Top Ten Smart Money Moves – January 13, 2017

Top Ten Smart Money Moves, starting January 2015, is the official trading newsletter of The Responsible Trader to promote his advocacy, Responsible Trading. This newsletter contains the previous day’s data from PSE, the Top Ten Foreign Buying and Selling, Top Ten in Total Traded Value, including Trading Notes based on the data of the previous day. This newsletter is given free to all the friends of The Responsible Trader and to members of the Facebook group and the other organizations where he is a member. For the previous issue where complete details about the newsletter was fully discussed, please refer to: Daily Top Tens October 17, 2014.

Trading Notes for Today – (Based on January 13, 2017 Data)

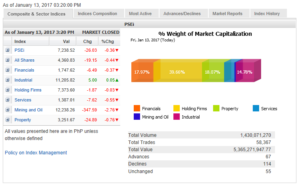

Total Traded Value – PhP 5.365 Billion – Low

Advances Declines Ratio – (Ideal is 2:1) 114 Declines vs. 67 Advances = 1.70:1 Neutral

Total Foreign Buying – PhP 2.285 Billion

Total Foreign Selling – (PhP 2.625 Billion)

Net Foreign Buying (Selling) – (PhP 0.340) Billion – first day of Net Foreign Selling after 10 days of Net Foreign Buying

Data from the Philippine Stock Exchange

Screenshot courtesy of: www.pse.com.ph

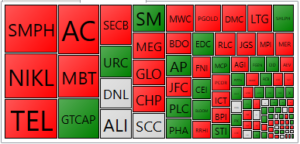

PSE HEAT MAP

Screenshot courtesy of PSEGET

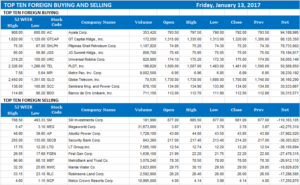

Top Ten Foreign Buying and Selling

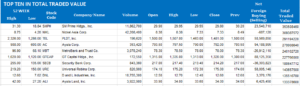

Top Ten in Total Traded Value

From now on, I will just quote the related article from Business World so that we will have everything in one piece:

==================================================

Volatile trading seen as markets focus on Trump

Posted on January 16, 2017

LOCAL STOCKS are headed for another week of volatile trading, as investors face increasing uncertainty from developments abroad, including the leadership change in the United States.

The benchmark Philippine Stock Exchange index (PSEi) may move within the 7,150 to 7,400 range this week, according to 2TradeAsia.com, with retracements near 7,000 being an ideal point to re-enter selective sectors.

In a weekly outlook, 2TradeAsia.com noted that investors will keep a close watch on the inauguration of billionaire Donald J. Trump as the 45th president of the US on Jan. 20.

“Players are aiming to hear clearer highlights how the new administration will help support fiscal spending and tax reforms. Any hint on these angles could provide the boost, and reinforce expectations of sequels to last year’s ‘Trump rally’,” it said.

“Furthermore, with expectations that the US economy will be driven mostly by expansionary fiscal policies moving forward, investors are expected to take cue on any significant move from government and shift focus from the Fed[eral Reserve]’s contractionary monetary policy,” the brokerage added.

Last week, the market witnessed a rebalancing of portfolios among investors ahead of Mr. Trump’s inauguration, further weighing on the PSEi that had turned susceptible to profit taking after six consecutive sessions of ascent.

The bellwether slipped 9.68 points or 0.13% week on week to 7,238.52 on Friday, erasing nearly a fourth of the 523.7 points registered during the first six sessions of this year’s trading when it tumbled starting Wednesday.

“While the early surge in share prices — not only in the domestic market but among global equities — was a welcome surprise, we have been pointing out that the underlying narratives that led us to have a tempered view remains,” Justino B. Calaycay, Jr., head of research and marketing at A&A Securities, Inc., said in a weekly trading post.

Mr. Calaycay cited as risks accelerating inflation in the country and the peso’s depreciation, the fluid movement of global oil prices and uncertainty over the timing of the subsequent rate adjustments flagged by the Federal Open Market Committee of the US central bank. The leadership change in the US effective Jan. 20 also ushers in policy uncertainties in the near term, he said.

“Thus, while we are hopeful that the initial rally that greeted the year will be sustained, we are aware of the emerging risks.”

On the other hand, 2TradeAsia.com said investors may draw positive sentiment from the visit of Japanese Prime Minister Shinzo Abe, who came with a P434-billion aid package and five agreements on trade, infrastructure and low-carbon growth partnership. “This latest partnership could help expand similar deals and lead to multipliers to support economic growth.” Keith Richard D. Mariano

Source: http://www.bworldonline.com/content.php?section=StockMarket&title=volatile-trading-seen-as-markets-focus-on-trump&id=139098

==================================================

We aim to continue promoting financial literacy on the area of stock market trading and investing to our countrymen both here and abroad through the following:

1. The Book: “The Responsible Trader – a Thinking Person’s Guide for Trading the Philippine Stock Market” now earned the name “The Bible of Philippine Trading.” You can download Chapter 1, Section 1 of the book here: http://theresponsibletrader.com/the-responsible-trader-hope-for-trading-knowledge-test/.

As requested by those abroad and those who want the book in digital form, we have produced an eBook version. For those interested please send email to: ninjatrader19@gmail.com Subject: The Responsible Trader – eBook Version.

2. The Website: :http://www.theresponsibletrader.com where we publish our daily newsletter Top Ten Smart Money Moves, Stock Trading Lessons, and Inspirational Materials. (FREE)

3. The YouTube Channel: https://www.youtube.com/theresponsibletrader – where you can learn the course “Master’s Certificate in Technical Analysis” which was simplified in an easily understood manner. You can download these videos and learn them at your own convenient time. (FREE)

4. My Slideshare: http://www.slideshare.net/TheResponsibleTrader – where you can view and download copy of the Powerpoint Presentation of my TRT-POV (The Responsible Trader’s Point of View) of the videos posted in our Youtube Channel. (FREE)

===================================================

Good luck on all your TRADES today.

DISCLAIMER There is a very high degree of risk involved in TRADING. Past results are not indicative of future returns. Nothing contained in this newsletter constitutes a solicitation, recommendation, PROMOTION or endorsement of any security. In accordance with the Responsible TRADER’s Creed: I will never tell and you take full responsibility for all your TRADING results

NOTES: Please take note of the following changes effective August 6, 2015: 1. Caption Market Breadth has been changed to Total Traded Value to simplify the presentation. 2. Market Breadth is expressed in terms of Number of Advances and Declines. Expressing this as a Ratio by using the larger number as Numerator we derive the Market Sentiment whether Bullish or Bearish. 3. Based on Past three-year data of Average Total Traded Values, following classifications will be used to make the presentation more relevant to present times. a. Low – Total Traded Value less than PhP 8 Billion b. Medium – Total Traded Value Php 8 Billion but not more than P15 Billion c. High – Total Traded Value more than Php 15 Billion