North Korea.

After squeezing out gains on Tuesday, the benchmark Philippine Stock Exchange index (PSEi) tumbled 21.23 points or 0.31% to finish at the session’s low of 6,813.90.

The all-shares index slid 12.26 points or 0.31% to end at 3,913.55.

“There was a last-minute sell-off. China’s growth concerns continue to affect market sentiment after reporting a disappointing manufacturing data,” Joylin F. Telagen, equity research analyst at IB Gimenez Securities, Inc., said in a mobile phone message.

“The market closed in the red anew as market players stayed on the sidelines. Uncertainty remains arising from China and the Middle East. Investors are waiting for more fresh leads and positive news to enter the market,” BDO Unibank, Inc. Chief Market Strategist Jonathan L. Ravelas said in a separate message.

The spotlight was back on China this week after a closely watched survey of the country’s massive manufacturing sector showed it contracted for a tenth straight month, renewing fears of a slowdown in the world’s second largest economy.

As a result, China’s benchmark indices opened the new year with a 7% drop, rattling global markets and forcing its government to introduce a series of damage-control measures.

Also hurting sentiment were reports quoting North Korea’s official KCNA news agency saying Pyongyang “successfully” carried out a hydrogen nuclear device test, fueling geopolitical concerns in the region, analysts said.

Fears about Pyongyang’s threat to security added to a host of investor worries that include sluggish growth in China, escalating tensions between Saudi Arabia and Iran, and the impact of rising interest rates in the US.

Counters closed mixed, with property losing 40.64 points or 1.41% to 2,828.42, becoming the biggest drag to the market.

Likewise, mining and oil gave up 81.03 points or 0.79% to 10,093.97; financials fell 7.67 points or 0.50% to 1,522.12; and holding firms went down by 26.18 points or 0.40% to 6,487.89.

In contrast, services advanced 7.23 points or 0.48% to 1,495.99 and industrial climbed 52.32 points or 0.48% to 10,907.05.

Value turnover inched up to P4.26 billion after 459.84 million shares changed hands, from P3.99 billion on Tuesday.

Losers dominated gainers, 101 to 68, while 35 issues were unchanged. Net foreign selling accelerated to P149.86 million from P125.88 million on Tuesday.

“We’re in the consolidation stage for the week and if the shares stabilize already, investors will get back and we will see a much better market participation,” IB Gimenez Securities’ Ms. Telagen said.

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=stocks-decline-anew-on-china-geopolitical-risks&id=121022

==================================================

Good luck on all your TRADES

luck on all your TRADES today

today .

.

DISCLAIMER There is a very high degree of risk involved in TRADING . Past results

. Past results are not indicative of future returns

are not indicative of future returns . Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION

. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER

or endorsement of any security. In accordance with the Responsible TRADER ’s Creed: I will never tell and you take full

’s Creed: I will never tell and you take full responsibility for all your TRADING

responsibility for all your TRADING results.

results.